- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

IN THIS ARTICLE

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Short Term vs. Long Term Disability Insurance

- What Is Short Term Disability Insurance?

- What Is Long Term Disability Insurance?

- Summary of the Differences Between Short Term and Long Term Disability Insurance

- Can You Have Both Short Term and Long Term Disability Insurance?

- The Benefits of Having Both Policies

- Client Struggles and Success Stories

- How to Get Both Short Term and Long Term Disability Insurance

- Conclusion: Why Canadian LIC Can Help

Can I Have Both Short-Term and Long-Term Disability Insurance?

By Harpreet Puri

CEO & Founder

- 11 min read

- October 8th, 2024

SUMMARY

Many Canadians want to know whether they can have Short Term and Long Term Disability Insurance to secure their financial stability in case of an unexpected illness or injury. This often arises when individuals realize that even a slight downtime at work can wreak havoc on their financial health. It becomes even more pressing, however, when they realize that some injuries or illnesses could call them away from their jobs for a lengthy time, making both forms of Disability Insurance extremely valuable.

It is not unusual for clients to walk through the door of Canadian LIC with these concerns. They are splitting time between two coverages, unsure of whether it is possible, perhaps even necessary, to have Short Term and Long Term Disability Insurance. Quite commonly, they have employer-provided Short Term coverage but are concerned about where to turn when recovery far exceeds the predicted time taken to recover. In this blog, we will discuss how Short Term and Long Term Disability Insurance can work in tandem, and we will find out their unique benefits in order to make the case as to why anyone, be it self-employed or holding a group policy at work, would be smart to have both Short Term and Long Term Disability Insurance.

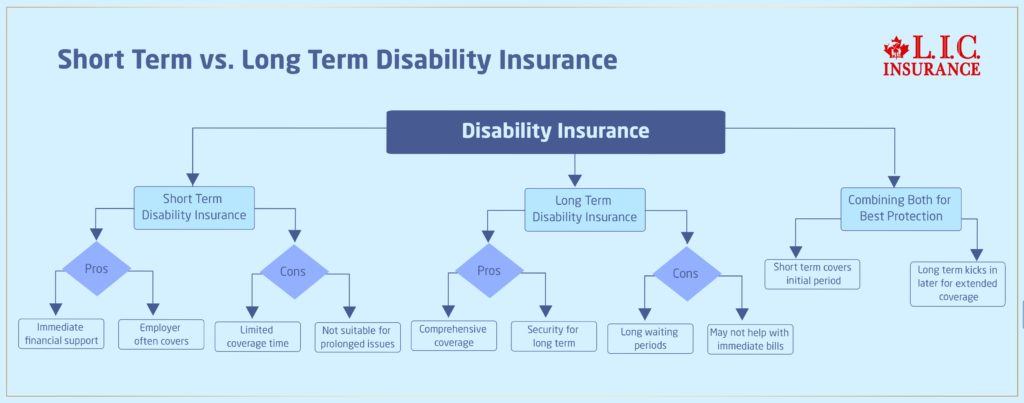

Short Term vs. Long Term Disability Insurance

People are left with a tough choice between taking Short Term or Long Term Disability Insurance. The fight is real: Short Term schemes seem to bridge the immediate need, but what happens if recovery takes longer than anticipated? On the other hand, Long Term Disability Insurance provides more comprehensive coverage, but waiting for months to receive benefits just isn’t possible when the rent and bills are due next week.

Canadian LIC clients often express frustration with this dilemma. One common story we hear is from individuals who have a relatively secure Short Term policy through their employer yet feel uneasy about not having something in place for the long haul. Conversely, some clients have long-term policies but realize, after suffering an unexpected injury, that the long waiting period leaves them financially vulnerable in the interim. Understanding how to combine these two types of coverage can make a world of difference in protecting your income and financial well-being.

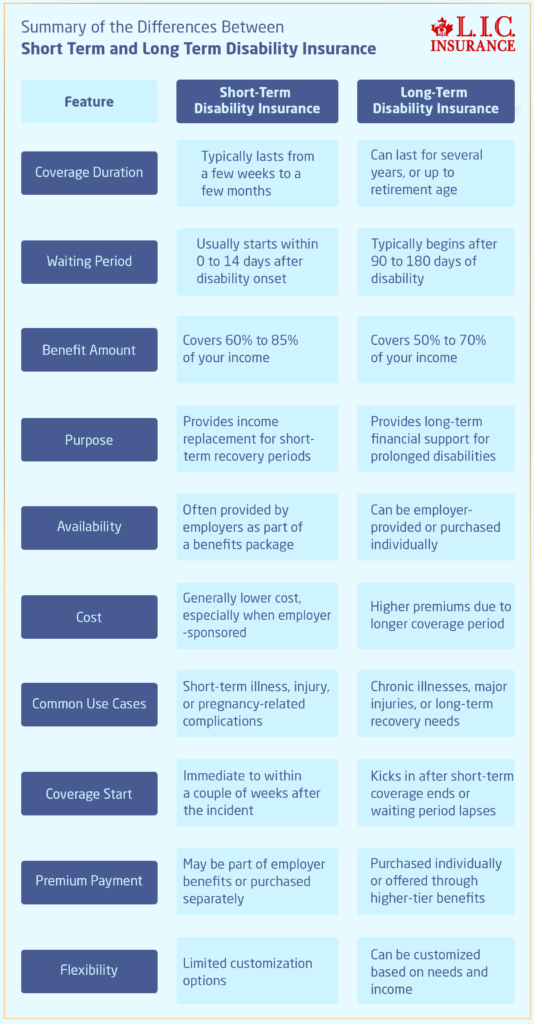

What Is Short Term Disability Insurance?

Short Term Disability Insurance covers you for a short period, a number of weeks or several months, depending on the policy. This is generally meant to replace some income when you are off and cannot work because of an illness, injury, or even problems with pregnancy. Practically all Short Term disability policies cover about 60% to 85% of your income, thereby filling in the income gap during that time you are indisposed.

Employers commonly offer Short Term Disability Insurance as part of their benefits package. However, individuals with small businesses and who are self-employed have to procure a private policy in order to be well-covered in case they have a temporary disability.

What Is Long Term Disability Insurance?

Long Term Disability Insurance covers you in case you are disabled for a longer period, sometimes until retirement. It usually has a waiting period between 90 to 180 days after a disability begins but covers a much longer period, ensuring your financial security if it will take months or years to return to work.

At Canadian LIC, we have seen firsthand just how essential having Long Term Disability Insurance is since the clients sometimes face severe or protracted medical conditions for which Short Term coverage would not be effective. In such cases, long-term coverage offers clients truly ultimate, long-lasting, continuous income replacement.

Summary of the Differences Between Short Term and Long Term Disability Insurance

Can You Have Both Short Term and Long Term Disability Insurance?

The short answer is yes, you can—and in many cases, you should have both Short Term and Long Term Disability Insurance. They complement each other and together provide more comprehensive protection for different stages of disability.

For example, you got hurt. That means you cannot be at work for six months; in the first few months, most likely, your Short Term Disability Insurance would pay for those, and Long Term Disability Insurance would kick in if time off became longer than that. Thus, once more, no gap in income during your time away from work.

Many of the Canadian LIC clients operate businesses through Disability Insurance and go for both policies as they are conscious of the fact that there is a requirement to preserve personal income while ensuring that the business, too, can be kept intact. Short Term Disability Insurance meets immediate financial requirements, whereas Long Term Disability Insurance provides peace of mind at the onset of more serious, long-lasting conditions.

The Benefits of Having Both Policies

There are several advantages to having both Short Term and Long Term Disability Insurance:

- Comprehensive Coverage: You get protection for both Short Term and long-term illnesses or injuries. Short Term policies cover you in the immediate aftermath, while long-term policies ensure continued support.

- No Gaps in Coverage: With both policies, you eliminate the risk of being left without income when transitioning from a Short Term disability period to a long-term one.

- Flexibility: Depending on your needs, you can choose to customize the waiting periods and coverage limits for both policies, creating a plan that perfectly fits your financial situation.

- Income Stability: By having both policies, you ensure that your income is protected in the short and long run, whether you’re recovering for a few weeks or facing long-term rehabilitation.

Client Struggles and Success Stories

We have helped many clients make their way through this challenging world at Canadian LIC. One was a small business owner who only had Short Term Disability Insurance. After an unexpected surgery, the client was unable to return to work for months; his Short Term benefits expired after three months. A lack of Long Term Disability Insurance put him in a tight spot where he struggled financially with living expenses and business expenditures to the point of nearly losing his business altogether.

Another client, being a little more farsighted, purchased a Short Term and a long-term policy. She soon learned that she had a very serious, chronic condition that required a long leave from her job. Her Short Term Disability Insurance began to pay her at this point, but by the time her illness worsened, her long-term policy provided her with income to get her through. She didn’t have to worry about lost income or the added stress of paying bills while focusing on her recovery.

Stories like these outline how individuals can be well prepared by having Disability Insurance of two different types that will ensure their protection and security from financial suffering during hard times.

How to Get Both Short Term and Long Term Disability Insurance

If you are thinking about adding both Short Term and Long Term Disability Insurance to your financial plan, there are many things to take into consideration. You will want to look into a range of different types of Disability Insurance Policies and compare your options. It’s important to look at:

- Coverage amount: How much of your income will be replaced?

- Waiting periods: How long will you need to wait before benefits start?

- Benefit period: How long will the benefits last?

- Premiums: How much does each policy cost?

It is also prudent to obtain a Disability Insurance Quote Online from reputable providers to see what fits within your budget. Many individuals find that combining Short Term and Long Term Disability Insurance offers the best protection without breaking the bank.

Conclusion: Why Canadian LIC Can Help

Having Short Term and Long Term Disability Insurance can be very smart, especially for people who want to insure their income, whether they are self-employed, own their own business, or are just one of the employees who have benefits through an employer. They complement each other because they help make sure you will not suffer from the financial impact of Short Term or long-term disabilities.

Nothing provides as good a balance between Short Term and Long Term Disability Insurance as is available for our clients with Canadian LIC. We have seen how both policies matter to individuals to provide protection both for themselves and their loved ones, and we can help you choose the best and tailor your coverage.

If you have finally decided to take it to the next level in securing your financial future, then call Canadian LIC, one of the best insurance brokerages in Canada today. Get your Disability Insurance Quote Online today. Let us help build the protection you need for life’s unexpected challenges.

More on Disability Insurance

- Do Disability Insurance Premiums Increase Over Time?

- What Is the “Elimination Period” in Disability Insurance?

- Can I Work Part-Time While Receiving Disability Benefits?

- Does Disability Insurance Cover Mental Health Issues?

- Is Disability Insurance Taxable?

- How to Calculate Disability Insurance?

- Why Can’t I Buy Disability Insurance?

FAQs: Can I Have Both Short Term and Long Term Disability Insurance?

Yes, you can have both. Many people combine them to make sure they’re covered for both Short Term needs and long-term illnesses or injuries. At Canadian LIC, we see clients who initially think they only need one but later realize both are essential to protect their income at different stages of recovery.

Even if your employer offers Short Term coverage, adding Long Term Disability Insurance can be crucial. We often advise clients at Canadian LIC that employer plans may not be enough if the disability lasts longer than a few months. Adding your own policy ensures you’re protected beyond the employer’s offering.

Short Term Disability Insurance covers you first, typically for a few weeks or months. Long Term Disability Insurance kicks in once the Short Term policy ends. This combination ensures continuous coverage. At Canadian LIC, clients often ask us how to avoid income gaps, and having both policies helps you avoid that problem.

Yes, self-employed individuals can definitely get both types of Disability Insurance. This is especially important for business owners who don’t have employer-sponsored benefits. At Canadian LIC, we help many clients in business get a Disability Insurance Quote Online tailored to their needs.

If you only have Short Term coverage, you risk losing income if your recovery takes longer than expected. On the other hand, if you only have long-term coverage, you might have to wait months before benefits start. Many Canadian LIC clients face this challenge, which is why we often recommend considering both Disability Insurance Policies for full protection.

The amount depends on your income and financial needs. We recommend a plan that replaces at least 60% to 85% of your income. At Canadian LIC, we work with clients every day to help them understand how much they need, especially when they are looking for Disability Insurance for Business to protect both personal and business finances.

Refunds depend on your policy and provider. Some plans offer partial refunds if cancelled early, while others do not. At Canadian LIC, we always advise clients to review policy terms carefully before making changes to avoid unexpected issues.

Applying is straightforward. You can either contact an insurance provider directly or get a Disability Insurance Quote Online. At Canadian LIC, we help our clients explore the best Disability Insurance Policies for both Short Term and long-term needs, ensuring they understand the benefits and costs involved.

Absolutely. Many business owners rely on Disability Insurance to protect their income and operations if they’re unable to work. At Canadian LIC, we see business clients who need coverage not only for personal protection but also to ensure their businesses can run smoothly during their recovery.

The waiting period for a Long Term Disability Insurance Plan is typically between 90 to 180 days after the start of your disability. During this time, Short Term Disability Insurance usually covers your needs. We often advise Canadian LIC clients to choose policies that complement each other so they have continuous coverage.

Yes, many insurance providers allow you to adjust or extend your coverage if your income or circumstances change. At Canadian LIC, we help our clients reassess their Disability Insurance Policies regularly, ensuring they always have the right amount of coverage.

Yes, adding both types of coverage can increase your premiums, but it also provides more comprehensive protection. We often advise Canadian LIC clients to compare plans and get a Disability Insurance Quote Online to find a balance between cost and coverage that works for them.

Yes, many clients at Canadian LIC choose to combine Disability Insurance Plans with other types of coverage like life insurance or critical illness insurance. This strategy offers more complete protection for both personal and business-related risks.

If you recover sooner, your benefits will stop once you’re able to return to work. However, having both Short Term and Long Term Disability Insurance ensures that you’re protected if recovery takes longer than anticipated. At Canadian LIC, we’ve seen many clients who benefited from both policies when recovery times were unpredictable.

If you need more help or would like to learn how Short Term and Long Term Disability Insurance can protect you, feel free to reach out to us at Canadian LIC.

Sources and Further Reading

Here are some useful sources and further reading materials related to the topic of Disability Insurance in Canada:

- Government of Canada: Disability Insurance Information

Provides an overview of disability benefits, eligibility, and insurance options in Canada.

https://www.canada.ca/en/services/benefits/disability.html - Canadian Life and Health Insurance Association (CLHIA): Guide to Disability Insurance

Offers detailed information on different types of Disability Insurance Policies, including both Short Term and long-term options.

https://www.clhia.ca - Canadian Business Owner’s Guide to Disability Insurance

This guide helps business owners understand the importance of disability coverage for protecting both personal income and business operations.

https://www.canadianbusiness.com/disability-insurance/ - Financial Consumer Agency of Canada: Protecting Your Income with Disability Insurance

An excellent resource on the need for Disability Insurance and how to choose the right policy for your needs.

https://www.canada.ca/en/financial-consumer-agency.html - Insurance Bureau of Canada: Disability Insurance FAQs

Frequently asked questions about Disability Insurance and the differences between Short Term and long-term policies.

https://www.ibc.ca

These resources offer valuable insights into Disability Insurance in Canada, helping you further understand your options and the importance of adequate coverage.

Key Takeaways

- Short Term and Long Term Disability Insurance work together: Short Term covers immediate needs, while long-term provides protection for prolonged disabilities.

- You can have both types of insurance: Combining Short Term and Long Term Disability Insurance ensures continuous income protection, with no gaps during your recovery.

- Critical for business owners: Disability Insurance for Business owners helps protect both personal income and business operations in case of an illness or injury.

- Employer plans may not be enough: Adding personal policies ensures more comprehensive coverage beyond employer-provided Short Term plans.

- Customized coverage is available: You can tailor Disability Insurance Policies to suit your income and lifestyle needs. Always compare Disability Insurance Quote Online for the best fit.

Your Feedback Is Very Important To Us

We would love to hear your thoughts on using RESP funds for apprenticeship programs. Your feedback will help us understand the challenges families face and improve our services to better assist you.

Your feedback will help us better understand the challenges individuals face when considering Short Term and Long Term Disability Insurance in Canada and how we can assist you in finding the right coverage. Thank you for your input!

IN THIS ARTICLE

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Short Term vs. Long Term Disability Insurance

- What Is Short Term Disability Insurance?

- What Is Long Term Disability Insurance?

- Summary of the Differences Between Short Term and Long Term Disability Insurance

- Can You Have Both Short Term and Long Term Disability Insurance?

- The Benefits of Having Both Policies

- Client Struggles and Success Stories

- How to Get Both Short Term and Long Term Disability Insurance

- Conclusion: Why Canadian LIC Can Help