- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Can I convert my Term Policy to Whole Life?

- What is Term Life Insurance, and Why Do Many Start Here?

- Whole Life Insurance: A Brief Overview

- Why Consider Converting Term Life Insurance to Whole Life Insurance?

- How the Conversion Process Works

- Conversion from Term to Whole Life Insurance

- Pros and Cons of Converting to Whole Life Insurance

- Is Converting the Right Decision for You?

- Making Your Choice with Canadian LIC

Can I Convert My Term Policy to Whole Life?

By Pushpinder Puri

CEO & Founder

- 11 min read

- November 1st, 2024

SUMMARY

This is a common dilemma for many Canadians: Term Life Insurance versus Whole Life Insurance. Term Policies are relatively cheap, clear-cut, and provide cover for a given period, but over time, situations in life change, and priorities do as well, which is why most policyholders ask whether their Term Life Insurance Policy can be converted into Whole Life Insurance. This is an all too common dilemma, and at Canadian LIC, we hear from clients regularly who are exploring their options. Many find themselves in a situation where they initially chose Term Life Insurance because of its lower premiums but later wish for lifelong coverage, guaranteed cash value, and added flexibility of Whole Life Insurance. It is rarely easy to switch in terms of decisions, but the good news is that most Term Life Insurance Policies have conversion options available.

In this blog, we will dive a little deeper into Term Life Insurance and Whole Life Insurance and learn about converting a Term Policy to Whole Life Insurance in Canada, with all the ins and outs. Knowing what it really means, why you should consider it, and how to do it will let you make the right choices for your financial future.

What is Term Life Insurance, and Why Do Many Start Here?

Term Life Insurance is very popular because of its simplicity and affordability. It covers you for a specific period, say ten, twenty, thirty or fifty years, during which your premium will be stable. But if you die during this term, your beneficiaries receive the policy’s death benefit. This makes it very attractive to young families, people paying off debts, or just to cover those peak financial responsibility years.

Based on our experience, here are some reasons why clients usually go for a Term Life Insurance Policy:

- Affordability: Term Life Insurance generally has lower premiums than Whole Life Insurance, making it a budget-friendly option.

- Flexibility of Coverage: A Term Policy allows you to choose a term length that aligns with financial milestones, such as paying off a mortgage or funding your children’s education.

- Straightforwardness: Without a cash value component, Term Policies are simple to understand and manage.

However, there comes a point for many policyholders when they begin looking for a more permanent solution. This shift often occurs as they approach the end of their term and realize they would like the security of lifelong coverage. This is where a conversion option becomes invaluable.

Whole Life Insurance: A Brief Overview

Whole Life Insurance is classified under Permanent Insurance since coverage exists for a lifetime unless the premiums are stopped and paid. Unlike term life, though, whole life also maintains a cash value account in which the cash increases on an annual basis. Therefore, the policyholders can make any withdrawal or borrow the existing cash value account, and as such, it’s appealing if it is a tool, both as an insurance product that also serves as a financing tool.

Whole Life Insurance has the following features:

- Lifetime Coverage: Whole Life Insurance is designed to last your entire lifetime.

- Cash Value Accumulation: A portion of your premium builds cash value, which can grow over time.

- Fixed Premiums: With Whole Life Insurance, premiums remain the same throughout the policyholder’s life.

While Whole Life Insurance does have its merits, it is often more expensive. Therefore, most people opt for Term Life Insurance and leave the option of conversion open for later.

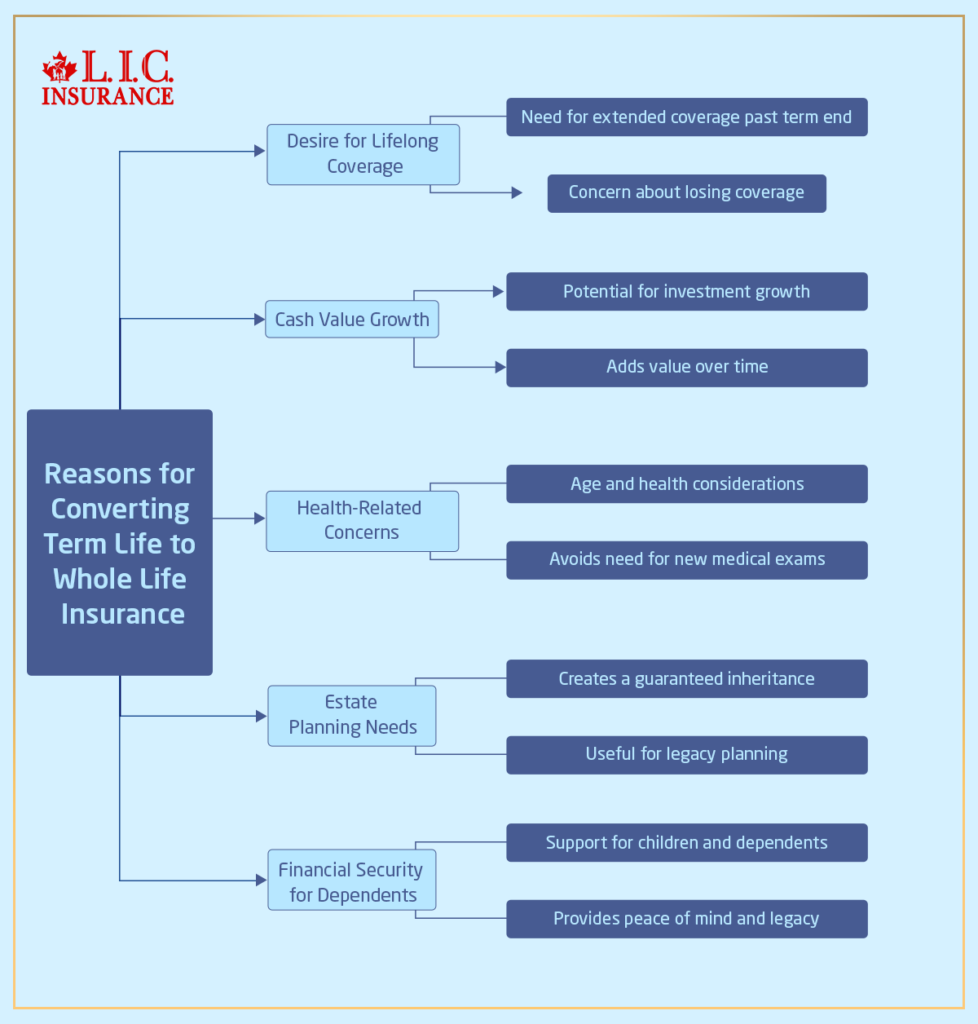

Why Consider Converting Term Life Insurance to Whole Life Insurance?

The motivations for converting a Term Life Insurance Policy to Permanent Coverage are varied and personal, but several common themes stand out.

- Desire for Lifelong Coverage: One of the most compelling reasons to convert is the realization that lifelong coverage may better suit your needs. Many of our clients find that as they near the end of their Term Policy, they are not comfortable losing coverage.

- Cash Value Growth: The cash value component of Whole Life Insurance provides an appealing investment opportunity. We often speak with clients who, as they approach retirement or major life milestones, see the potential in a policy that builds value over time.

- Health-Related Concerns: As we age, health can become a concern, making it harder or more costly to qualify for a new policy. By converting a Term Policy to whole life, clients can maintain coverage without undergoing a new medical exam.

- Estate Planning Needs: Whole Life Insurance is an asset that can be used in estate planning. Some policyholders convert their Term Life Insurance because they want to leave a guaranteed inheritance for their loved ones.

- Financial Security for Dependents: Some clients wish to continue offering financial support to their children, even after they become independent. Whole Life Insurance provides peace of mind, and they can leave a legacy for their family.

How the Conversion Process Works

In general, converting a Term Life Insurance Policy to a Permanent Policy is a pretty straightforward process, although specifics will vary with your provider and policy. Most Term Life Insurance Policies offer a conversion privilege: you can switch to whole life without a medical exam. Here’s how it generally works:

- Check Your Policy’s Conversion Option: Not all Term Policies include a conversion feature, so it’s essential to verify this with your Life Insurance Company. Your conversion option might have an expiration date or other conditions, such as an age limit for conversion.

- Choose the Timing Wisely: Timing is crucial when it comes to converting a Term Policy to Whole Life Insurance. Waiting too long may lead to higher premiums on your new Whole Life Policy, so evaluating your options early is beneficial.

- Consult with Your Insurance Provider: Contacting your insurance provider is a key step. They can clarify how the conversion process will affect your premium, policy details, and any associated benefits.

- Consider Partial Conversions: Some clients may find it advantageous to convert only a portion of their Term Life Insurance to Permanent Policies. This option allows you to maintain some of the affordability of term insurance while gaining the benefits of Whole Life Insurance on a smaller scale.

- Understand the New Premiums: Whole Life Insurance premiums are generally higher than term premiums. Reviewing your budget and considering the long-term costs associated with Whole Life Insurance is essential in making this decision.

Conversion from Term to Whole Life Insurance

There are numerous cases at Canadian LIC where clients have opted to convert their term life policy to Whole Life Insurance. A notable case is of a client who opted for a 20-year Term Policy to protect his family during the time he would pay off his mortgage. As he was nearing the end of his term, he contacted us with fears about losing his coverage due to health issues he had developed over the years.

Instead of letting his term insurance lapse and then being welcomed by perhaps sky-high prices when he would apply for a new policy, he opted for conversion into a Whole Life Insurance policy. This way, the insured would be assured of life-long coverage, thus not having to worry once and for all, besides acquiring a cash value part where he can benefit by extracting that cash if ever additional money is required later. It was, in every respect, peace of mind – knowing he would never lack coverage for his loved ones.

Pros and Cons of Converting to Whole Life Insurance

Converting a Term Life Insurance Policy to Whole Life Insurance comes with both advantages and disadvantages. Here’s a breakdown to consider:

Pros

- Lifelong Coverage: With Whole Life Insurance, you’ll never have to worry about outliving your policy.

- Cash Value Growth: Whole Life Insurance builds cash value, which can be accessed during your lifetime.

- Premium Consistency: Whole life premiums remain consistent over time, eliminating the need to requalify for a new policy later in life.

Cons

- Higher Premiums: Whole Life Insurance costs more than Term Life Insurance. For those on a tight budget, this can be a challenge.

- Limited Flexibility: Once you convert to Whole Life Insurance, you lose the flexibility to change to a different policy type.

Is Converting the Right Decision for You?

Deciding to convert from Term Life Insurance to Whole Life Insurance is a significant choice that should be considered carefully. Here are some scenarios where conversion may be beneficial:

- You Need Lifetime Coverage: If you’re nearing the end of your Term Policy and still want coverage, Whole Life Insurance can provide that without the need for a new medical exam.

- You Want to Build Cash Value: For those looking to add an investment component to their insurance, Whole Life Insurance’s cash value can serve as a financial tool.

- Your Health Has Changed: Converting to Whole Life Insurance can help those who might face difficulty getting a new policy due to health issues.

Conversely, if you still need coverage for a certain period or may not comfortably pay the high premiums, then keeping Term Life Insurance and, alternatively, considering other types of coverage would be wise.

Making Your Choice with Canadian LIC

We’re here to help at Canadian LIC with making those insurance decisions to help guide your needs at various changes in life. Every day, we visit clients who begin term life policies but discover, after time, whole life could better fit. It is actually a great strategy in reaching long-term goals of money security for a family with the conversion of a Term Policy into a Whole Life Policy.

Through us, you will have a team of experienced professionals working for you, who can understand your needs and lead you through the decision-making process. We are here to help you explore options, clarify any questions, and make sure you are confident in the future of your insurance coverage.

Whether you want to learn more about Term Life Insurance and Whole Life Insurance, require advice on Term Life Insurance Policies, or wish to learn more about Term Life Insurance Quotes, we can help. Contact Canadian LIC today to explore how we can assist you in making the transition smoother and more aligned with your future goals.

More on Term Life Insurance

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs on Converting Term Life Insurance to Whole Life Insurance

Converting Term Life Insurance to Whole Life Insurance means switching your current Term Policy to a Whole Life Policy without needing a new medical exam. Many people choose this option when they want lifetime coverage or the benefits of cash value, which Term Life Insurance Policies do not offer. At Canadian LIC, we see clients who initially chose term insurance for its affordability but later feel the added benefits of Whole Life Insurance make sense for their changing needs.

People often make the switch when they want lifetime coverage or a policy that builds cash value. As life circumstances evolve, Term Life Insurance Policies may no longer fully meet some clients’ needs. In our experience, clients approaching retirement or those thinking about estate planning often find the cash value and permanence of Whole Life Insurance more appealing.

Most Term Life Insurance Policies allow conversion within a specific period, often based on age limits or a specific term period. It’s a good idea to check with your provider or speak with an advisor at Canadian LIC to confirm when your conversion option is valid. Timing is crucial, and we often guide clients on when it might make the most financial sense for them to make this change.

In most cases, you don’t need a new medical exam to convert Term Life Insurance to Whole Life Insurance. This is one reason why so many clients choose to convert; they can keep coverage without having to requalify, even if their health has changed since they took out the original policy. We frequently see clients who find this feature valuable, especially if they have developed health issues over the years.

Yes, Whole Life Insurance premiums are typically higher than Term Life Insurance premiums. This increase is due to the added benefits of Whole Life Insurance, including cash value and lifetime coverage. When we discuss options with clients, we ensure they understand the cost difference so they can decide if the benefits of Whole Life Insurance fit their current financial plans.

Some providers offer a partial conversion, allowing you to convert a portion of your Term Life Insurance to permanent while keeping the rest as term coverage. This option can provide a mix of affordability and permanence. Canadian LIC frequently assists clients with partial conversions as a flexible solution, offering them some whole life coverage without fully increasing their premiums.

Whole Life Insurance offers different benefits than Term Life Coverage. It provides lifetime coverage and a cash value component, which can be borrowed against or accessed later. Term Life Insurance, by contrast, only offers coverage for a specific term and doesn’t accumulate cash value. The choice depends on what you need: many clients at Canadian LIC find that Whole Life Insurance fits their long-term goals better as they get older, while Term Life Insurance Policies are often ideal during younger years.

Once you convert to Whole Life Insurance, it’s generally a permanent decision, meaning you won’t be able to switch back to a Term Policy. This is why we encourage clients to think carefully and discuss their options with us before making the change. Whole Life Insurance is a commitment, and understanding what it offers in comparison to Term Life Insurance Policies can help you feel confident in your decision.

Whole Life Insurance offers lifelong coverage, which can be part of your legacy planning. Unlike Term Life Insurance, Whole Life Policies do not expire, so your family is always covered. Many of our clients at Canadian LIC choose to convert because they want to ensure their family will have support regardless of when they pass away, especially as they approach their policy’s end.

If the conversion period expires, you will likely need to reapply for new coverage, which could require a medical exam. For clients facing this situation, we advise acting sooner rather than later if they’re interested in converting. Waiting until the conversion option expires could mean facing higher premiums or losing coverage altogether if health conditions have changed.

This decision often depends on your current goals, budget, and long-term needs. If you’re looking for cash value accumulation, lifetime coverage, or an estate planning tool, Whole Life Insurance could be beneficial. However, if your main priority is affordable coverage for a specific period, sticking with Term Life Insurance may make more sense. Canadian LIC works with clients to help assess their goals and provide advice on the best course for their unique situations.

Yes, you can get a quote for your new Whole Life Insurance policy after conversion. At Canadian LIC, we can help you understand the costs associated with conversion based on your policy details, Term Life Insurance Quotes, and the coverage amount you need. This allows you to see the financial impact of conversion before making a commitment.

Not all Term Life Insurance Policies come with a conversion option. It depends on the specific policy and provider. At Canadian LIC, we often review policies with clients to check for this feature, as many are unsure whether they have the option. We advise always confirming with your provider or speaking to an advisor if you’re considering this route.

Many Term Life Insurance Policies have age restrictions on conversion, often around age 65 or 70. This varies by provider, so it’s wise to check early on. We find that clients who start thinking about conversion sooner often have more options, so discussing age limits is part of our regular conversations with policyholders considering the switch.

When you convert to Whole Life Insurance, a new policy is created that starts building cash value from that point onward. This cash value grows over time and can be accessed if needed. Clients often appreciate the long-term growth potential of cash value in Whole Life Insurance, especially when they’re planning for future financial needs. Canadian LIC helps explain how cash value works and how it can benefit you and your loved ones over time.

When you convert, the death benefit may remain the same or adjust based on the new Whole Life Policy terms. Some clients prefer to keep the same coverage amount, while others choose to adjust it to match their current financial goals. We assist clients in assessing what death benefit level suits them best, especially if they’re considering leaving an inheritance or supporting loved ones long-term.

Yes, it’s always a good idea to compare quotes to see how each option fits your budget. Term Life Insurance Quotes are generally lower due to limited coverage, while whole life quotes are higher but come with added benefits. Many clients at Canadian LIC like to weigh both options side by side, helping them make a confident decision about conversion based on real numbers.

Partial conversion is available with some but not all Term Life Insurance Policies. This feature allows you to keep part of your term coverage while converting another portion to Whole Life Insurance. Canadian LIC frequently sees clients who find this flexibility useful, as it allows them to combine affordability with the lifelong benefits of Whole Life Insurance.

Converting from Term Life Insurance to Whole Life Insurance can align well with long-term financial goals, especially if you’re seeking stability and cash value growth. Whole Life Insurance can provide resources for future needs, and many clients use it for retirement planning or as a legacy for their family. Discussing these goals with an advisor can help you see how conversion might support your larger financial picture.

The process is typically straightforward and doesn’t take long once the paperwork is in place. Our team at Canadian LIC guides clients through every step, ensuring the switch is smooth and hassle-free. Most clients are pleasantly surprised at how quickly they can complete the conversion and start building lifelong coverage.

Your premiums will increase when you convert to Whole Life Insurance due to the added benefits and cash value growth. At Canadian LIC, we work with clients to estimate their new premiums and ensure they feel comfortable with the cost difference. Understanding this change can help you decide if Whole Life Insurance fits within your budget.

Whole Life Insurance provides lifelong coverage and cash value accumulation, which many find valuable. While it costs more than Term Life Insurance, these benefits make it an appealing choice for clients looking for a permanent solution. Canadian LIC helps clients see how Whole Life Insurance’s features might work for them based on their personal goals and financial situation.

You can often convert your Term Life Insurance Coverage before it expires, but waiting until the last minute can limit your options. Many clients come to Canadian LIC close to their term’s end, and we work quickly to help them secure a conversion if desired. However, acting sooner gives you more control over the process.

Whole Life Insurance’s cash value component allows you to build a financial resource that can be accessed through loans or withdrawals if needed. Many clients use cash value to fund retirement or handle unexpected expenses. The ability to build cash value adds another layer of financial security that Term Life Insurance Policies do not provide, making Whole Life Insurance a preferred option for long-term planning.

Yes, most conversions allow you to switch without a new medical exam. This is valuable for clients whose health has changed since they purchased their Term Life Insurance. At Canadian LIC, we often see clients benefit from this feature, allowing them to keep coverage despite health changes without the worry of being disqualified for a new policy.

Whole Life Insurance can play a key role in estate planning. It allows you to leave a legacy for your loved ones, ensuring they receive financial support after you’re gone. Clients considering estate planning often find Whole Life Insurance a secure choice for passing on assets and achieving their legacy goals.

Absolutely! Our advisors at Canadian LIC review Term Life Insurance Policies regularly with clients who are exploring conversion options. We help you understand your policy’s features, compare quotes, and assess if conversion to Whole Life Insurance aligns with your goals. We’re here to help you make the best choice for your future.

These are some of the common questions we answer for clients who are considering converting Term Life Insurance to Whole Life Insurance. We are here at Canadian LIC to walk you through every step in making the most informed decision for your future.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA) – CLHIA provides detailed information on different types of life insurance available in Canada, including guidelines for term and Whole Life Insurance options.

- Government of Canada: Life Insurance Basics – This resource offers foundational knowledge on life insurance in Canada, covering types of insurance, including term and whole life, and factors to consider for conversion.

- https://www.canada.ca/en/financial-consumer-agency.html

Insurance Bureau of Canada (IBC) – IBC provides consumer-friendly guides on life insurance, including differences between Term Life Insurance Policies and Whole Life Insurance, as well as conversion options.

- Financial Consumer Agency of Canada (FCAC) – FCAC offers unbiased advice on various financial products, including life insurance, with tips on comparing policies and understanding long-term benefits.

These sources offer valuable insights for those looking to understand more about the nuances of Term Life Insurance and Whole Life Insurance, Term Life Insurance Policies, and Term Life Insurance Quotes in the Canadian market.

Key Takeaways

- Flexible Conversion Option: Many Term Life Insurance Policies offer a conversion feature that lets you switch to Whole Life Insurance without a medical exam, ideal if health changes arise.

- Lifelong Coverage: Whole Life Insurance provides permanent coverage with a cash value component, unlike Term Life Insurance Policies, which only cover a specific period.

- Financial and Legacy Planning: Whole Life Insurance helps build cash value and can play a role in estate planning, providing long-term security and potential financial growth.

- Consider Timing and Costs: Converting your Term Policy earlier can offer financial advantages, but Whole Life Insurance premiums are generally higher than Term Life Insurance Quotes.

- Guidance from Canadian LIC: Canadian LIC advisors can review your Term Life Insurance Policies to help determine if converting to Whole Life Insurance aligns with your future goals.

Your Feedback Is Very Important To Us

Thank you for sharing your feedback. Your responses will help us understand and address the challenges Canadians face when converting Term Life Insurance Policies to Whole Life Insurance.

IN THIS ARTICLE

- Can I convert my Term Policy to Whole Life?

- What is Term Life Insurance, and Why Do Many Start Here?

- Whole Life Insurance: A Brief Overview

- Why Consider Converting Term Life Insurance to Whole Life Insurance?

- How the Conversion Process Works

- Conversion from Term to Whole Life Insurance

- Pros and Cons of Converting to Whole Life Insurance

- Is Converting the Right Decision for You?

- Making Your Choice with Canadian LIC