You might feel both excited and nervous about your trip to Canada, especially if you’re worried about your health. What if you get sick or have an accident out of the blue? This worry grows if you already have health problems, which are sometimes called “pre-existing conditions.”

Understanding the complicated parts of Visitor Insurance can be hard, especially when it comes to pre-existing conditions. By breaking down how Visitor Insurance in Canada works and what conditions it covers, this blog aims to make things clearer for everyone. Our goal is to give you information that will make you feel safe and carefree on your trip.

Let's Get To Know Visitor Insurance First

First things first, let’s discuss what exactly Visitor Insurance entails. Also known as visitor health insurance, this type of policy covers medical emergencies and other unexpected situations you might encounter while visiting a foreign country, such as Canada.

You might be wondering why you would need Visitor Insurance at all. Canada is renowned for its excellent healthcare system, so what’s the point of additional insurance? The answer lies in the costs involved. Although Canada does provide high-quality healthcare services, these are not free for non-residents. Without the healthcare benefits that Canadian residents enjoy, you, as a visitor, would face significant medical expenses in case of illness or injury.

This is where Visitor Insurance proves invaluable. By securing a Visitor Insurance policy, you safeguard yourself against the financial impact of unforeseen medical issues. It ensures that you can receive the necessary care without worrying about the financial strain it could cause.

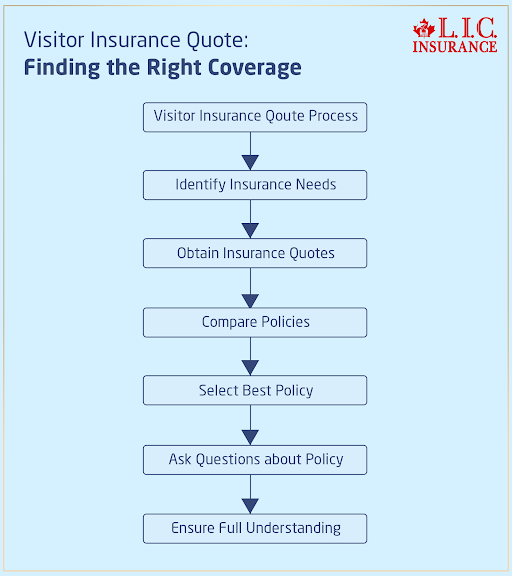

Visitor Insurance Quote: Finding the Right Coverage

Not all Visitor Insurance is created equal, and there are quite a few companies and plans out there that offer different coverages—at very varying price points. So, who is best for you?

Another option could be to get a Visitor Insurance Quote. In this, the number of days of stay would have to be entered along with pre-existing medical conditions, after which the quote would be generated.

Getting a Visitor Insurance Quote is one of the very first and essential steps when buying insurance for visitors. It allows for comparing several policies and is surely a guarantee for the best coverage at the most competitive price. It even goes ahead to take the time to ask any questions that you may be having regarding the policy just to ensure that one fully understands what he is getting himself into.

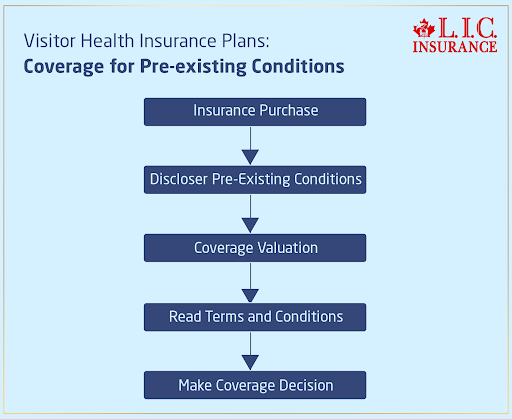

Visitor Health Insurance Plans: Coverage for Pre-existing Conditions

This now brings us to the main question: Can you get Visitor Insurance, including coverage for pre-existing conditions? The answer is “yes,” with a few qualifying factors.

In truth, most Visitor Health Insurance Plans even cover pre-existing conditions. However, the terms and extent of coverage vary from policy to policy. While a policy may have broad coverage in pre-existing conditions, another one will have different sorts of restrictions and exclusions.

Some may, for example, require that all pre-existing medical conditions be disclosed at the time of purchase. If these conditions are not disclosed, they are not covered by the insurance, no matter what caused them. Other policies may cover pre-existing conditions but enforce waiting periods before they take effect.

Always read very carefully the terms and conditions of the visitor’s health insurance plan before making the purchase, noting the points of what is covered and what is not, specifically pre-existing conditions. Additionally, if someone has any pre-existing conditions, it would be best if they were honest about them when they get a quote for visitor’s insurance. This way, the price and terms of the coverage can be matched.

Visitor Insurance Struggles: A Real Story

Let us share this incident from our personal experience as an example to show how crucial knowledge of Visitor Insurance coverage regarding a pre-existing condition is.

A few years ago, when one of our client’s aunts was visiting Canada, everything was arranged for her to come and see our client. She suffered from some kind of illness and had a pre-existing heart condition. Under her normal travel insurance, she thought all possible medical expenses during the stay were going to be covered.

But if you fall ill on your trip, go for medical treatment, and then at the point of treatment find out that your insurance policy does not cover this particular illness and classifies it as “pre-existing,” it can really be shocking. As a result, she was left facing hefty medical bills that put a significant strain on her finances.

This experience taught our client a valuable lesson about the importance of thoroughly researching and understanding insurance coverage, especially when dealing with pre-existing conditions. I hope others can learn from it as well.

To Wrap It All Up

In conclusion, a visitor to Canada with pre-existing conditions can obtain insurance, but attention to detail and the fine print are required to understand what the coverage actually provides. Obtain a quote for Visitor Insurance and read the terms of all visitor’s health insurance policies carefully so you are properly covered during your visit to Canada.

The last thing you’d want, however, is to find yourself in an emergency without a proper insurance cover. Don’t wait until it’s too late, and spare a little time to find out about investing in a good and comprehensive visitors’ insurance policy.

As for the top insurance brokerage that offers advice through the maze of Visitor Insurance, look to none other than Canadian LIC. Their knowledge and personal service will give you peace of mind in finding the perfect policy to suit your needs, even with pre-existing conditions. Don’t leave these things to chance. Get in touch with experts at Canadian LIC right away for the best guidance.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs About Visitor Insurance and Pre-Existing Medical Conditions

Yes, a pre-existing condition does get coverage, but knowing the limitations of the coverage and options available would help. Although in many of the plans of the visitor health insurance, a pre-existing condition is included in the coverage terms.

Some pre-existing conditions are fully covered, but some plans may be restricting or excluding them. One should make it a point to disclose all pre-existing conditions right in the beginning while getting a quote for Visitor Insurance so that the person gets his pricing accurate along with detailed coverage.

Sarah was travelling to Canada to meet her relatives, and her pre-existing condition of asthma was a problem. She googled search for “Visitor Insurance Plans” and found a “Pre-existing condition with zero waiting period” feature in one of them. Sarah was able to disclose her asthma when getting a Visitor Insurance Quote and hence got covered for the travel.

The best would be to compare several insurance providers in regard to the insurance coverage and plans offered. First, look for the most reputable insurance companies that offer specific Visitor Health Insurance Plans. Thus, you might ask for travel insurance visitor quotes from different companies.

They should provide details on when your travel will begin and when it will terminate, if necessary. From there, get a few quotes, comparing the coverage options against one another to get the best policy value for your dollars.

David was a businessman who was soon about to fly for a business trip to Canada. He was in search of Visitor Health Insurance Plans that would cover his pre-existing heart condition. He was pretty prompt in getting quotes from different providers and comparing the coverage options available using an insurance comparison tool online.

Simply by shopping around and seeking the best value for his money, David was able to procure one of the best, most competitively priced Visitor Health Insurance Plans, giving comprehensive coverage for the trip.

For instance, say there is a pre-existing condition, but you need Visitor Insurance. For this, you should first disclose this fact at the time of taking the quote for Visitor Insurance. Make sure you accurately tell the truth about your medical history to get the correct pricing and appropriate insurance.

Study each of the policies keenly to come up with the most preferable coverage for you after you get quotes from several of them. If you have any questions or concerns, don’t hesitate to reach out to the insurance provider for clarification.

While Emily was about to travel with her family to Canada, the issue that concerned her was her son’s allergy to peanuts. When she was getting quotes for Visitor Insurance, she finally revealed his allergy. Finally, she came across a plan in which there was coverage of pre-existing conditions, and under it, no exclusion was done. Only because Emily took the time to talk through her concerns with the company’s insurance provider, her family was able to enjoy the holiday.

Travelling to Canada would be quite impossible without Visitor Insurance, as it safeguards from a number of uncertain events such as medical emergencies. As much as Canada does offer good health care service, it’s also not free of charge. Being a guest in their country, you don’t have the same rights to such services as a Canadian citizen would. Visitor Insurance takes the financial burden of unplanned, unexpected medical expenditure off your shoulders and ensures that this will not be a hindrance in promptly getting you the needed care.

Mark and his wife planned a romantic trip to Canada. Suddenly, the wife got sick; she was found to be suffering from appendicitis. Had Visitor Insurance not been there, they would have had to suffer due to an exorbitant medical bill. However, they thanked their stars because Visitor Insurance was bought before the trip. It really came in handy as she had to undergo emergency surgery on reaching there and was eventually hospitalized for a couple of weeks. However, thanks to the Visitor Insurance that covered the cost of her surgery and subsequent hospitalization, they continued with the recovery process rather than thinking over monetary issues.

Coverage for pre-existing conditions, if provided, varies with the Visitor Insurance plan. Some of the plans provide all-inclusive coverage—both the course of treatment and medication are provided—while in some other cases, it might be limited or not allowed. Review the plan terms and conditions of the Visitor Insurance carefully so you know what they consider regarding pre-existing conditions.

Rachel came to Canada to attend a conference, and right while being within Canada, her arthritis flared up. She bought Visitor Insurance, but she was doubtful whether this condition was covered or not. However, when she reviewed the policy, she actually found out that the policy really covered her arthritis, and then she got treated without worrying about the bill.

Yes, you can purchase a Visitor Insurance plan after arriving in Canada, but it is usually advisable to buy a Visitor Insurance policy before landing in Canada. It is also possible to obtain insurance before your arrival, allowing you to travel to Canada and live comfortably for the duration of your stay. However, if insurance is not purchased on the date of the travel and if an extension of insurance coverage is required while in Canada, some insurers allow for the selling of coverage subsequent to the date of arrival.

John, coming for a two-week vacation, has just landed in Canada. However, before his departure, he forgot altogether to buy Visitor Insurance. On the third day of the stay, as he went hiking, he slipped and sprained his ankle. Finally, he managed to purchase Visitor Insurance online and pay off the medical bills. He could not help but regret that he should have bought insurance earlier, which would have saved both trouble and uncertainty.

Of course, if you feel the Visitor Insurance policy is no longer required, you have every right to cancel it at any time. The process and possible charges will be as per the insurance company. Some insurance companies will refund you for the unused portion of the coverage if you cancel the policy. Few may impose a cancellation fee, or the cancellation terms are in the policy. It is important that you check the cancellation policy of the visitor’s insurance plan before buying it.

Maria had planned an entire family trip to Canada, and all the plans were shuffled just an hour before due to a family emergency situation. So, the Visitor Insurance policy that Maria’s family had bought for that trip was standing cancelled. She called her insurer, who advised that she could cancel the policy for a refund of part of the money, which, in reality, really came in handy in easing some financial pressure over a crisis.

Most Visitor Insurance Plans cover emergency medical evacuation back to the home country, which is deemed necessary on grounds of medical liability. Thus, such coverage will guarantee medical treatment in the home country in cases when medical facilities or conditions are not available or adequate in Canada.

However, it is quite important to read and understand the terms and conditions of the Visitor Insurance policy in order to know the exact value for limitation in coverage and the requirements to be adhered to in emergency medical evacuation.

James came to Canada on a visit. He had an acute allergic reaction and needed specialized treatment, in his case. However, the Visitor Insurance plan he purchased covered emergency medical evacuations. James was airlifted to his home country for treatment under that policy. His insurance plan, which allowed him to get the care he needed, thus came to the rescue in time to save his life.

Sources & Further Reading

Government of Canada – Visitors to Canada: Health Insurance:

This official website provides information on health insurance for visitors to Canada, including what is covered and how to obtain coverage.

Insurance Bureau of Canada – Visitor to Canada Insurance:

The Insurance Bureau of Canada offers insights into Visitor Insurance in Canada, including the types of coverage available and factors to consider when purchasing a policy.

Travel Insurance Review – Visitor to Canada Travel Insurance:

This website provides reviews and comparisons of Visitor Insurance Plans available in Canada, helping travelers make informed decisions about their coverage options.

Canadian Life Insurance Company (Canadian LIC) – Visitor Insurance: https://www.canadianlic.com/services/visitor-insurance/

Canadian LIC offers Visitor Insurance Plans tailored to the needs of travelers to Canada, including coverage for pre-existing conditions. Their website provides information on available plans and how to obtain a quote.

World Nomads – Understanding Pre-existing Conditions and Travel Insurance:

World Nomads provides insights into pre-existing conditions and travel insurance, explaining how coverage works and what travelers need to consider when purchasing a policy.

These sources offer valuable information and insights into Visitor Insurance in Canada, including coverage options, policy terms, and considerations for travelers with pre-existing conditions. By consulting these resources, travelers can make informed decisions about their insurance needs and ensure they have the coverage they require for a safe and worry-free trip to Canada.

Key Takeaways

- Visitor Insurance provides coverage for medical emergencies during visits to Canada.

- You can get Visitor Insurance with pre-existing conditions, but coverage varies.

- Visitor Insurance is for short-term visits, while travel medical insurance is more comprehensive.

- Compare quotes to find the best coverage for your needs.

- Disclose pre-existing conditions when obtaining a quote to ensure accurate pricing.

- Consider factors like condition severity and trip duration when choosing insurance.

- Understand cancellation and refund policies before purchasing insurance.

- Many plans offer coverage for emergency medical evacuation if needed.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]