You and your spouse have long-awaited visiting your children in Canada, who moved there many years ago. For a long time, you have wanted to spend some quality time with your family. Recently, you’ve heard about something that is called a Canadian Super Visa—an extraordinary way in which parents and grandparents can enjoy an extended stay. But then comes the real question, “Can we both be covered under a Super Visa Insurance Policy?” The question is asked more than one can imagine, and finding the appropriate answers to this is very important to help you stay free of worries and make your time enjoyable.

In today’s blog, we will explain in detail how you can include your spouse in the same Super Visa Insurance Policy. We will take you through the intricacies of Super Visa Insurance. Join us as we explore how to secure the best coverage for both you and your spouse so your attention is with your family and not in your pocket.

Covering The Basics First

Let us first explain what Super Visa Insurance is. This is necessary for the insurance coverage of visiting parents and grandparents under the Super Visa Insurance program, which encompasses medical emergencies, hospitalization, and repatriation with a minimum coverage of $100,000. Therefore, visitors will be assured of a good time on their visit without burdening their health conditions with whatever little the Canadian healthcare system has at its disposal.

Including Your Spouse in the Same Super Visa Insurance Policy

Know that when one considers all the variables involved in insurance, it’s a breath of relief to know that there’s at least one point you can simplify: you can be covered in the exact same Super Visa Insurance Policy as your spouse. Let’s delve into the benefits and the process with some helpful insights from Canadian LIC.

Simplified Paperwork

Why it matters: Handling one set of documents rather than multiple can greatly reduce your administrative burden.

Canadian LIC’s experience: Imagine juggling various policy forms for two people. Not only is that double the amount of paperwork, but double the errors, omissions, and mistakes. In doing so, we helped the Thompson couple shift their focus from endless forms back to preparing for this Canadian adventure.

Cost-Effectiveness

Managing your budget wisely can allow you more financial freedom during your stay in Canada.

John and Maria initially intended to purchase separate policies. Comparing the Super Visa Insurance Cost for individual versus joint policies, using Canadian LIC’s quote system saved them more than 20%. That is money that is better spent on enjoying experiences with your family here in Canada.

Unified Coverage Benefits

One policy means uniform coverage terms, making understanding and utilizing your benefits easier.

When Mr. and Mrs. Lee fell sick during their visit, having one policy meant they were both familiar with how to proceed with the claims, avoiding confusion and delays. This unified approach gave them peace of mind, knowing precisely what the policy covers.

Dealing with Less Complexity in Claims

Fewer complications mean a smoother process in stressful times.

The Martins had an emergency when Mr. Martin had to be hospitalized. Instead, they had one easy claim to deal with rather than two different approaches to claims in such a situation. That type of simplicity is very priceless at times of need and really gives the advantages associated with shared policies in those instances.

Opportunities for Customized Plans

Tailored insurance plans better meet your specific needs.

More often than not, the health requirements of couples differ. By taking out a joint policy, it is often possible to adjust a policy to suit both parties and sometimes even at a reduced cost compared to two separate policies.

Continuous Support and Assistance

Having a single point of contact for your insurance needs can enhance your experience.

Handling one insurance account for both spouses means you have a consistent contact person who understands the specifics of your policy deeply. This was a game-changer for the Hudsons, who appreciated having a go-to expert at Canadian LIC, familiar with their history and ready to assist at any moment.

Getting the Right Super Visa Insurance Quote

The right Super Visa Insurance Quote isn’t a question of the lowest price; it is one of the best values. Here’s how Canadian LIC helps with this.

Customized Quotes: Your details and that of your spouse are considered when generating a personal quote, so no such insurance policy is ever issued, which leaves you in a situation wherein you end up paying too much or, even worse, are underinsured.

Comparison Tools: Our online comparison tools enable you to weigh policies from several Super Visa Insurance Companies side by side, concentrating on the features that matter most for couples.

Expert guidance: Our advisors are trained in recognizing the special needs of couples who apply together. They can help guide you in avoiding common mistakes and point you toward the best options for your situation.

Let’s consider the case of the Nguyen family, who approached Canadian LIC for their Super Visa Insurance. Mr. and Mrs. Nguyen were concerned about managing two separate insurance policies and the associated costs. Our team helped them secure a joint policy that not only saved them money but also simplified the entire application process. This is a common scenario we encounter, and our experience ensures that couples receive the best possible advice tailored to their specific needs.

You can also add your spouse to the same Super Visa Insurance Policy. This will not only lighten your paperwork but often can also save money and make the entire insurance process quite easy. At Canadian LIC, we are dedicated to making insurance easy to understand and manage. You’re not just purchasing a policy when you work with us; instead, you’re getting a friend who’s here to stay with you throughout your visit to Canada.

Ready to begin? Reach out to Canadian LIC today for your Super Visa Insurance Quote, and enjoy peace of mind with top-class insurance coverage specially tailored according to your needs. Be one of the hundreds of couples who trusted us in their journey to Canada—making your Canadian family reunion memorable and secure.

How to Choose the Right Super Visa Insurance Policy

Choosing the right insurance policy can be daunting. Here’s how you can make an informed decision:

Get Multiple Quotes: Start by obtaining Super Visa Insurance Quotes from several reputable companies. This will give you a comparative perspective on what coverage options are available and at what cost.

Evaluate the Coverage: Ensure the policy covers all the essentials. Beyond the minimum $100,000 coverage, check for provisions for pre-existing conditions, hospitalization, and other medical emergencies.

Consider the Total Super Visa Insurance Cost: When comparing policies, look beyond the premiums. Consider deductibles, coverage limits, and exclusions to understand the actual cost of the insurance.

Read Reviews: Look at what other customers are saying about their experiences with different Super Visa Insurance Companies. Their insights can provide valuable information about customer service and claims processing.

Expert Tip from Canadian LIC

At Canadian LIC, we often find that clients benefit from a detailed consultation that helps them understand the nuances of each policy. For instance, the Kapoor family was initially leaning towards the cheapest option available until we discussed how different policies handle claims differently and what that could mean in case of an actual medical emergency. This conversation is vital for making an educated choice.

Common Challenges and Solutions

Knowing Super Visa Insurance involves several challenges. Here are the most common ones we see at Canadian LIC and how we help our clients overcome them:

Understanding Policy Details: Insurance documents can be complex. We break down the terms and conditions in simpler language, ensuring our clients fully understand what they are signing up for.

Dealing with Pre-existing Conditions: Many older applicants have pre-existing medical conditions, which can complicate insurance coverage. We help clients find policies that offer the best possible coverage for these conditions.

Adjusting Coverage Needs: Sometimes, the needs change during the policy period. We assist clients in adjusting their coverage, ensuring it always matches their requirements.

Why Choose Canadian LIC?

Choosing the right broker can make a significant difference. Here’s why Canadian LIC stands out:

Expertise: With years of experience and a focus on Super Visa Insurance, our team is equipped to offer you the best advice.

Customer-Centric Approach: We listen to your needs and tailor our services accordingly. Our goal is to ensure your satisfaction and peace of mind.

Comprehensive Support: From obtaining quotes to filing a claim, we’re with you every step of the way.

The Ending Thought

Including your spouse in your Super Visa Insurance Policy is not only possible but advisable. It makes everything less complicated and usually less expensive, plus it gives you peace of mind that both of you are covered. At Canadian LIC, we want to help you go through this with much ease. Our years of experience, customized advisory services, and dedicated support help ensure that you can focus on what truly matters: spending quality time with your family in Canada.

Get started right away. Contact Canadian LIC for your Super Visa Insurance Quote today. Let us help you make informed decisions that safeguard your health and ensure a memorable stay in Canada. Secure your Super Visa Insurance with the best, and have a hassle-free journey with Canadian LIC to meet your family members and loved ones.

More on Super Visa Insurance

Can I Get Super Visa Insurance If I Am Over 85 Years Old?

How Do I File A Complaint About My Super Visa Insurance Provider?

What Are The Consequences Of Not Having Valid Super Visa Insurance?

What Happens If The Super Visa Insurance Expires While The Visitor Is Still In Canada?

Is There A Waiting Period For Super Visa Insurance?

Is Super Visa Insurance Refundable?

How To Find The Most Affordable Super Visa Insurance Plan?

Where Can You Buy Super Visa Insurance In Canada?

Can We Cancel Super Visa Insurance?

Can I Pay Monthly For Super Visa Insurance?

When Should Super Visa Insurance Start In Canada

Benefits Of Super Visa Insurance

Mistakes To Avoid While Buying Super Visa Insurance

What To Look For In Super Visa Insurance In Canada?

Everything You Need To Know About The Canadian Super Visa Insurance

How To Apply For A Super Visa Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Including Your Spouse in the Same Super Visa Insurance Policy

In the case of the spouse, the Super Visa Insurance Cost may come differently. The key factors here will be age, state of health, and the amount of coverage one wants to be covered for. Generally, it is cheaper to have a shared policy than to have two different policies. Canadian LIC helped the Andersons once, who were surprised to find that putting together their policies saved them an average of 15% compared to when they held individual policies. We would suggest that you get a customized quote for Super Visa Insurance to know the exact costs for your specific scenario.

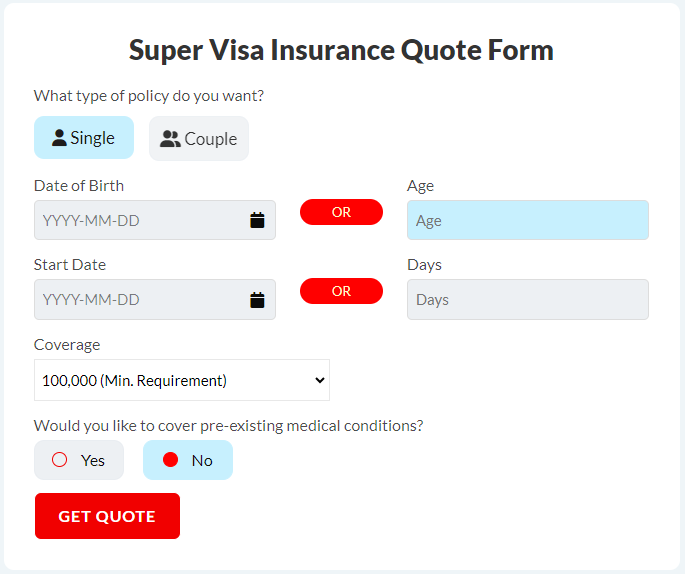

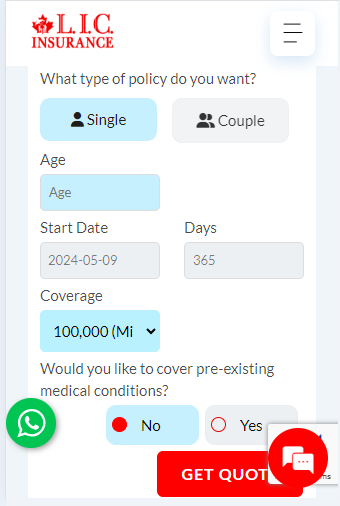

Getting a super visa medical insurance coverage quote online is easy. Log on to the website of Canadian LIC, where you can fill in your details and those of your spouse with the help of our quote tool. In fact, we have exhaustive comparisons of Super Visa Insurance Companies so that you can get numerous options for proper coverage. The Martins are just one of the latest couples we helped use our online tool to choose the right plan at the right price.

Yes, most insurance companies offering Super Visa Insurance can cover your spouse under the same policy. Again, this is also where the availability of a joint policy and the terms offered may differ between companies. At Canadian LIC, we deal with a diverse range of insurers and can help you choose the best company that will meet your specific needs. For instance, when the case of the Zhao couple was that of a specific health condition coverage policy, we guided them to the right insurer that would offer the best coverage for both.

Including your spouse on a single policy simplifies the process for insurance. Not only will you deal with less paperwork, but also you will manage only one policy instead of two. Besides, the combined policy will ensure that you both get equal benefits from your insurer with regard to handling claims and knowing what is covered under your policy. The Thompsons, for instance, already had single policies before they sought assistance from us. Holding even one single policy together quite easily curbed their stress while staying in Canada.

While choosing an insurance company for a Super Visa Insurance company joint policy, consider the reputation of the insurer, quality of customer service, ease of filing claims, and, of course, the costs involved. Consider how well the company handles claims for couples. At Canadian LIC, we suggest insurers with seamless, transparent claim processing records and ensure the best coverage options. We helped the Patel family wade through these considerations to select an insurer that really looked after them during their time in Canada.

One potential drawback could be that if one person’s health condition significantly impacts the policy terms, it might affect the overall cost and coverage for both. In many cases, the benefits of convenience and prospects of cost savings outweigh such considerations. We urge you to discuss your specific health profiles with a Canadian LIC advisor who can help assess the best approach for you and your spouse. This became particularly useful for the Kim family, whose one member had pre-existing conditions that influenced coverage options.

Canadian LIC has expertise in customized service. We can help you compare a few good policies of adept Super Visa Insurance Companies, extract detailed quotes from them, and advise you on what is best for you. Our advisors have experience in handling spouse-included cases and know how to help you through the intricacies to the best of your interest, like the Lees, who needed to be guided through myriad coverage options that would work best for them medically.

In many situations, it leads to savings in the case when you can add your spouse to the Super Visa Insurance Policy. Still, the actual amount by which a Super Visa Insurance Cost is decreased depends on factors like age, pre-existing medical conditions, and the insurance company itself. At Canadian LIC, we assisted the Robertson couple in comparing prices of both individual and joint policies. They were thrilled to find out that not only was a joint policy cheaper but also more manageable.

You will need to provide details regarding your and your spouse’s age, medical history, and conditions that might prevail at the time in order to get the proper Super Visa Insurance Quote. This will help the insurance company assess the risk and charge the premium accordingly. A couple, the Changs, whom we helped, realized that being upfront about their health conditions assisted them in getting an optimal quote for the kind of coverage they wanted to purchase with no surprises later on.

Some of the firms that offer Super Visa Insurance have special policies for couples, which enjoy better rates and options for two people. At Canadian LIC, we deal with a myriad of different insurers and can help point customers toward those who have the best packages for couples. For example, moving the Singh family to an insurer known for its great policies for couples brought them optimum coverage at great pricing.

It is quickly possible today because of the internet comparison tool of Canadian LIC. Just input yourself and your spouse’s details in order to obtain a number of quotes to compare. This would greatly reduce the hassle as the tool filters all Super Visa Insurance Companies for the best rates with the most comprehensive coverage. The Lopez family used our tool and found it incredibly helpful to visualize their options and make an informed decision without visiting multiple websites or calling different companies.

When including your spouse in the Super Visa Insurance Policy, it’s crucial to read the fine print for details on coverage limits, exclusions, and conditions related to pre-existing health issues. Pay attention to clauses that discuss renewability, cancellation terms, and refund policies. Canadian LIC helped the Moussa family understand the fine print of their joint policy, which ensured they were aware of all the terms and helped them avoid potential issues during their stay in Canada.

Yes, most Super Visa Insurance Companies allow you to upgrade or change your coverage after the policy has started, depending on your needs. Additional fees or some restrictions, however, may apply. Please review your policy regularly at Canadian LIC and contact us if there are changes in your situation. We helped the Gagnon couple upgrade their policy when they finally decided to extend their stay, therefore ensuring that their coverage would meet their new requirements.

Obviously, the speed with which one gets coverage may differ, but with Canadian LIC, we always do our best to fast-track the processing of your application. Coverage can basically be effective within 24 to 48 hours once the application has been approved and payment is received. For instance, the O’Connor couple was in a hurry to have their insurance in order before their flight, so we clearly fast-tracked their application to ensure they were covered in time for departure to Canada.

Involving your spouse in the same Super Visa Insurance Policy is not only possible but often a smart financial and logistical choice. Our commitment at Canadian LIC is to make this process as smooth and beneficial as possible for you. Be it getting coverage or applying for the same, we’ve got your back. Let’s connect today and ensure your visit to Canada is both secure and enjoyable for you.

Sources and Further Reading

Government of Canada – Super Visa Information:

Visit the official Canadian immigration website to understand the detailed requirements and process for obtaining a Super Visa. Government of Canada – Super Visa

Insurance Bureau of Canada:

This resource offers comprehensive information on different types of insurance available in Canada, including Super Visa Insurance. Insurance Bureau of Canada

Canadian Life and Health Insurance Association:

A detailed guide on health and life insurance products in Canada, including advice on choosing the right Super Visa Insurance Policy. CLHIA – Guide to Insurance

Canadian Consumer Handbook – Tips for Insurance Buyers:

Provides tips and advice for Canadian consumers purchasing insurance, helping you understand what to look for in a policy and how to compare options. Consumer Handbook – Insurance Tips

Insurance Brokers Association of Canada:

Offers resources on how to work effectively with brokers to find the best insurance solutions, including Super Visa Insurance. IBAC – Working with Brokers

These resources and further reading suggestions will provide you with the information needed to make informed decisions about Super Visa Insurance, ensuring a smooth and well-prepared application process for visiting Canada.

Key Takeaways

- Joint policies simplify applications, reduce paperwork, and often save costs compared to separate policies.

- Understand the minimum $100,000 coverage requirement for healthcare, hospitalization, and repatriation.

- Joint policies typically offer cost savings and streamlined insurance management.

- Compare insurance quotes from different companies to find the best rates and suitable coverage.

- Pay attention to policy details, especially coverage limits and terms for pre-existing conditions.

- Utilize expert services like Canadian LIC for guidance on Super Visa Insurance complexities.

- Prepare all required documents accurately for smooth processing of your Super Visa Insurance application.

Your Feedback Is Very Important To Us

Thank you for taking the time to complete our questionnaire. Your feedback is crucial in helping us understand the challenges and concerns you may have faced when including your spouse in the same Super Visa Insurance Policy. Please answer the following questions to the best of your ability.

Your insights are invaluable in helping us improve our services and support other applicants effectively. Thank you for your participation!

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]