Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

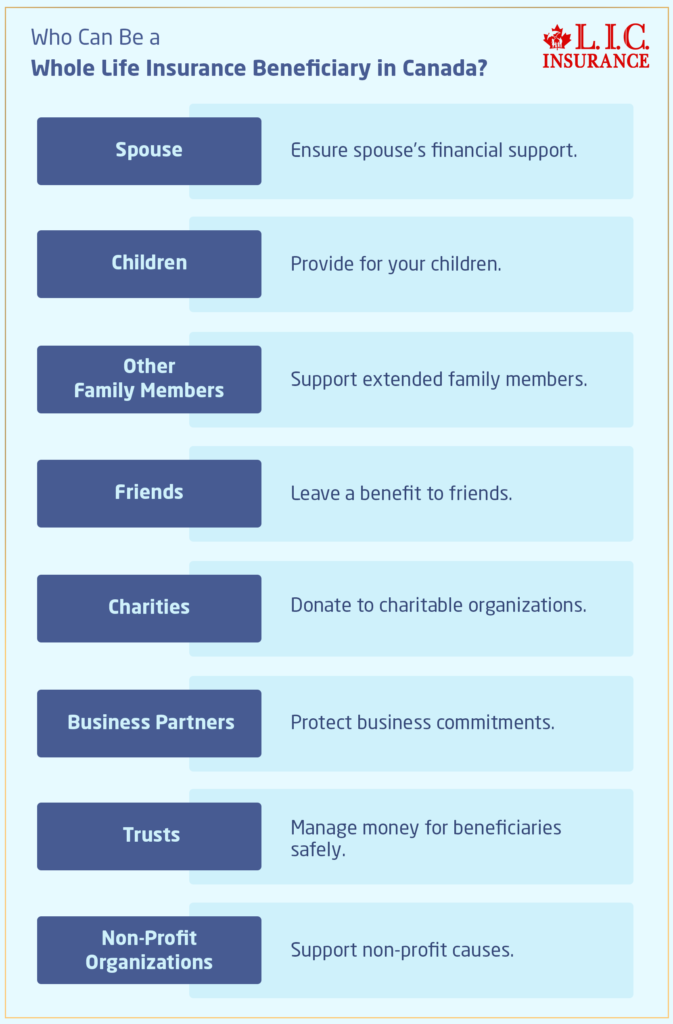

When it comes to Whole Life Insurance Policies, many have frequently considered questions such as who to give their policy to when they are no longer alive. While some may want to provide the benefits to only one person, there are others who would like to share the benefits with many close ones. This is a very common situation, and it can easily daunt one because of so many options to choose from. The one thing most of the clients that Canadian LIC works with have in common is not knowing how to name multiple beneficiaries and what takes place if more than one is chosen. How does naming multiple beneficiaries work? How can this benefit you and your family? How will it impact your Whole Life Insurance Policy?

CEO & Founder

Naming beneficiaries for a Whole Life Insurance Policy involves important decisions but may come with equal shares of challenges. Some individuals feel conflicted about how to divide the policy’s payout fairly among their loved ones. Others may worry about whether certain family members will feel left out or if disputes could arise later. Canadian LIC’s clients often express concerns like these:

All of these are very valid concerns, and the good news is that Whole Life Insurance Policies allow for flexibility when naming policy beneficiaries. Not only does this flexibility extend to naming multiple beneficiaries, but it also extends to deciding what percentage the policy yields to each person.

Whole Life Insurance provides guaranteed lifetime coverage, building up cash value over time. The distinguishing feature of Whole Life Insurance Policies is that they pay a death benefit lump-sum amount out to one’s beneficiaries upon the policyholder’s death. When purchasing Whole Life Insurance, one common question is: can a person name multiple people for the death benefit? Yes, you can name multiple beneficiaries, and there is more than one way to do it.

You can divide the life insurance death benefit into percentages and specify exactly how much each beneficiary will receive. In fact, you may determine that 60% of the death benefit goes to your spouse, and your children share the remaining 40%. Some clients might even want to leave part of the benefit to charities or other non-family members. As we have seen at Canadian LIC, through various combinations, clients can ensure their financial legacy extends to all those people and causes that matter most.

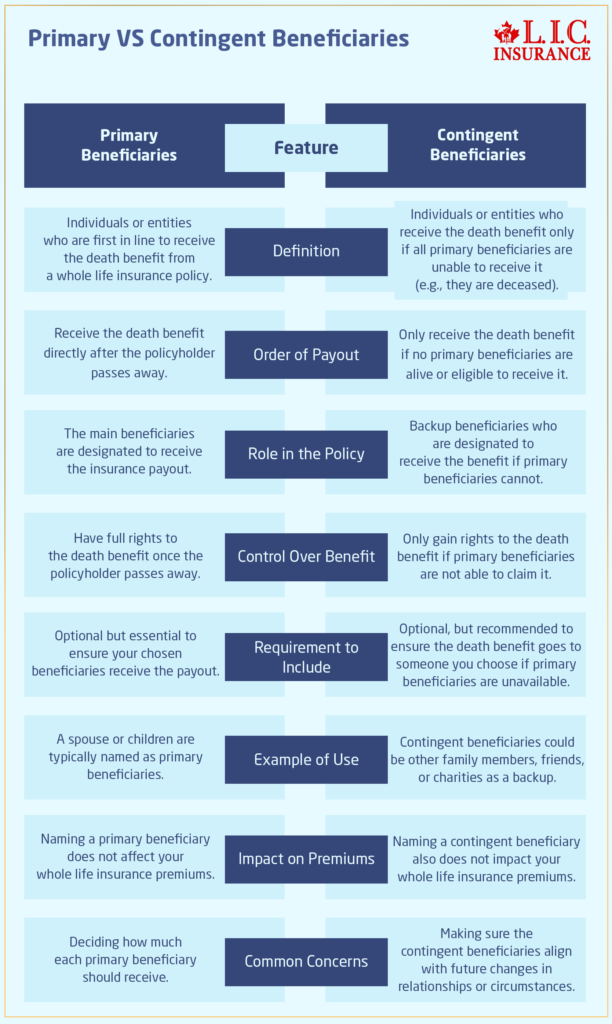

One thing that is vital to understand regarding naming the beneficiary for your Whole Life Insurance is the distinction between primary and contingent beneficiaries. Primary beneficiaries are those individuals or entities that receive the death benefit payouts first; in case they are alive at the death of the policyholder, they will be entitled to their share.

The contingent beneficiary or secondary beneficiary are those who receive the benefit in case your primary beneficiaries are no longer alive. If you name your spouse as a primary beneficiary and your children as contingent beneficiaries, for instance, then your children will only receive the benefit if your spouse predeceases you.

Most of the clients that come into Canadian LIC are very uncertain if they should include contingent or secondary beneficiaries, but doing so is highly recommended. It makes certain that when something might happen to your primary beneficiaries, then the death benefit will still go to somebody important to you.

Once you have decided upon naming multiple beneficiaries, the next decision you will face is how you wish to divide your Whole Life Insurance Policy’s death benefit. This is where most policyholders find difficulties. At Canadian LIC, we have often encountered questions such as:

The beauty of Whole Life Insurance Policies is that they give you complete control over this process. You can apportion the benefit any way you like. Some policyholders prefer naming equal shares to all their beneficiaries, but in many cases, one or more gets larger portions than others, depending on their needs. For example, suppose one of your children has more financial responsibilities – or medical needs – compared to the others. In that case, you may want to leave a greater percentage of your estate to him or her and smaller percentages to other family members.

Canadian LIC helps its clients to thoughtfully consider these decisions, considering the financial circumstances of each beneficiary. What’s more, our clients appreciate our flexibility in updating beneficiaries as the circumstances of life change to ensure a policy reflects one’s current wishes.

Given the cost of premiums, one might also want to think about naming multiple beneficiaries for your Whole Life Insurance Policy. Whole Life Insurance Premiums are considerably higher than Term Life Insurance since the Whole Life Insurance Policy serves lifetime protection with a cash value component included. However, in the case of the Canadian LIC, its clients consider this investment worth paying for the guarantee of taking care of one’s loved ones.

This may bring up the most frequently asked question: will naming multiple beneficiaries increase the premiums? Thankfully, it does not. The amount of beneficiaries you name is not one of the factors in your Whole Life Insurance Premiums. Whether it be one person or many, it’s the same premiums. You can rest assured and focus on having the death benefit apportioned to whom you want to, with no additional expenses.

Life is subject to change, and so, too, are the choices you make for beneficiaries. Another frequent question that comes up from our clients at Canadian LIC is whether they can change their beneficiaries down the road. Fortunately, Whole Life Insurance allows you to update your designation as a beneficiary at any time. This will make sure that your policy reflects current circumstances and relationships.

At Canadian LIC, we have seen how beneficiary designations can create stress and even lead to legal battles between family members. One such client named only one of his children as a beneficiary, thinking that he or she would share with siblings. Unfortunately, after the policyholder was no longer alive to clarify, misunderstandings developed, and the family went through protracted disputes that could have been avoided if the death benefit had been clearly allocated amongst all of the children.

This example drives home a valuable lesson: when naming multiple beneficiaries, one should be crystal clear regarding one’s wishes. In so doing, you circumvent any potential conflict down the line and guarantee that your financial legacy is apportioned exactly how you wanted by stating what percent goes to whom.

When naming multiple beneficiaries for your Whole Life Insurance Policy, it’s important to work with an experienced brokerage who understands the nuances of these decisions. Our work at Canadian LIC engages our clients in discussions at every step, helping them balance financial priorities and family dynamics. Indeed, the team knows the importance of customizing policies to reflect each client’s unique needs.

We have seen our clients having some changes in their lives, which require constant updating. This may range from adding new beneficiaries to changing the percentage to reallocate the death benefit. Canadian LIC strives for this changeover to be smooth and to reflect the wishes of our clients.

Some clients might wish to leave a portion of their Whole Life Insurance Policy to a charity or non-profit organization. This is sometimes a very good way to leave a substantial legacy to a cause that you are passionate about. When naming a charity as your beneficiary, you have the option to name what percentage of the death benefit you want the organization to receive, just like you would with individual beneficiaries.

At Canadian LIC, we work quite often with clients looking to balance their need for insurance coverage with charitable giving. Many find it quite satisfying to support a worthy cause while simultaneously providing for their family.

With the diverse nature of today’s world, many clients would like to know whether they can name non-traditional beneficiaries on their whole life policies. These could be lifelong friends, business associates, or even one’s pets. Yes, you can name non-traditional beneficiaries, but this takes careful consideration and legal documentation. For example, if someone wishes to bequeath a part of the death benefit to a pet, then a trust would have to be set up so the money would be used for the care of the pet since pets cannot directly inherit the money.

Canadian LIC has helped many clients with these kinds of non-traditional beneficiary arrangements. We liaise directly with the lawyers to ensure your wishes are appropriately executed, whether it be leaving a share to a good friend or ensuring your loved pet is well looked after; Canadian LIC will help guide you through these more unique scenarios.

Some of our clients worry that it makes things more complex when naming multiple beneficiaries. At Canadian LIC, we routinely hear, “Will this be difficult for my family to manage when the time comes?” Fortunately, the answer is no. The onus is on the life insurance company to distribute the death benefit in accordance with your wishes, making the process easy for your beneficiaries.

If you clearly spell out how you wish the death benefit to be divided, everything else will be handled by the insurance company. This may alleviate a lot of effort for your loved ones at a time when they will already be dealing with grief. Canadian LIC has worked with countless families who appreciate the simplicity of the process when it’s handled with clear instructions.

Whole Life Insurance Quotes raise many questions for people. Amongst these, one common question pertains to whether the number of beneficiaries affects the premium or life insurance options available. As explained above, having multiple named beneficiaries does not result in any difference in the cost of your policy. Whether you add one or ten, the price of your Whole Life Insurance is the same.

When Canadian LIC provides you with a quote for Whole Life Insurance, it looks at your total needs for coverage, the cash accumulation aspect, and what options you have to pay premiums. You are free to designate as many beneficiaries as you see fit without concern for how this impacts the policy cost.

If you are purchasing Whole Life Insurance Quotes and thinking of naming more than one beneficiary, then Canadian LIC can surely offer personalized advice for you. Let our experienced team help you compare quotes from a variety of providers to find the policy that fits your family’s needs while ensuring you’re able to distribute the death benefit exactly as you choose.

Naming multiple beneficiaries does come with a few legal considerations. For instance, in Canada, if any of your beneficiaries are minor children, the death benefit cannot be paid directly to them. Instead, you will have to name a trustee who will manage those funds on their behalf until they reach the age of majority. At Canadian LIC, many of our clients were surprised to learn about this legal requirement, but we work with them to make sure the right legal structures are put in place to protect their children’s inheritance.

Moreover, it is important to communicate this with your beneficiaries to avoid miscommunication, which could lead to potential conflicts once a loved one has passed. Canadian LIC has experienced how this might avoid conflict among family members and ensure that everyone is aware of your final wishes.

As life evolves, so may your wishes regarding how your whole life policy is set up. This flexibility is one of the reasons so many clients choose Whole Life Insurance: you are not bound to these initial decisions, whether it be changing your death benefit, switching up the premium structure, or adjusting the beneficiary list. Whole Life Insurance Policies will continue to flex and adapt to meet your growing needs.

At Canadian LIC, we help our clients make these changes when needed. Whether the need is to increase the death benefit for one beneficiary or add some new beneficiaries to it, our team will guide and support you through the process. We’ve seen clients who initially name only one beneficiary but decide to add grandchildren, charities, or other family members later in life. The ability to customize your policy over time ensures that your wishes are always reflected in your coverage.

Deciding how to share your Whole Life Insurance Policy among multiple beneficiaries is one of the most personal decisions an individual will ever make. It is the kind that requires you to take into consideration your very important family dynamics, financial goals, and future wishes. Here at Canadian LIC, we understand the difficulties that surround such a decision and are committed to helping you make those decisions with confidence.

As your insurance brokerage, Canadian LIC will bring a great deal of experience in tailoring Whole Life Insurance to suit the particular needs of the individual client. We realize how important it is to ensure that your loved ones are looked after in the way you want. We work closely with you to make sure your wishes are taken into consideration when designing your policy while keeping your premiums for Whole Life Insurance as affordable as possible.

We have helped numerous clients in making their policies well-structured, updated, and tailored according to the changes in their lives. Are you naming multiple beneficiaries for the first time or reviewing an existing policy for change? Canadian LIC is here to help.

Lastly, if you are researching Whole Life Insurance and you want to have multiple beneficiaries named, now is the time to consider your options. Working with Canadian LIC will put your mind at ease because you will know your loved ones will be taken care of, and your policy will be set up exactly as you like it. Let’s get started today and let the best insurance brokerage, Canadian LIC, help you secure the future for those who matter most in your life.

Call 1 844-542-4678 to speak to our advisors.

Yes, you can name multiple beneficiaries for your Whole Life Insurance Policy. Many clients at Canadian LIC choose this option to ensure their death benefit is distributed among loved ones, like children, spouses, or even charities. You can assign specific percentages of the death benefit to each beneficiary so everyone gets what you want them to receive.

No, naming multiple beneficiaries will not change your Whole Life Insurance Premiums. Whether you name one person or several, your premiums stay the same. Canadian LIC often explains to clients that the number of beneficiaries doesn’t influence the cost of the policy.

You have full control over how much each beneficiary receives. Many Canadian LIC clients divide the death benefit based on their loved ones’ needs. Some leave more to children with higher financial responsibilities or medical needs. You can adjust these percentages at any time.

If a primary beneficiary passes away before you, their share of the death benefit typically goes to the contingent beneficiaries. At Canadian LIC, we encourage clients to name contingent beneficiaries as a backup in case something happens to the multiple primary beneficiaries.

Yes, you can name a charity as one of your beneficiaries. Many Canadian LIC clients do this to support causes they care about. You can divide the death benefit between your loved ones and the charity in any way you choose.

No, there is no extra charge for updating your beneficiaries. At Canadian LIC, we see clients regularly update their policies due to changes in family or financial situations. You can make these changes whenever needed, and it doesn’t affect your Whole Life Insurance Premiums.

Yes, you can name minor children as beneficiaries. However, the death benefit cannot be paid directly to them. Instead, you’ll need to name a trustee to manage the funds until they reach the age of majority. Canadian LIC helps clients set up the right legal arrangements to ensure their children’s future is secure.

No, it doesn’t make the life insurance payout process more complicated. At Canadian LIC, we see that when clients clearly specify how they want the death benefit divided, the insurance company handles the rest. Your beneficiaries will receive their shares based on your instructions.

Yes, you can change your beneficiaries anytime. Many clients at Canadian LIC update their beneficiaries as their lives change, such as after getting married, having children, or changing financial priorities. It’s important to keep your policy up to date so that it reflects your current wishes.

You can always add more beneficiaries later. We often see clients at Canadian LIC adding beneficiaries as their family grows or when they want to include a charity or close friend. Your Whole Life Insurance Policy offers flexibility to make these changes as needed.

If you don’t name your life insurance beneficiary, the death benefit may go to your estate, which can lead to legal complications. At Canadian LIC, we advise clients to always name beneficiaries to ensure their loved ones receive the death benefit without delays or any additional legal process.

No, naming multiple beneficiaries does not delay the payout. As long as your instructions are clear, the insurance company will distribute the death benefit according to your wishes. At Canadian LIC, we ensure our clients’ policies are set up so that their beneficiaries receive timely payments.

Yes, you can change the percentage each beneficiary receives at any time. Canadian LIC often helps clients adjust these percentages as their family or financial needs evolve. You can easily update the policy to reflect these changes without impacting your Whole Life Insurance Premiums.

Yes, you can name anyone as a beneficiary for your Whole Life Insurance Policy. Many clients at Canadian LIC have named friends, business partners, or charitable organizations as beneficiaries. The flexibility of Whole Life Insurance allows you to make decisions based on your personal relationships.

It’s a good idea to inform your beneficiaries about your policy so they know what to expect. At Canadian LIC, we often suggest clients have open discussions with their loved ones about their decisions. However, it is not a requirement to inform them, but doing so can prevent confusion later.

Yes, you can divide the death benefit equally, or you can choose different percentages for each beneficiary. Many clients at Canadian LIC prefer to keep things simple by giving all their beneficiaries an equal share, while others customize the distribution based on specific needs.

At Canadian LIC, we work closely with clients to understand their personal situations and financial goals. We help guide them through the process of naming beneficiaries and making sure their Whole Life Insurance Policy reflects their wishes. Every situation is different, and we tailor our advice accordingly.

In Canada, the death benefit from a Whole Life Insurance Policy is generally tax-free for your beneficiaries. Whether you name one or multiple beneficiaries, there is no additional tax burden on them. Canadian LIC clients often appreciate knowing their loved ones will receive the full benefit without extra taxes.

Yes, you can remove a beneficiary at any time. Canadian LIC has helped many clients update their policies to reflect changes in family dynamics or relationships. The process is straightforward and does not impact your Whole Life Insurance Premiums.

A contingent beneficiary only receives the death benefit if the primary beneficiary passes away before the policyholder. At Canadian LIC, we often recommend naming contingent beneficiaries to ensure the benefit goes to someone you trust if something happens to the primary beneficiary.

Yes, you can request Whole Life Insurance Quotes at any stage of the process. At Canadian LIC, we encourage clients to explore their options early on. Whether you’ve decided on your beneficiaries or not, getting Whole Life Insurance Quotes can help you choose a policy that fits your financial needs.

Your Whole Life Insurance Premiums determine the size of the death benefit you can afford. At Canadian LIC, we help clients balance their premium payments with their desired coverage. You can choose a policy that provides enough coverage for all your beneficiaries while keeping the premiums manageable.

If you forget to update your beneficiaries, the original designations will stand, even if your circumstances have changed. Canadian LIC always advises clients to review their Whole Life Insurance Policy after major life events, such as marriages, births, or divorces, to ensure the policy reflects their current wishes.

No, there is no limit to how many beneficiaries you can name. Some Canadian LIC clients name just one person, while others include multiple family members, friends, and charities. The choice is entirely up to you, and you can modify it whenever needed.

These are some of the common questions people have that will clear out all your misunderstandings and misconceptions about naming multiple beneficiaries for your Whole Life Insurance Policy. For further assistance in regard to your policy, Canadian LIC is always ready to guide and advise you through every step of the process.

These resources provide additional information on Whole Life Insurance Policies, helping you make informed decisions about naming multiple beneficiaries.

CEO & Founder

We are conducting a short survey to better understand the struggles Canadians face when naming multiple beneficiaries for their Whole Life Insurance Policies. Your responses will help us improve our services and guide others through this process. Thank you for your participation!

Thank you for your feedback! Your insights will help us improve our guidance and services related to naming beneficiaries for Whole Life Insurance Policies in Canada.