Have you ever found yourself in the midst of planning a long trip to Canada to see your loved ones, only to have your travel schedule change unexpectedly? Imagine this: you have secured your Super Visa Insurance, your bags are almost packed, and then suddenly, a family emergency or an unexpected work commitment forces you to postpone your trip. Such changes can raise many questions and concerns, especially regarding the flexibility of your Super Visa Insurance. Can you change the effective dates after purchase without losing coverage or incurring penalties?

At Canadian LIC, we see many clients facing these issues. They come to us stressed and worried that their well-laid plans and investments in Super Visa Insurance will be lost due to changes beyond their control. This blog will explore the options and process of changing the effective dates of your Parent Super Visa Insurance after purchase using real-life scenarios we see with our clients every day at Canadian LIC. By understanding this, you will be better equipped to handle the uncertainties of travel planning and ensure your insurance coverage matches your actual travel dates.

Understanding Super Visa Insurance Flexibility

This is a type of insurance targeted to provide medical coverage to visiting parents or grandparents who come to stay with their family members in Canada for an extended period. One of the most important factors in this insurance is its commencement date, which should be as close as possible to your arrival date in Canada. Life can, however, be very unpredictable, with frequent changes in travel plans. Fortunately, most insurance providers realize this and hence offer some flexibility when changing policy dates.

Challenges and Solutions

Scenario 1: Last-Minute Delays

John and Linda, a couple from the UK, planned a six-month stay in Canada to be with their daughter and her family. Two weeks before departure, John required unexpected surgery, delaying their trip by a month. They contacted us at Canadian LIC, worried about their Super Visa Insurance, which had already been set to start. We helped them navigate through the process of contacting the insurer to shift the effective date forward by a month, ensuring they would keep coverage and avoid additional costs.

Key Takeaway: Always communicate changes as soon as possible to your insurance provider or broker so they can adjust your policy’s effective dates accordingly.

How to Change the Effective Dates of Your Insurance

Step 1: Review Your Policy Terms

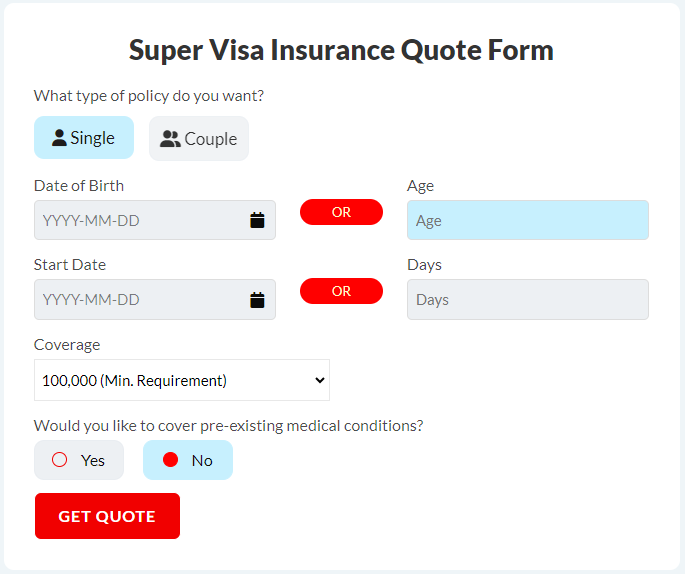

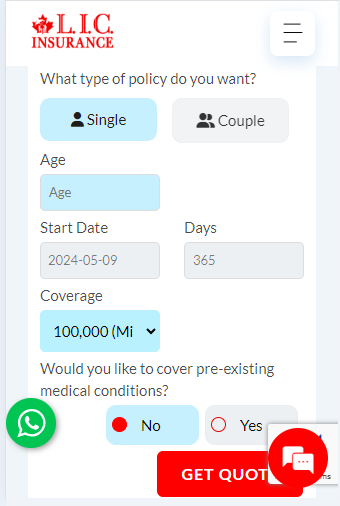

Understand your policy and know exactly what it says about changing the effective date before you do. Some policies allow for changes to be made at no charge if completed prior to the original effective date. Others will require a minimal administrative fee.

Step 2: Contact Your Insurance Provider

Call your insurance company with your policy number and suggest new dates. This is the real value of quality providers like Canadian LIC, where our agents take care of these communications efficiently and professionally on your behalf to make sure you get the best possible outcome.

Step 3: Provide Necessary Documentation

A case in point is the need to explain the reason for the change; some insurance companies may ask to back this with documents—for example, medical records or proof of visa delays. Having these documents prepared will definitely speed up the process.

Step 4: Confirm the Changes

Once your insurer has agreed to the changes, be sure to obtain written confirmation of the changes; this must include details of new effective dates and adjustments to coverage or premiums.

Considerations and Tips

When planning to adjust your insurance rates, consider the following:

Timing is crucial: The sooner you request the change, the easier it typically is to adjust without penalties.

Keep documentation: Always keep records of communications and formal approvals regarding date changes.

Review the new terms: Make sure the new dates are independent of the overall length of coverage you initially purchased.

Why Choose Canadian LIC?

At Canadian LIC, we specialize in insurance related to the super visa for parents. Our professionals are well-experienced in handling unexpected changes, providing Super Visa Insurance Quotes, and ensuring the best possible adjustments to our client’s plans. We work skillfully on the fine points of Super Visa Insurance policies and take immense care in negotiating terms suiting the changing needs of our clients.

The End

Travel plans can be fluid, especially when it’s for several months and having Parent Super Visa Insurance Coverage that can adjust to changes in your schedule is critical. If you need to change the effective dates of your Super Visa Insurance, remember that this can be done efficiently with the right guidance and proactive approach. At Canadian LIC, we will make sure your insurance needs are met with minimal hassle so you can focus on what matters most – enjoying your time with your family in Canada.

Don’t let the thought of inflexible insurance plans hold you back. Contact Canadian LIC today and talk to us about your Super Visa Insurance needs. Find out for yourself how we are the top insurance brokerage for Super Visa Insurance Plans. Your journey to Canada starts with a safe and secure footing, and we will make sure that happens.

More on Super Visa Insurance

Can I Include My Spouse In The Same Super Visa Insurance Policy?

Can I Get Super Visa Insurance If I Am Over 85 Years Old?

How Do I File A Complaint About My Super Visa Insurance Provider?

What Are The Consequences Of Not Having Valid Super Visa Insurance?

What Happens If The Super Visa Insurance Expires While The Visitor Is Still In Canada?

Is There A Waiting Period For Super Visa Insurance?

Is Super Visa Insurance Refundable?

How To Find The Most Affordable Super Visa Insurance Plan?

Where Can You Buy Super Visa Insurance In Canada?

Can We Cancel Super Visa Insurance?

Can I Pay Monthly For Super Visa Insurance?

When Should Super Visa Insurance Start In Canada

Benefits Of Super Visa Insurance

What To Look For In Super Visa Insurance In Canada?

Mistakes To Avoid While Buying Super Visa Insurance

Everything You Need To Know About The Canadian Super Visa Insurance

How To Apply For A Super Visa Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Adjusting the Effective Dates of Your Super Visa Insurance

Knowing how to navigate changes to your parent’s Super Visa Insurance Policy can be frustrating. At Canadian LIC, we realize the flexibility that a long-term visitor to Canada needs. That is why we have taken the time below to compile a short list of the most frequently asked questions to help you manage your Super Visa Insurance effectively.

Generally, yes, you can change your effective date of insurance even after it is purchased. Obviously, notify your insurance provider as soon as you realize that your travel plans have changed. We helped Robert, a client whose visa processing got delayed, adjust his insurance start date accordingly without any penalties.

Some companies may charge a small fee for the change of dates in the Super Visa Insurance Policy. Others do it free, provided that it is before the original start date. We recommended that customers, such as Maria, who had to delay their trip due to family issues, check their policy details or call us if there are additional fees.

You will probably be asked for your policy number, the new dates on which you would want your coverage to start and end, and possibly reasons or documentation for change, such as a new flight itinerary or delayed visa approval letter. Our team at Canadian LIC assists clients in gathering and submitting the necessary documents to have this process go through seamlessly.

It’s best to request changes as early as possible. That said, in most instances, changes can usually be made up until the original start date of the policy. However, for urgent changes past this date, direct help from specialized brokers such as Canadian LIC may be vital, which was the case with our client Li. Her departure had been rescheduled by the airline.

Changing the effective date should not affect the total duration of your coverage unless you request that the end date be extended or shortened. We take care that clients like John, who extended to support his daughter after her surgery, get their coverage adjusted without losing any protection initially intended.

Yes, refunds are usually possible if you cancel your insurance before it starts, subject to cancellation fees determined by the insurer. We struggled through the arduous process of cancelling Helen’s policy after she was denied the super visa, and we secured a full return, less a small administration fee.

You should apply for an extension in your insurance coverage before it elapses. We assist clients like Tom to go through the processes for extension, ensuring that the coverage runs continuously without a gap that might adversely affect the status of your visa.

Always insist that your insurance provider give you a written confirmation once such changes are made. We shall, as we did in the case of Sarah, whose dates have been updated since she entered Canada, obtain official documentation for our clients to reflect the update.

Yes, you can still notify your insurer of this if you are not sure of the new travel dates. It is possible to obtain a flexible start date or, with some policies, even hold it without specific dates until they can be confirmed. We helped a client, Alex, whose work commitments were shifting around, to keep his coverage on hold without committing to specific dates until his schedule was nailed down.

This can affect your premiums if the overall length of cover has changed or the insurance market rates have altered. An example of this is when our client Emily had to push her date back a few months. We updated her premium quote to show the new coverage period, so she would only pay for what was required.

While it is technically possible to change the effective dates more than once, it is subject to the approval of the insurance provider. In the case of Michael, where there were several changes in the travel plans, we instructed our clientele to make the insurer clearly aware and handle these easily.

If you have a pending visa application, and your insurance is due to start, please notify your insurer at the soonest time possible to change the effective date. We have done this with numerous clients, including Sarah, by reaching out to their insurance providers to hold off on initiating coverage until after the visa approval.

Most plans require any changes at least a few days prior to the original effective date. This can vary. Canadian LIC helped a client, Omar, adjust his insurance start date just 48 hours before the policy was due to start because of our strong relationships with the insurers.

You need to adjust your insurance rates to avoid having no coverage when you actually travel, or you might end up paying for coverage when you are not in Canada. A client, David, faced this issue when he neglected to update his travel dates, resulting in no coverage during his actual stay. We helped him rectify this swiftly to ensure his rescheduled trip was covered.

Whenever you ask for Super Visa Insurance Quotes, inquire about the flexibility of changing the dates and the fees or conditions involved. At Canadian LIC, we, as a practice, indicate and explain these features to our clients and ensure that they select suitable Super Visa Insurance Plans that offer date-change flexibility.

Changing dates in your Super Visa Insurance can be easy. We at Canadian LIC are fully equipped to make these changes effectively so that your visit to Canada does not get disrupted. If you have more questions or would like to request assistance, please do not hesitate to contact us. Let’s ensure your stay in Canada is fully protected from the moment you land until the day you return home, with all the flexibility you need.

Sources and Further Reading

Immigration, Refugees and Citizenship Canada (IRCC) – Super Visa Information

Description: Official government page providing detailed information about the Super Visa, including eligibility requirements and application processes.

Canadian Life and Health Insurance Association (CLHIA) – Guide to Travel Health Insurance

Description: A comprehensive guide by the CLHIA covering aspects of travel health insurance in Canada, including what consumers should know before purchasing.

Canadian Insurance Top Broker – Article on Super Visa Insurance

Description: Provides insights and tips on selecting the right Super Visa Insurance, including what to look for in terms of coverage and flexibility.

Insurance Bureau of Canada – Consumer Information

URL: http://www.ibc.ca/

Description: The Insurance Bureau of Canada offers resources on various types of insurance available in Canada, including travel insurance. It’s a great resource for understanding insurance policies and consumer rights.

Expat Network – Navigating Health Insurance for Visitors to Canada

URL: https://www.expatnetwork.com/navigating-health-insurance-for-visitors-to-canada/

Description: Though primarily aimed at expats, this article offers valuable advice on health insurance for long-term visitors to Canada, such as those on a Super Visa.

These resources will provide you with a well-rounded understanding of Super Visa Insurance, enabling you to make informed decisions about your insurance needs while in Canada.

Key Takeaways

- Most Super Visa Insurance providers offer flexibility to adjust policy dates to accommodate changes in travel plans.

- Communicate any necessary changes to your insurance provider as soon as possible to ensure coverage aligns with your actual travel dates.

- Some insurers may charge a fee or require new premium calculations for date adjustments.

- Be prepared to provide necessary documentation

- Always ensure that any adjustments to your insurance dates are confirmed in writing by your insurance provider.

- Consulting with experienced brokers like those at Canadian LIC can simplify the process of adjusting your insurance dates.

- Familiarize yourself with the terms and conditions of your Super Visa Insurance Policy regarding date adjustments before finalizing your purchase.

Your Feedback Is Very Important To Us

This questionnaire aims to understand the specific challenges and satisfaction levels related to changing the effective dates of Super Visa Insurance,

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]