- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

Can I Contribute to an RESP After My Child Turns 18?

SUMMARY

The blog addresses whether one is allowed to contribute to a Registered Education Savings Plan (RESP) after a child is 18 years old. Contributions are allowed up to age 31, although the government grants (CESG) only apply until age 17. The RESP has remained open for 36 years, meaning that the savings have grown tax-free. It is meant to be flexible in that it allows delayed education, unused contribution room, and savings for graduate studies, thereby encouraging families to catch up on contributions made for their child’s education.

- 11 min read

- September 23th, 2024

By Harpreet Puri

CEO & Founder

- 11 min read

- September 23th, 2024

Introduction

There is probably no other question we at Canadian LIC receive as much as, “Can I contribute to an RESP after my child turns 18? “That resonates deeply with most parents who stay committed to securing a bright educational future for their children. Perhaps life was busy, and you could not contribute as much as you wanted in the early years. Maybe your financial condition will improve, which will enable you to invest freely in your child’s education.

Be it whatever reason, this is a question affecting many families across Canada, especially when thinking about maximizing education savings. Knowing that parents want to do everything possible for their children’s future success and that contributing to an RESP is one of the most effective ways to do so, everyone at Canadian LIC agrees that there is value in doing things for the long term, including investing in your child’s future. But then again, when your child is about to reach age 18, do the doors remain open for them to make further contributions? Let’s see what answer we will find out as we discuss this and some other eye-openers in RESPs that we bump into every day in communicating with our clients.

Understanding RESP Contributions: The Basics

A Registered Education Savings Plan is one of the most popular savings vehicles in Canada, and it helps parents fund their child’s post-secondary education. Contributions grow tax-free, and you could also benefit from government grants such as CESG, which will add 20% to your own contributions up to a certain limit. However, many parents remain clueless about how RESP rules will apply once a child reaches 18.

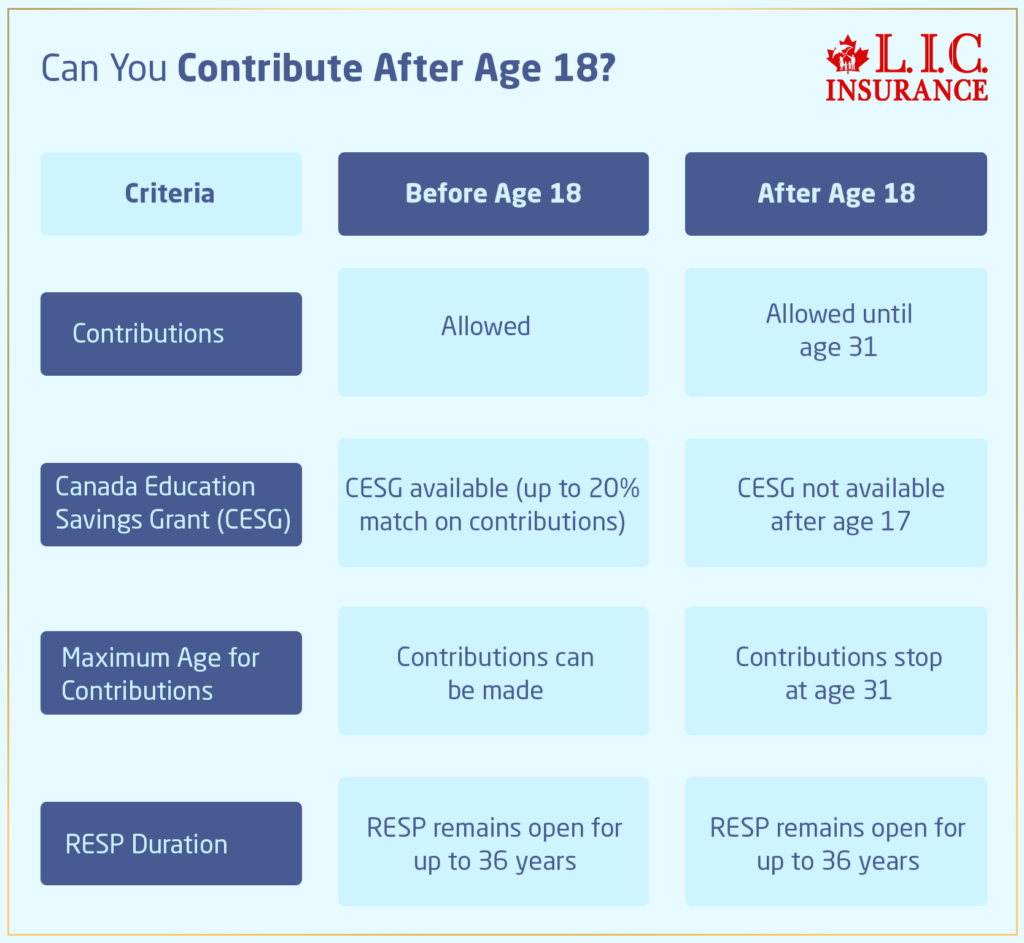

The Age Factor: Can You Contribute After Age 18?

Once your child turns 18, you can still contribute to their RESP, but there are a few important details to consider. Here’s what you need to know:

- Contributions Are Still Allowed Until the Age of 31: An RESP can remain open for up to 36 years, which means you can contribute up to the beneficiary’s 31st birthday. This flexibility can be a lifesaver for parents who didn’t have the opportunity to contribute earlier or who want to keep adding to the plan to secure their child’s future education further.

- Canada Education Savings Grant (CESG) Stops at Age 17: While you can continue contributing to the RESP, the Canada Education Savings Grant (CESG), which matches your contributions up to 20%, is only available until the child turns 17. After that, while you can still make contributions, you won’t be eligible for additional CESG payments. This is an important consideration when deciding whether to continue contributing after your child’s 18th birthday.

Balancing Education Costs

Let’s face it—it takes a small fortune to raise kids, and many families become strapped for money when their children are young. We’ve had clients who, when the children were young, couldn’t add much to their RESPs because of the cost of a mortgage, childcare or other day-to-day living expenses. Now that the children have all reached or nearly passed the age of 18, they are relatively freer and start musing over whether it is too late in the day to add more resources to their child’s future education.

The good news is that, even if you did not maximize contributions early on, there is still time. Although the CESG is no longer available, any contribution you make can be allowed to grow tax-free, which has very significant implications at the time your child needs to withdraw to attend school.

Tax-Free Growth Still Applies

This is another excellent benefit of saving in an RESP after your child has reached the age of 18. Any earnings generated within the RESP continue to grow tax-free. Meaning that even if your child is almost at the close of their teenage years, compounded interest is still working on your behalf.

In many instances, families that contributed less in the early years can now contribute more to the RESP and enjoy tax-deferred growth for a longer period. Whether it’s adding a few thousand dollars or just small amounts, it all adds up, and it’s never too late to give a child a better financial foundation when aiming to attend post-secondary education.

What If Your Child Delays Education?

Another even more frequent angst we see at Canadian LIC is what happens if your child does not go to school right out of high school. Many young adults take a gap year or delay entrance into post-secondary education for whatever reason: some want to get a job and save money; others just might not feel ready for university or college right after the graduation letter comes in.

This is a big advantage of the flexibility of an RESP. Since an RESP may be open for as long as 36 years, there is enough time for your child to decide when he would like to carry on further education. You won’t have to worry about the money going down the drain or losing your contributions. Funds remain available to your child should he or she wish to matriculate in a qualified institution, be it after high school or many years later.

Delayed Education and RESP Contributions

We’ve also had clients who, when their child decided to take a few years off before going to university, were worried that their RESP savings would be lost. However, because the RESP is still open, they can continue to contribute, and that tax-deferred growth keeps on working in their favour. By the time the child grows up and is ready to enter school, there will be a sizeable amount of savings waiting for them, and the parents will find solace in that they can still do their best to help the child achieve his or her educational goals.

Other Ways to Maximize an RESP After 18

Even though government grants stop at 17, there are still strategic ways to maximize your RESP after your child turns 18. For example:

- Take Advantage of Unused Contribution Room: If you haven’t contributed the full $ 50,000 lifetime maximum per beneficiary, you can continue making contributions until you reach that limit. This can provide more substantial funds for your child when they enter post-secondary education.

- Catch-Up Contributions: If you missed out on contributing during your child’s younger years, now might be the time to catch up. Even without the CESG, those contributions can make a significant difference, especially as your child starts to think about tuition, textbooks, and living expenses for their education.

- Plan for Graduate Studies: If your child is considering graduate school, an RESP can be an excellent tool for supporting these future educational goals. Since you can continue contributing until the age of 31, there’s ample time to save up for these advanced education expenses.

Registered Education Savings Plan Quote: Getting the Most Out of Your Contributions

In fact, parents who are continuing their RESP contributions ask questions such as “How much should I contribute now?” or “Will it still make a difference at this stage?” For that reason, at Canadian LIC, we have helped many families answer this question by providing Registered Education Savings Plan Quotes that show how their contributions will add value over time.

We have all seen how small contributions can increase significantly through compounding interest and tax-free savings. With the appropriate strategy and support from the Registered Education Savings Plan Providers, families can continue saving for their child’s education in a manner that is comfortable and attainable.

Our clients frequently report to us how much peace they feel knowing that they are still putting toward the future of their child when the child has long passed 18 years of age. Many thought they had missed the boat, but with the flexibility of the RESP, they found that they could still make a meaningful impact on their child’s educational journey.

Canadian LIC: Your Trusted RESP Provider

We have dealt with so many families in the Canadian LIC who, at one point or another, have questioned whether it is too late to add more to their child’s RESP. We’re happy to report that the answer is a resounding no! If your child is 18, 19, or even 25 years of age, it’s not too late; you can keep growing your RESP and provide your child with all that help he or she needs to access education beyond high school. We offer RESP Quotes and can help illustrate just how your contributions will grow over time.

We believe in the great power of education, and we understand that every little contribution helps. Our clients report that working with us gives them the confidence and peace of mind that comes with the knowledge that they’re making the very best financial decisions for their family’s future. We can guide you to options with the best Registered Education Savings Plan Providers and take a plan tailored specifically to your financial goals.

Wrapping It Up: Take Action Now for Your Child's Future

You can make contributions to a RESP after your child has aged out at 18 years of age. Aside from being easy, it may also be one very savvy decision if you want the financial resources to pour into your child at the right time to pursue post-secondary education. After all, government grants are no longer received upon reaching 17, yet many other advantages- tax-free growth, flexible contribution options, and savings opportunities beyond age 17-place RESP contributions squarely at the top of the list for many families.

Whether you are just now getting started or catching up on contributions, Canadian LIC can help you make sense of it all. As the best insurance brokerage, we are committed to assisting families in securing their children’s futures through successful savings strategies such as the RESP.

More on RESP

- What Are the Differences Between a Family Plan and an Individual Plan RESP?

- What Is the Uptake of RESPs Among Different Communities in Canada?

- What are RESP Rules and Contribution Limits in 2024?

- How Long Can an RESP Remain Open?

- What Happens If I Miss Contributing to an RESP for a Year?

- Can I Open an RESP for a Child Who Is Not My Own?

- Can RESP Be Used for Rent?

- What Are the Disadvantages of RESP?

- What Expenses Are Eligible for RESP in Canada?

- What Is The RESP Limit In Canada?

- How Do I Withdraw Money from RESP Canada?

- Does a RESP Beneficiary Need to Live in Canada?

- Can I Use My RESP Outside Canada?

- How Do I Check My RESP in Canada?

- What Happens to RESP If You Leave Canada?

- Can You Transfer an RESP to an RRSP?

Frequently Asked Questions (FAQs) About Contributing to an RESP After Your Child Turns 18

Yes, you can continue contributing to your child’s Registered Education Savings Plans (RESP) after they turn 18. In fact, contributions can be made until the child turns 31. We often see parents at Canadian LIC who, due to earlier financial constraints, couldn’t contribute much when their children were younger but find this flexibility helpful now.

No, the Canada Education Savings Grant (CESG) stops when your child turns 17. However, you can still contribute to the RESP, and the money you add will continue to grow tax-free. Many clients come to us with this question, and we reassure them that, while the grant ends, it’s still worth contributing as the plan grows tax-free.

Yes, you can get a Registered Education Savings Plan Quote anytime, regardless of your child’s age. Many parents come to us at Canadian LIC, wondering how their future contributions will perform. A RESP Quote helps you see how much your savings could grow, even after your child’s 18th birthday.

There is no penalty for contributing after your child turns 18 as long as you do not exceed the lifetime contribution limits of $50,000. We often explain to our clients that there’s no harm in continuing to invest in their child’s future, even if they’re past 18.

The RESP can stay open for up to 36 years, so your child has plenty of time to decide when to start their post-secondary education. At Canadian LIC, we’ve worked with parents whose children took gap years or pursue other interests before going back to school, and they were relieved to know their RESP was still valid.

Yes, an RESP can be used for graduate studies. Many of our clients at Canadian LIC come to us looking to save for their child’s advanced education. Whether your child is entering graduate school at 22 or 25, your RESP contributions will still be there to support them.

You can continue contributing to the RESP until your child turns 31, so there’s still time to reach the lifetime limit of $50,000. We see many parents who initially felt they missed their opportunity but later realized they could catch up on their contributions.

Absolutely. A RESP Quote can help you understand how much your contributions can grow over time. Parents often approach us at Canadian LIC because they want to know if contributing after 18 is still worth it. We’ve seen how getting a quote clarifies the long-term value of continued contributions.

If your child chooses not to go to school, you can withdraw your contributions without penalty. However, any government grants, like the CESG, will need to be repaid. Many of our clients at Canadian LIC have faced this dilemma, and we’ve helped them explore options, such as transferring the RESP to another child.

Yes, grandparents and other family members can contribute to an RESP as long as the child is under 31. At Canadian LIC, we’ve seen many families where grandparents wanted to continue supporting their grandchildren’s education, and the RESP allowed them to do so.

Finding the right RESP provider can make a big difference. At Canadian LIC, we guide families toward the best Registered Savings Plan Providers that offer flexibility, good investment options, and reasonable fees. Choosing the right provider is key to making sure your RESP performs well.

Yes, you can transfer the RESP to another child as long as they meet certain requirements, such as being a sibling. We often advise our clients at Canadian LIC to consider this option if their original child decides not to pursue post-secondary education.

Many parents feel unsure about managing their RESP after their child turns 18. At Canadian LIC, we work closely with families to ensure they make the most out of their RESP, even as their children grow older. You can rely on us for expert guidance and to ensure your savings continue to grow effectively.

Yes, you can get a Registered Education Savings Plan Quote at any time, even after your child turns 18. Parents often come to us at Canadian LIC, unsure if their contributions will still make an impact. A RESP Quote can help you understand how much your money will grow and how it can benefit your child’s education, no matter their age.

You can contribute to an RESP until your child turns 31. Many parents we work with at Canadian LIC are surprised by this flexibility. They often think they’ve run out of time, but there’s still plenty of opportunity to add to their child’s education savings.

Yes, many Registered Education Savings Plan Providers offer flexibility, allowing you to continue contributing and managing the account as needed after your child turns 18. We’ve helped many parents at Canadian LIC find providers that suit their long-term savings goals and adjust to changes in their child’s educational plans.

Yes, your contributions will continue to grow tax-free, even after your child turns 18. We’ve worked with clients who found that this tax-free growth made a big difference when they withdrew funds for their child’s education, even if they started contributing later in life.

Yes, as long as the RESP remains open, you can withdraw funds when your child begins post-secondary education, even if they start later. At Canadian LIC, we’ve seen parents relieved to learn they didn’t have to rush their child’s education just to access the RESP funds.

You can continue contributing until you reach the $50,000 lifetime contribution limit. We regularly help clients who want to maximize their RESP contributions even after their child turns 18. Every dollar helps, and with continued contributions, you can make a substantial impact on your child’s future education costs.

Yes, if your child attends an eligible institution outside of Canada, you can still use RESP funds. We’ve helped many families at Canadian LIC who were unsure if their RESP would cover international education, and they were happy to learn that it could.

No, the withdrawal limits remain the same regardless of your child’s age. Once they enroll in a qualified post-secondary program, you can start withdrawing funds. Parents often ask us at Canadian LIC if age affects withdrawal limits, but rest assured, the rules remain the same as long as it’s for educational purposes.

A RESP Quote can show you how much your investments will grow over time. Even though the Canada Education Savings Grant (CESG) stops at age 17, your contributions can still earn interest and grow tax-free. At Canadian LIC, we recommend getting a quote to understand the potential growth and the financial benefits of continuing your RESP contributions.

Yes, you can change Registered Education Savings Plan Providers even after your child turns 18. At Canadian LIC, we’ve assisted many families in transferring their RESPs to providers that offer better investment options or lower fees. It’s never too late to switch to a plan that better meets your needs.

If your child doesn’t pursue post-secondary education, you can withdraw your contributions without penalty. However, any government grants will need to be repaid. At Canadian LIC, we often work with parents in this situation and help them explore options such as transferring the RESP to another child or using the funds for their own education.

No, it’s not too late. You can still start contributing to an RESP even if your child is already 18, up until they turn 31. Many parents we see at Canadian LIC begin their RESP journey later when they’re in a better financial position, and we help them maximize the benefits, even starting later.

Yes, RESP funds can be used for both full-time and part-time post-secondary education. We’ve seen many clients at Canadian LIC who needed to use their RESP for their child’s part-time studies, and they were able to do so without issue.

By addressing these FAQs, we hope to clear up common concerns and provide parents with a path forward for continuing RESP contributions after their child turns 18. If you’re still unsure or have more questions, seeking advice from Registered Education Savings Plan Providers can give you the clarity you need to keep building your child’s educational future.

Sources and Further Reading

- Government of Canada – Registered Education Savings Plan (RESP) Overview

Official information on RESP contributions, limits, and eligibility criteria.

Canada.ca – RESP - Canada Education Savings Grant (CESG)

Details on how the CESG works and eligibility for government grants.

Canada.ca – CESG - Canadian Scholarship Trust – RESP Contribution Rules

Insights into RESP contribution limits and rules for continued savings after your child turns 18.

CST.org – RESP Contributions - Canadian LIC – Registered Education Savings Plan Quotes and Providers

Comprehensive advice on choosing the best RESP providers and getting an accurate RESP Quote for your child’s education.

Canadian LIC – RESP

These resources provide additional information to help you understand RESP rules, grants, and how to maximize your contributions after your child turns 18.

Key Takeaways

- RESP contributions can continue until your child turns 31 – You can still contribute to an RESP after your child turns 18, offering more time to grow their education savings.

- CESG stops at age 17 – While you can keep contributing, the Canada Education Savings Grant ends once your child reaches 17 years old.

- Tax-free growth continues – Even after 18, your RESP continues to grow tax-free, making every contribution valuable for future education costs.

- RESP flexibility for delayed education – RESP funds remain available for up to 36 years, providing flexibility if your child doesn’t attend school immediately.

- Registered Education Savings Plan Quotes help assess future growth – Getting a RESP Quote from Registered Education Savings Plan Providers can show how much your contributions will grow.

- Funds can be used for part-time or international education – RESP funds are valid for various educational paths, including part-time or international programs.

By Pushpinder Puri

CEO & Founder

Your Feedback Is Very Important To Us

We appreciate your time in helping us understand your experiences with contributing to a Registered Education Savings Plan (RESP) after your child turns 18. Your feedback will help us better address your concerns and improve our services.

Thank you for sharing your thoughts. Your feedback helps us provide better solutions and support for families navigating RESP contributions after their child turns 18.

IN THIS ARTICLE

- Can I Contribute to an RESP After My Child Turns 18?

- Understanding RESP Contributions: The Basics

- The Age Factor: Can You Contribute After Age 18?

- Balancing Education Costs

- Tax-Free Growth Still Applies

- What If Your Child Delays Education?

- Delayed Education and RESP Contributions

- Other Ways to Maximize an RESP After 18

- Registered Education Savings Plan Quote: Getting the Most Out of Your Contributions

- Canadian LIC: Your Trusted RESP Provider

- Wrapping It Up: Take Action Now for Your Child's Future