- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Can I Pay Term Insurance Monthly?

- What Is Term Life Insurance?

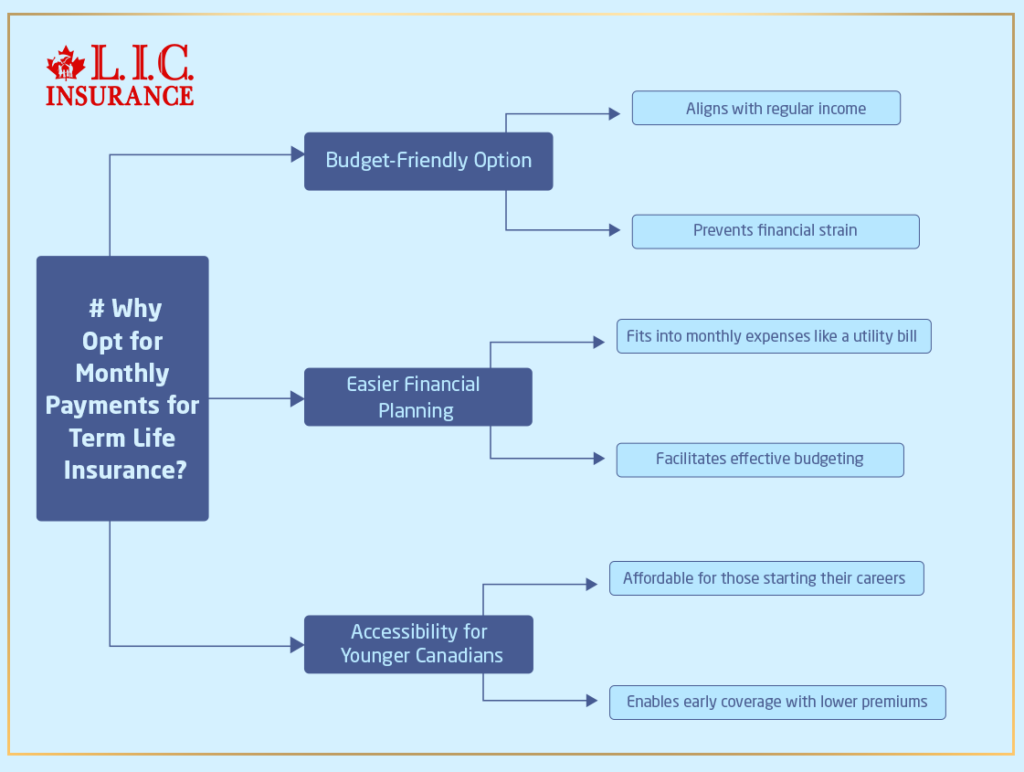

- Why Opt for Monthly Payments for Term Life Insurance?

- Understanding the Term Life Insurance Monthly Cost

- Are There Additional Costs for Paying Monthly?

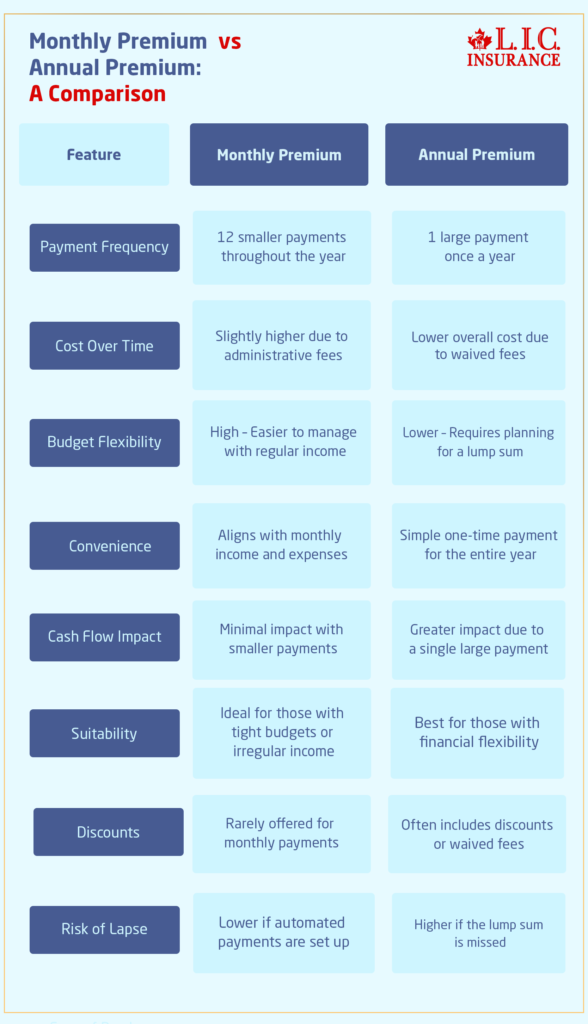

- Monthly Premium vs Annual Premium

- Monthly Premium vs Annual Premium: A Comparison

- Which Is a Cost-Effective Option?

- How to Decide Which Mode of Premium Is Right for You

- How Canadian LIC Helps Clients Choose the Right Payment Plan

- Benefits of Paying Term Life Insurance Monthly

- Tips for Managing Term Life Insurance Monthly Costs

Can I Pay Term Insurance Monthly?

By Harpreet Puri

CEO & Founder

- 11 min read

- November 22th, 2024

SUMMARY

Many Canadians have to juggle their monthly bills for rent or mortgages, grocery bills, and utilities, to name a few. Adding an insurance premium to the list becomes nothing but burdening. The option to pay for Term Life Insurance on a monthly basis surely reduces the stress behind some costs. This option will surely give easy and manageable ways to ensure the financial security of your loved ones without requiring a big upfront lump-sum payment. Canadian LIC has witnessed how the payment of monthly Term Life Insurance benefits each family across the nation; let’s break down how to address concerns about affordability and access when choosing to carry Term Life Insurance Policies.

What Is Term Life Insurance?

Term Life Insurance covers a certain number of years, for example, 10 years, 20 years, 30 years, or 50 years. It is, relatively speaking, the most straightforward and least expensive means to guarantee your family’s financial security. The agreement usually provides in return for regular payments that your beneficiaries will receive a death benefit in case you die during the term.

With Term Life Insurance, you can usually determine how you wish to pay the Life Insurance Premiums- you may pay annually, semi-annually, or monthly. However, monthly payment is preferred by many because it divides the amount into smaller bites. Canadian LIC’s experience with its clients can be attributed to this phenomenon: most clients prefer this method because it fits most people’s budgeting system of income and expenses.

Why Opt for Monthly Payments for Term Life Insurance?

For many families, paying a large lump sum can be difficult. A monthly payment option allows individuals to align their Term Life Insurance premiums with their regular income. It provides flexibility and prevents financial strain.

For instance, Canadian LIC helped a young couple in Toronto who were faced with difficulty paying their mortgage, childcare costs, and other monthly bills. That couple used Term Life Insurance because its monthly Term Life Insurance Cost was manageable and benefited their family without disrupting the budget.

When you choose monthly payments, you can plan your budget more effectively. The premiums become part of your monthly expenses, much like a utility bill or subscription service.

Younger individuals just starting their careers often have limited disposable income. Monthly payments make Term Life Insurance Policies accessible, ensuring they can secure coverage early in life when premiums are lower.

Understanding the Term Life Insurance Monthly Cost

The cost of paying Term Life Insurance Monthly Cost varies based on several factors, including:

- Age: The younger you are, the lower the monthly premiums.

- Coverage Amount: Higher coverage leads to higher premiums.

- Policy Term: A 30-year policy will have higher monthly payments than a 10-year policy.

- Health and Lifestyle: Smokers or individuals with pre-existing medical conditions typically pay higher premiums.

Are There Additional Costs for Paying Monthly?

Some insurers may charge a bit extra on monthly Life Insurance premium pay rather than annual premium. For these ones, the reason may be a clear administrative procedure involved in making monthly payments along with some small interest fee. However, for most users, convenience and flexibility outweigh the minor added costs.

Monthly Premium vs Annual Premium

Monthly and annual premiums come along with a Term Life Insurance Policy; however, it’s essential to understand how they differ when choosing between the two. Both options offer clear advantages, depending on your financial situation and preferences.

- Advantages:

- Monthly premiums pay for this Term Life Insurance spread out throughout the month. It is perfect for individuals or families who have a preference for making monthly payments without overburdening themselves with large payments based on annual income.

- Drawbacks:

- In some cases, monthly payments may include administrative fees, making the overall cost slightly higher than paying annually.

- Advantages:

- Annual premiums are typically more cost-effective over time. Some insurance providers offer discounts for lump-sum payments, saving you money on administrative fees.

- Drawbacks:

- Paying a large amount upfront can strain your finances, especially if your budget doesn’t allow for such flexibility.

Monthly Premium vs Annual Premium: A Comparison

Canadian LIC has seen that the majority of clients favour monthly instalments since these are convenient and very affordable. However, those with the means to pay annually often enjoy the savings and simplicity of a single payment.

Which Is a Cost-Effective Option?

When comparing the cost-effectiveness of monthly versus annual premiums, it’s important to look beyond the immediate price tag.

Paying annually often results in a lower overall cost since many insurance providers waive administrative fees for lump-sum payments. For instance, a Term Life Insurance policy with an annual cost of $1,200 might have a monthly equivalent of $110, totalling $1,320 per year.

While annual payments may save money, monthly payments offer flexibility, making it easier for families and individuals to fit the premiums into their budgets. This is especially beneficial for younger clients or those managing multiple financial responsibilities, such as mortgages or childcare.

Canadian LIC’s advisors help clients weigh these factors by comparing the monthly and annual costs of Term Life Insurance, ensuring they choose the most practical option for their financial situation.

How to Decide Which Mode of Premium Is Right for You

Choosing the right mode of premium payment requires careful consideration of your financial habits, goals, and current situation. Here’s a guide to help you make an informed decision:

- If one can afford to make a large payment in advance without affecting the other current financial obligations, then an annual premium might be more suitable.

- If you have to manage your cash month by month, choose monthly installments.

If one is considering long-term saving, one will generally pay less money if paying annually, assuming that the means to do so are present. Canadian LIC has found that clients tend to appreciate the ability to make a single payment and the resulting savings.

- Individuals with irregular or seasonal income might find monthly payments easier to manage.

- Those with steady, predictable income may prefer the convenience of an annual payment.

Canadian LIC advisors specialize in assisting clients in choosing the right payment mode for their Term Life Insurance Policies. Based on an analysis of your financial situation and goals, they shall recommend whether monthly or annual premiums best suit you.

Use online calculators to compare the quotes for Term Life Insurance for monthly and yearly payments. Comparing these costs will provide you with a comprehensive knowledge of the exact cost variations and enable you to make a decision.

It really all comes down to your financial flexibility and priorities. Canadian LIC’s goal is to ensure every client finds a plan with comprehensive coverage at a manageable cost, whether monthly or annually.

How Canadian LIC Helps Clients Choose the Right Payment Plan

It puts a lot of emphasis on knowing each customer’s special financial condition. In consultations, our advisors explore different Term Life Insurance Policies, discuss monthly versus annual payment options, and help clients find a plan that fits their budget.

For example, a customer in Vancouver initially avoided buying Life Insurance because of the lack of funds. Canadian LIC’s team introduced a flexible monthly payment plan, enabling the client to secure Term Life Insurance without compromising their other expenses.

Benefits of Paying Term Life Insurance Monthly

- Consistency in Coverage: Monthly payments ensure that your coverage remains active. Missing a large annual payment can lead to a policy lapse, but smaller, regular payments are easier to manage.

- Peace of Mind for Families: Knowing that your family is protected even if you’re gone is invaluable. Monthly payments make this peace of mind accessible to everyone, regardless of their financial situation.

- No Large Upfront Costs: By eliminating the need for a significant upfront payment, monthly plans provide an entry point for people who might otherwise delay or avoid purchasing insurance.

Tips for Managing Term Life Insurance Monthly Costs

Before committing to a policy, compare quotes from different providers to find the most affordable option. Many online tools can provide Term Life Insurance Quotes tailored to your needs.

Ensure the amount covered matches your family’s financial needs: mortgage payments, education costs, and living expenses. It would help if you then settled on an appropriate amount to avoid overpaying for unnecessary coverage.

Some insurance providers offer discounts for bundling policies or maintaining a good health record.

As your life’s individual circumstances change, review your Term Life Insurance Policies to ensure they still meet your needs. Adjust coverage or payment plans if necessary.

Misconceptions About Monthly Payments for Term Life Insurance

While monthly payments might include a minor administrative fee, the overall difference is usually minimal. It’s a practical option for people who prefer spreading out their expenses.

This payment option is for anyone who values flexibility. Many high-income individuals also choose monthly payments for convenience.

How to buy Term Life Insurance Online with Monthly Payment Options

To buy Term Life Insurance online has never been simpler than purchasing online. Almost all companies, including Canadian LIC, provide simple digital interfaces for comparing quotes for Term Life Insurance, adjusting coverage, and choosing a payment frequency.

Success Stories from Canadian LIC

Canadian LIC has dealt with all types of clients, providing Term Life Insurance to each of them within their budget. The most notable case is that of a single parent from Calgary who was determined to give his children everything they needed. He chose the plan of monthly payments, thus getting a well-rounded coverage without weakening everyday spendings.

Why Canadian LIC Is the Best Insurance Brokerage for Monthly Payment Plans

With years of experience in the Canadian insurance market, Canadian LIC has managed to establish a reputation about reliable customer-focused services. They know how difficult it is for families to budget for essential expenses such as Life Insurance and offer solutions that work for every financial situation.

Canadian LIC works with a wide range of insurance providers, allowing them to compare Term Life Insurance Policies and find the most affordable and comprehensive options for their clients.

Through Canadian LIC’s user-friendly website, clients can quickly access Term Life Insurance Quotes and explore monthly payment plans.

Every client’s situation is unique, and Canadian LIC takes the time to understand individual needs, whether it’s helping a young family secure coverage or guiding seniors through their options.

Take Control of Your Financial Future

The option to pay Term Life Insurance monthly makes it possible for everyone to prioritize financial security for their loved ones.. Whether you’re a single parent, a young professional, or just a retiree planning ahead for your future, Canadian LIC is there to lead you through it all.

With Canadian LIC, you are actually purchasing an insurance policy as well as finding a partner committed to helping you protect your family’s future.

Start by checking Term Life Insurance Quotes today and see just how easy it can be to secure affordable, flexible coverage. Canadian LIC’s team is here to help you choose a plan that works within your budget and gets you closer to achieving financial goals.

So, Ready to Take the Next Step?

Term Life Insurance makes every parent feel protected regarding the family’s financial future. This aspect of protection is very accessible and can be managed in a monthly payment term. Specializing in providing low-cost, flexible Term Life Insurance coverage to clients, Canadian LIC operates within each individual’s unique needs.

More on Term Life Insurance

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions About Paying Term Life Insurance Monthly

Both options have their merits. Monthly payments leave room for flexibility and make it easier to match premiums with your periodic income. Annual payments may be slightly cheaper overall, as some providers waive administrative fees on a lump sum payment basis. It just depends on your financial situation and budgeting preferences.

Yes, with level-Term Life Insurance, your monthly premiums remain fixed throughout the policy term. This consistency allows you to budget effectively and eliminates the worry of rising premiums.

Yes, most likely. Most Canadian LIC’s partners in Canada do permit policyholders to change the payment frequency, but one should refer to policy terms for details.

A grace period is sometimes allowed under the policy, where you still have a period to settle your payment without losing coverage. However, failure to remit by the end of the grace period can lead to a lapse in the policy. Canadian LIC advises settling for regular automatic payments to avoid such a situation.

You can use online calculators or request Term Life Insurance Quotes from providers like Canadian LIC. The Term Life Insurance Monthly Cost would vary depending on your age, health, coverage amount, and policy term.

Yes, you can usually pay premiums monthly for a Permanent Insurance Policy, just like Term Policies. However, the monthly cost of Term Life Insurance will likely increase when you switch to permanent coverage. Canadian LIC provides clear comparisons so clients can make informed decisions.

Sources and Further Reading

- Sun Life Canada: Offers detailed insights into Term Life Insurance Policies, including payment options and coverage details.

Sun Life - Canada Life: Provides comprehensive information on Term Life Insurance, including FAQs and policy comparisons.

Canada Life - Blue Cross Canada: Discusses affordable Term Life Insurance options and critical illness coverage.

Blue Cross - Manulife: Offers information on Term 100 Life Insurance rates and payment options for Canadian Armed Forces members.

ManuLife Insurance - Canada Protection Plan: Provides a range of life and critical illness insurance products, many available without medical exams.

Wikipedia

Key Takeaways

- Monthly Payment Flexibility: Term Life Insurance Policies in Canada allow you to pay premiums monthly, making it easier to manage your budget.

- Cost Comparison: Monthly payments may cost slightly more than annual ones due to administrative fees, but they offer greater affordability and convenience.

- Budget-Friendly Option: Paying monthly helps families and individuals align premiums with regular income, especially for those with tight budgets.

- Fixed Premiums: Most Term Life Insurance Policies offer fixed premiums for the entire term, ensuring predictability in monthly costs.

- No Lump-Sum Requirement: Monthly premiums eliminate the need for a large upfront payment, making Life Insurance accessible for more people.

- Online Convenience: You can buy Term Life Insurance Online and choose monthly payments to suit your financial needs.

- Conversion Options: Many Term Life Insurance Policies allow conversion to permanent coverage, providing lifelong financial security without a medical exam.

- Guidance from Experts: Canadian LIC offers personalized advice to help clients choose between monthly and annual payments, ensuring the best fit for their financial goals.

- Tailored Solutions: Whether you’re a young professional, a family with children, or nearing retirement, there’s a Term Life Insurance payment plan to meet your needs.

- Accessible Protection: Monthly payment options ensure that Term Life Insurance remains an affordable safety net for families across Canada.

Your Feedback Is Very Important To Us

We value your feedback to help us improve our services and address your concerns effectively. Please take a few moments to share your thoughts.

Thank you for sharing your feedback! Your insights will help us address the struggles Canadians face with Term Life Insurance payments and improve our offerings.

IN THIS ARTICLE

- Can I Pay Term Insurance Monthly?

- What Is Term Life Insurance?

- Why Opt for Monthly Payments for Term Life Insurance?

- Understanding the Term Life Insurance Monthly Cost

- Are There Additional Costs for Paying Monthly?

- Monthly Premium vs Annual Premium

- Monthly Premium vs Annual Premium: A Comparison

- Which Is a Cost-Effective Option?

- How to Decide Which Mode of Premium Is Right for You

- How Canadian LIC Helps Clients Choose the Right Payment Plan

- Benefits of Paying Term Life Insurance Monthly

- Tips for Managing Term Life Insurance Monthly Costs