- Can I choose my own doctor or hospital with Super Visa Insurance?

- Struggles of Choosing the Right Doctor or Hospital

- Understanding How Super Visa Insurance Works with Healthcare Providers

- Types of Super Visa Insurance Policies

- Stories from Canadian LIC Clients

- Factors to Consider When Choosing Super Visa Insurance

- How to Ensure Your Super Visa Insurance Policy Offers Flexibility

- Why Flexibility Matters

- The Importance of Choosing the Right Super Visa Insurance Policy

- Comparing Super Visa Insurance Policies

- What Happens if You Don’t Have Flexibility?

- Canadian LIC’s Role in Simplifying the Process

- Conclusion: Securing the Right Super Visa Insurance

One of the most crucial requirements at the time of applying for a Super Visa Program to visit children or grandchildren in Canada is the requirement to obtain medical insurance for a Super Visa. This medically insures you from some unexpected medical calamity in Canada. One frequently asked question is: Can I choose my own doctor or hospital with Super Visa Insurance?

This is a valid concern for most people, more so for those who would not want to limit themselves to a specific list of healthcare providers. After all, health is one thing nobody wants to compromise on, and the liberty to choose the right doctor or hospital is something most wish to have.

Struggles of Choosing the Right Doctor or Hospital

What if you are coming to Canada to utilize this precious time with your loved ones, and all is going well? Then, out of the blue, you find yourself needing medical attention. You might be wondering if your Super Visa Insurance Policy will allow you to go to the hospital you’re comfortable with or if you’ll be restricted to a certain Canadian company. That is more common than one would think, and we often come across that with our clients here at Canadian LIC.

So many clients come to us with stories of having faced challenges with their previous insurance providers. A lot of the time, they’re told that their insurance will cover them for medical emergencies, and then, months or even years later, it turns out they have no choice as to which hospital or doctor they can see. It’s extremely frustrating, especially when you need urgent attention and want to feel sure that you’re getting the best possible care.

Knowing all the nuances of the Super Visa Insurance Policy is important in acquiring not just a visa but also ensuring peace of mind through the same period of your stay in Canada. Next, let’s review how insurance works when choosing a healthcare provider.

Understanding How Super Visa Insurance Works with Healthcare Providers

First of all, the Canadian healthcare system is highly reputed worldwide for its quality, but it operates quite differently compared with many other countries. One thing you need to know is that Canada has a mix of public and private healthcare providers. The medical insurance for a Canadian Super Visa generally covers private health care costs since the Canadian public health care system is reserved for a Canadian permanent resident and Canadian citizens.

But here is where the choice becomes a little tricky when it comes to choosing your health professional: it all depends on the specific details of the Super Visa Insurance Policy chosen and the freedom you will have in choosing any doctor or hospital. While some policies offer a wide network of doctors and hospitals to choose from, other policies are likely to limit your options.

We have taken care of thousands of our clients at Canadian LIC with all these complete details so they can find an appropriate plan for them. Now, we will explain the factors that can affect your choice of doctor or hospital because of Super Visa Insurance.

Types of Super Visa Insurance Policies

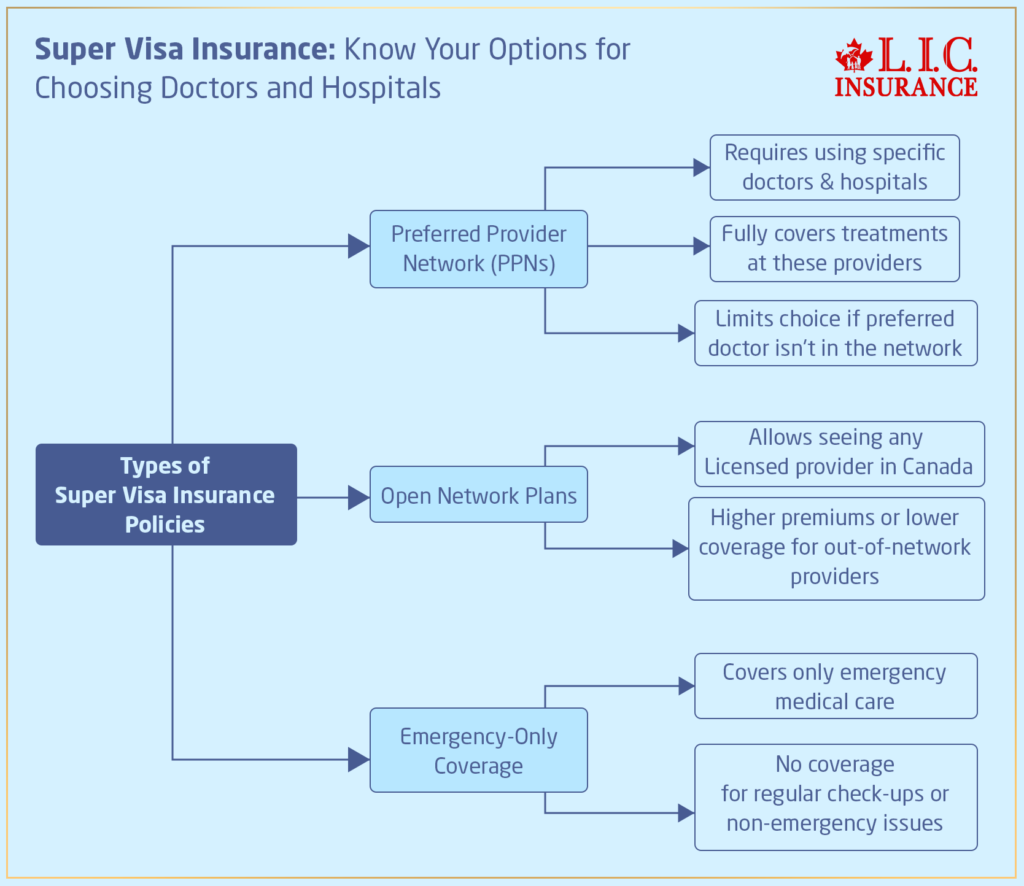

There are many forms of Super Visa Insurance with their set rules relating to the choice of health provider. At Canadian LIC, we always make it a point to explain these options to our clients so they do not get surprised when the time for medical care arises.

- Preferred Provider Networks (PPNs): Some of the Super Visa Insurance Plans have a network of preferred doctors and hospitals. If your policy includes a PPN, you are expected to retain your healthcare providers from this listing. The benefit here is that treatments at these providers are usually fully covered, meaning you won’t face any unexpected out-of-pocket medical expenses. However, the downside is that this does limit your choices if your preferred doctor or hospital isn’t in this network.

- Open Network Plans: Other plans allow you to see any licensed provider in Canada. You are free to go to any doctor or hospital of your choice; unfortunately, this freedom typically leads to these plans having higher premiums or covering a lower percentage of the medical bill if an out-of-network provider is utilized.

- Emergency-Only Coverage: Some of these policies cover strictly emergency medical care and, as such, will not allow you to see any doctor for other non-emergency issues. This may be somewhat frustrating if you develop a medical condition that is not an emergency but still needs treatment. Most clients at Canadian LIC reported frustration when they discovered that their policy does not allow them to consult a doctor for regular check-ups or minor health issues.

In many cases, the decision among available plans often boils down to a question of weighing budget concerns against medical needs. So many of Canadian LIC’s clients appreciate our expertise in advising on the best policy, given the individual client’s circumstances.

Stories from Canadian LIC Clients

At Canadian LIC, we’ve seen firsthand how important it is to have clarity on which doctors and hospitals are accessible through Super Visa Insurance. Let us illustrate with a few relatable examples that might resonate with some of your concerns.

Mr. Patel came to Canada to visit his daughter and grandchildren. Recently, he had high blood pressure, but it was stabilized. He wanted a routine check-up from a doctor during his visit to Canada. However, the insurance originally taken out for him limited him to a certain circle of providers, none of whom were remotely close to where his daughter resided. He had to drive across town every time he wanted to see a doctor, which really put a lot of stress on Mr. Patel.

Mr. Patel can now choose a doctor who is much closer to his family’s residence after switching his Super Visa Insurance Policy through Canadian LIC. He had more flexibility with the new policy and was much happier in knowing he now had choices regarding which healthcare provider he could visit.

Another case is that of Mrs. Chen, who visited Canada to see her son. Unfortunately, she met with a fall that necessitated immediate hospital admission. Fortunately, she had Super Visa Insurance from Canadian LIC, which made it possible for her to admit herself to a nearby hospital that had good care facilities. It saved a lot of time and concern for her family in a period that was troubling enough.

These stories are just a glimpse of the real-world struggles that people face when it comes to choosing healthcare providers. At Canadian LIC, we go out of our way to find the best possible Super Visa Insurance Policy for each client so they will not face further complications coming into Canada.

Factors to Consider When Choosing Super Visa Insurance

When you’re looking at different Super Visa Insurance Policies, several key factors will determine your ability to choose your doctor or hospital. Here’s what you need to consider:

- Geographical Location: If you’re visiting family in a major Canadian city, you’ll likely have more options for healthcare providers, even within a preferred network. However, if you’re in a rural area, the options may be limited, and you’ll want to ensure your policy offers more flexibility in choosing doctors and hospitals.

- Type of Medical Care Needed: Are you looking for basic emergency care, or do you anticipate needing regular check-ups or treatment for pre-existing conditions? Emergency-only policies might not be the best fit for those with chronic health conditions who need constant medical attention.

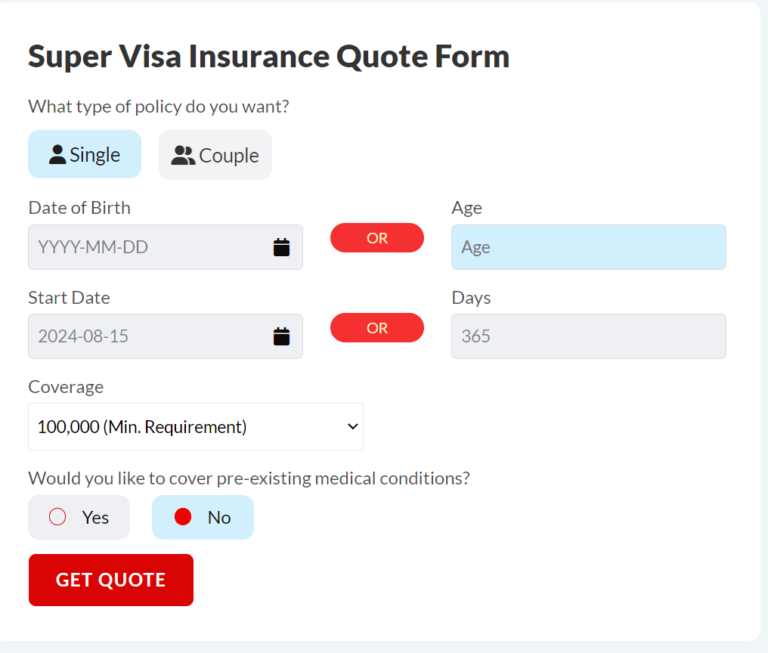

- Cost of the Policy: Plans that offer more flexibility in choosing your healthcare provider often come at a higher premium. It’s crucial to weigh the costs against the potential benefits, especially if you want the option to pick a specific doctor or hospital. At Canadian LIC, we help clients get accurate Super Visa Insurance Quotes Online, making it easier to compare policies and make an informed decision.

- Coverage for Pre-Existing Medical Conditions: If you have a pre-existing condition, it’s essential to select a policy that provides adequate coverage for it. In many cases, this may also influence your ability to choose specialized doctors.

How to Ensure Your Super Visa Insurance Policy Offers Flexibility

In order to make sure your Super Visa Insurance Policy provides the flexibility to choose your doctor or hospital, there are a few steps you should take:

- Read the Fine Print: Many people overlook the specific terms of their insurance policy, only to realize later that they’re limited in their choice of healthcare providers. At Canadian LIC, we make sure to explain the details of each policy to our clients so they know exactly what to expect.

- Ask About Provider Networks: Before purchasing a policy, ask if it includes a preferred provider network or if you’re free to choose any licensed healthcare provider in Canada. This simple question can help you avoid surprises later.

- Compare Policies and Get Quotes: Use tools to get Super Visa Insurance Quotes Online and compare the coverage options. At Canadian LIC, we simplify this process by providing transparent quotes and explaining the key differences between plans.

- Consult an Insurance Expert: Speaking with an experienced insurance broker can help you navigate the various policies available. At Canadian LIC, we’ve helped countless clients select the right Medical Insurance for a Super Visa based on their specific needs and concerns.

Why Flexibility Matters

The last thing one would want when visiting family in Canada on a Super Visa is a constraint on healthcare options. Having the ability to choose one’s own doctor or even hospital gives the peace of mind desired, especially when dealing with any medical emergency or ongoing health issues.

We have had many clients who say they feel so looked after, knowing their choices in health are totally up to them and not constrained by a network or insurance. That in itself can make a world of difference as far as your experience will go.

The Importance of Choosing the Right Super Visa Insurance Policy

At Canadian LIC, we know that being able to choose your own doctor or hospital is a huge priority for many visitors on a Super Visa. Flexibility in healthcare options affects more than just your experience; it affects your overall health and well-being during your stay in Canada. Nobody wants to feel helpless or restricted with his or her health, especially in another country.

The right Super Visa Insurance Policy should allow you to have peace of mind, comforted by the fact that you will obtain medical care when you need it. We always advise our clients to pay close attention to their medical history, anticipated healthcare needs, and location in Canada when choosing their insurance policy.

Comparing Super Visa Insurance Policies

When you buy Super Visa Insurance Policy, you sometimes may want to look at the least expensive option. However, one thing is very important: the flexibility that you get from your particular plan. A number of insurance companies offer super-low premiums but lock you in with regard to doctors and hospitals. Other options may be a little more costly yet grant you more freedom of choice concerning health care providers.

For example, suppose one already has a pre-existing medical condition or wishes to go to a particular hospital or doctor recommended by a family in Canada. In that case, a policy allowing direct access to healthcare providers may be worth the extra cost.

You can instantly compare a number of policies from different providers to see which one will suit your healthcare needs by obtaining Super Visa Insurance Quotes Online. This is an important step because choosing the wrong plan might leave you frustrated and unsupported in case a medical issue does arise.

What Happens if You Don't Have Flexibility?

One of the biggest problems that clients face is finding out, usually too late, that their Super Visa Insurance does not cover the freedom to choose which doctor or hospital they want to be treated by. This could be extremely stressful in the case of a medical emergency when the availability of the health care provider is of utmost importance.

Take the case of Mr. Singh, another client who came to us after having trouble with his previous insurance provider. Mr. Singh went to see his son in Toronto, and having chest pain, his family would naturally want to take him to a reputable hospital close to their house. But all his medical treatment was supposed to be at some participating hospital far away, which delayed all the procedures and caused a lot of problems for him.

Finally, he shifted to the most flexible policy, which gave him the freedom to choose any nearest and appropriate healthcare provider. His family was now relieved, knowing that in case of any future emergencies, they would not be restricted to a limited network of hospitals or doctors.

Canadian LIC's Role in Simplifying the Process

We at Canadian LIC understand how overwhelming this decision may be in choosing the right Medical Insurance for Super Visa. Many come to us with question after question: “Which one do I choose?” or “What exactly am I covered for on this policy?” Over time, our process has really been fine-tuned to allow literally anyone to lock down the best possible Super Visa Insurance Policies with ease and zero stress. Here is how we help:

We Listen to Your Needs

We start with understanding what you need from your Super Visa Insurance Policy. No two clients are alike in their needs, whether it be in freedom of choice of doctor, health concerns, or budgetary restrictions. For example, one of our clients, Mr. Ali, wanted his Super Visa Health Insurance to ensure that he would be able to continue seeing his long-time family doctor without any restrictions. We were pleased to get such a plan to suit his needs. We try listening to our clients’ needs and seeing that they are appropriately covered.

We Break Down Complex Insurance Terms

Insurance policies are often filled with terms that no one can understand. At Canadian LIC, we use the simplest form of the terms and explain the coverage in straightforward language. Often, clients come to us confused about network restrictions or policy terms. Mrs. Gupta, one of our long-term clients, was taken aback by the fine print involved in her policy. It wasn’t until after meeting with us that Mrs. Gupta finally had a clear picture of Medical Insurance for Super Visa and exactly what she was covered for.

We Compare Multiple Policies for You

With so many plans surrounding you, comparing the various Super Visa Insurance Plans can sound really daunting. We go the extra mile by comparing policies from various providers to find the most suitable one for you. Mr. Patel was not very sure whether he was getting a good deal on his insurance and approached us. We presented him with several reputed companies’ Super Visa Insurance Quotes Online and explained the differences to him so that he could make an informed choice.

We Ensure You Have Access to Your Preferred Doctors and Hospitals

One of the key concerns for visitors is to have a free choice of healthcare provider. We make sure that the Super Visa Insurance Policies we recommend would allow you to see the doctors or visit the hospitals that you prefer. Recently, we provided service to Mrs. Ahmed, who wanted to be sure she could go to a hospital near her son’s house. We could find a policy that could provide that convenience for her and peace of mind for herself and her family.

We Assist with Policy Adjustments

Just like your needs, your insurance coverage will change, and we have helped many of our clients, just like Mr. Wang, switched to better Super Visa Insurance Policies during their stay for mid-term. Whether you need to upgrade your coverage or switch providers, we make sure the transition is as smooth as possible.

We Provide Fast and Accurate Quotes

It is quick and effortless to get quotations for Super Visa Insurance Coverage with us online. We provide quotes both swiftly and precisely without any delay to your medical insurance. Mrs. Lee required her insurance in the shortest time, so we helped her to get the required Medical Insurance for Super Visa without any complications. Our process is swift, helping our clients get the coverage they need at the right time.

We Offer Ongoing Support After You Buy Your Policy

Our services do not stop once you pay for your policy. We offer after-sales service to make sure that you are clearly aware of how you can use your Medical Insurance for Super Visa. If you are unsure about how to submit a claim or obtain medical care, we will be there to support you in any way that we can. Mr. Singh was in need of support during his mother’s stay in the hospital. We told him about the claims process and followed up with him to ensure smooth processing.

We Understand the Canadian Healthcare System

Our team is well-versed in the Canadian healthcare system and how it interacts with Super Visa Insurance Policies. This knowledge allows us to provide you with the best options for accessing healthcare during your stay. One of our clients, Mrs. Zhao, was unsure how her policy worked with the local hospitals in Toronto. We guided her through the process, ensuring she felt confident in her coverage.

We Make the Entire Process Stress-Free

We are here to make the entire process from start to finish easier for you. We want you to enjoy time with your family, not stress over the little details of insurance. At Canadian LIC, we have worked with hundreds of clients who leave our office reassured that they made the right choice. Whether it is answering your questions or making sure you are covered in an emergency, we are here every step of the way.

We Build Relationships with Our Clients

At Canadian LIC, our clients are not numbers. We forge long-term relations wherein they can always count on a partner for their insurance needs. Mr. Sharma, who initially came to us for Super Visa Insurance Quotes Online, is now entrusting us with his entire family’s insurance requirements. We pride ourselves on becoming more than just a service provider and a trusted advisor here to stay for the length of time it takes.

It is here that hundreds of clients have found peace of mind in our experience and commitment to making the process of finding Medical Insurance for Super Visa much easier. Allow us to take you through the process of selecting the best Super Visa Insurance Policies and assisting you in getting the Super Visa Insurance Quotes Online that you require to make the right decision.

Conclusion: Securing the Right Super Visa Insurance

When it comes to choosing your own doctor or hospital with Super Visa Insurance, the key is finding a policy that offers the flexibility you need. At Canadian LIC, we have seen numerous clients who were stuck with inadequate policies because of all the restrictions placed on them by less flexible policies. This is the reason we strive to work hard to help our clients pick the right kind of Super Visa Insurance which best fits their requirements.

Whether it be medical emergency coverage, the ability to see specific health professionals, or comprehensive pre-existing condition care, the team at Canadian LIC is here to guide you through the process. We help you compare Super Visa Insurance Quotes Online to make sure you get a policy that will meet the Canadian government’s requirements and offer the desired flexibility and peace of mind.

Don’t wait until it’s too late; ensure that you purchase the right Super Visa Insurance Policy prior to your arrival in Canada. Let Canadian LIC help you select a plan that offers access to your preferred doctors and hospitals to make your stay in Canada as worry-free as possible.

More on Super Visa and Super Visa Insurance

- Are Psychological or Psychiatric Services Covered Under Super Visa Insurance?

- Appealing a Denied Claim Under Super Visa Insurance

- Can a Visitor Visa In Canada Be Converted to a Super Visa?

- Changing the Effective Dates of Super Visa Insurance After Purchase

- Including My Spouse in the Same Super Visa Insurance Policy

- Getting Super Visa Insurance If I You Are Over 85 Years Old

- Filing a Complaint About My Super Visa Insurance Provider

- Consequences of Not Having Valid Super Visa Insurance

- Super Visa Insurance Expiring While the Visitor Is Still in Canada

- Waiting Period For Super Visa Insurance

- Super Visa Insurance Refundable Or Not?

- Find the Most Affordable Super Visa Insurance Plan

- The Right Place To Buy Super Visa Insurance in Canada

- Medical Test for Super Visa Canada

- The Processing Time for a Super Visa in Canada

- Can Parents Work on Super Visa?

- Canceling Super Visa Insurance

- Paying Monthly for Super Visa Insurance

- The Right Time Super Visa Insurance Should Start in Canada

- 2023 Super Visa Program and Insurance Requirements

- Visitor Visa vs. Super Visa: The Differences

- Super Visa Income Requirement

- About Canadian Super Visa? And How to Apply for One?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs: Can I Choose My Own Doctor or Hospital with Super Visa Insurance?

Yes, but it depends on your policy. Some Super Visa Insurance Policies allow you to choose any doctor, while others may limit you to a list of preferred doctors. At Canadian LIC, we always guide clients through these options to avoid surprises later.

If your policy restricts you to certain hospitals, you will need to visit those hospitals for full coverage. Some clients at Canadian LIC face this issue and prefer switching to a policy that offers more flexibility. We help them find options that suit their preferences.

Yes, some Super Visa Insurance Policies let you choose any hospital, but these plans might have higher Super Visa Insurance Cost. We often see clients who are happy to pay a bit extra for the freedom to choose their healthcare provider. We help compare Super Visa Insurance Quotes Online to find the best option.

If you visit a hospital outside your policy’s network, you might have to pay out of pocket or face limited coverage. We’ve seen clients encounter this, which is why it’s important to know the details of your policy before any medical emergency arises.

The best way to find out is by reviewing the list of healthcare providers included in your policy. At Canadian LIC, we always make sure our clients understand whether their preferred doctors are included in their Super Visa Insurance Policies.

Yes, you can switch policies, but it’s important to maintain continuous coverage. Many of our clients at Canadian LIC have switched to more flexible policies to ensure they can visit their preferred doctors.

Yes, many Super Visa Insurance Policies include preferred provider networks. This means you must visit doctors or hospitals from a specific list to receive full coverage. We help clients navigate these options and decide if this type of plan works for them.

Yes, at Canadian LIC, we help clients get Super Visa Insurance Quotes Online that show different levels of coverage, including options for choosing your own doctor or hospital. This allows you to make a more informed decision based on your healthcare needs.

Most Super Visa Insurance Policies cover emergencies, but some may have network restrictions. We often advise clients to choose plans that allow them access to any hospital in case of an emergency so they don’t have to worry about location limitations.

If you have a pre-existing condition, you’ll want a policy that allows you to choose the specialist you prefer. We’ve helped many clients find policies that provide flexibility for specialist care, ensuring they get the treatment they need from the right healthcare provider.

Super Visa Insurance typically covers medical care within Canada. If you plan to visit a doctor outside Canada, the insurance might not cover those costs. At Canadian LIC, we explain these details to our clients upfront so they don’t face unexpected expenses during their visit.

In some cases, you may get partial reimbursement if you choose a doctor outside the network. However, this can vary based on your insurance provider. We’ve seen clients at Canadian LIC surprised by lower coverage when visiting non-network doctors, so we always encourage understanding your policy’s terms.

If your preferred hospital is full, your Medical Insurance for Super Visa should cover treatment at another hospital, depending on your policy. We help clients select policies with broader hospital networks to avoid these types of challenges.

It depends on your policy. Some require pre-approval, while others don’t. We always guide clients through these details at Canadian LIC, ensuring they understand whether they need to inform their provider before seeking medical care.

Yes, follow-up visits are typically covered if they are related to a medical emergency. Clients often ask this when recovering from surgery or illness, and we help them find Super Visa Insurance Policies that ensure comprehensive care for recovery.

The time to get approval for a specialist varies by policy. Some plans offer quicker approvals for specialists. At Canadian LIC, we help clients understand how to get the right approvals quickly so that there are no delays in care.

Super Visa Canada Insurance only covers the medical needs of the insured visitor. If you need medical coverage for a grandchild, you’ll need separate insurance. We always make this clear to clients who visit with family so that they’re aware of their coverage limits.

Most Super Visa Insurance Policies cover medications prescribed by a licensed doctor within the network. However, if the doctor is outside the network, coverage for prescriptions might be limited. Clients often ask about medication coverage, and we guide them through plans that suit their needs.

Some policies may cover virtual consultations, especially in cases of limited access to in-person care. At Canadian LIC, we’ve seen an increasing demand for this option, and we help clients choose Medical Insurance for Super Visa that includes virtual care options.

Yes, when you get Super Visa Insurance Quotes Online, you can compare policies that include specialist care. We assist clients by providing clear quotes and helping them understand which policies offer the specialist coverage they might need.

Surgeries are generally covered if they are medically necessary, and the hospital is within the network. We help clients at Canadian LIC find policies that cover surgeries at reputable hospitals across Canada.

Yes, most Super Visa Insurance Policies allow you to see multiple doctors if necessary. Clients with ongoing health concerns sometimes need multiple consultations, and we help them find the right policies to cover this.

Most Super Visa Insurance does not cover routine dental care, but some policies may cover emergency dental expenses. If dental care is important to you, we can help you explore policies with additional coverage options.

Choosing the best hospital depends on your policy’s network and your location in Canada. We regularly help clients find Medical Insurance for Super Visa that gives them access to top hospitals, ensuring they receive high-quality care

These frequently asked questions should help you develop a clear mind for any concern related to choosing your doctor or hospital with Medical Insurance for Super Visa. For flexible coverage, Canadian LIC can guide you in comparing online quotes for Super Visa Insurance and selecting the best policy according to your stay in Canada.

Sources and Further Reading

Government of Canada – Super Visa Program Requirements

Official details on Super Visa requirements, including the medical insurance criteria.

Visit the website

Canadian Life and Health Insurance Association (CLHIA)

Information on choosing health insurance for visitors, including Super Visa Insurance.

Visit the website

Canadian Healthcare System Overview

An overview of how the Canadian healthcare system works and how it relates to private medical insurance.

Visit the website

Insurance Bureau of Canada – Visitor Insurance

Details on visitor insurance policies, including Super Visa Insurance.

Visit the website

These resources provide additional insights into Super Visa Insurance Policies, how they work, and what to consider when purchasing Medical Insurance for Super Visa.

Key Takeaways

- Super Visa Insurance Flexibility: Choosing your doctor or hospital depends on the flexibility of your Super Visa Insurance Policy. Some allow open access, while others may restrict you to a network.

- Canadian LIC Simplifies the Process: Canadian LIC makes it easy to find the right Medical Insurance for Super Visa, offering clear guidance and support throughout the process.

- Policy Comparison: Comparing Super Visa Insurance Quotes Online is crucial for finding the best coverage that matches your healthcare needs and preferences.

- Ongoing Support: Canadian LIC provides continuous assistance, ensuring clients understand their policies and are covered for emergencies, doctor visits, or hospital stays

- Preferred Providers: Some policies have a preferred provider network, so it’s essential to know if your doctor or hospital is covered before needing care.

Your Feedback Is Very Important To Us

We would appreciate your feedback to better understand the challenges Canadians face when selecting their doctor or hospital under Super Visa Insurance. Your responses will help us improve our services and offer more personalized solutions.

Thank you for your feedback! Your responses will help us better address the needs of Canadians in selecting Medical Insurance for Super Visa that allows them the healthcare choices they deserve.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]