- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Can a Child Be the Owner of a Term Life Insurance Policy?

- What Does It Mean for a Child to Be the Owner of a Life Insurance Policy?

- Why Consider Life Insurance for Kids?

- Who Owns the Policy Until the Child Can Take Over?

- What Are the Benefits of Early Ownership?

- How to Buy Term Life Insurance for Kids Online

- Key Considerations Before Purchasing

- Canadian LIC: Helping Families Build a Secure Future

- Why Take Action Now?

Can A Child Be The Owner Of A Term Life Insurance Policy?

By Pushpinder Puri

CEO & Founder

- 11 min read

- November 29th, 2024

SUMMARY

Many parents in Canada need help with the appropriate financial moves for their children’s future. Among these considerations is the question of whether a child should own a Life Insurance Policy or not. Can a child own a Life Insurance Policy? And if a child can, what does it mean for his or her financial security? These issues often come up as families are considering alternatives like Term Life Insurance for children or term insurance plans as a broad financial security measure. At Canadian LIC, one hears stories of parents trying to weigh the affordability, practicality, and long-term benefits of making such a decision. Let’s dive into these questions to sort out something that can feel complex but has real benefits when attended to properly.

What Does It Mean for a Child to Be the Owner of a Life Insurance Policy?

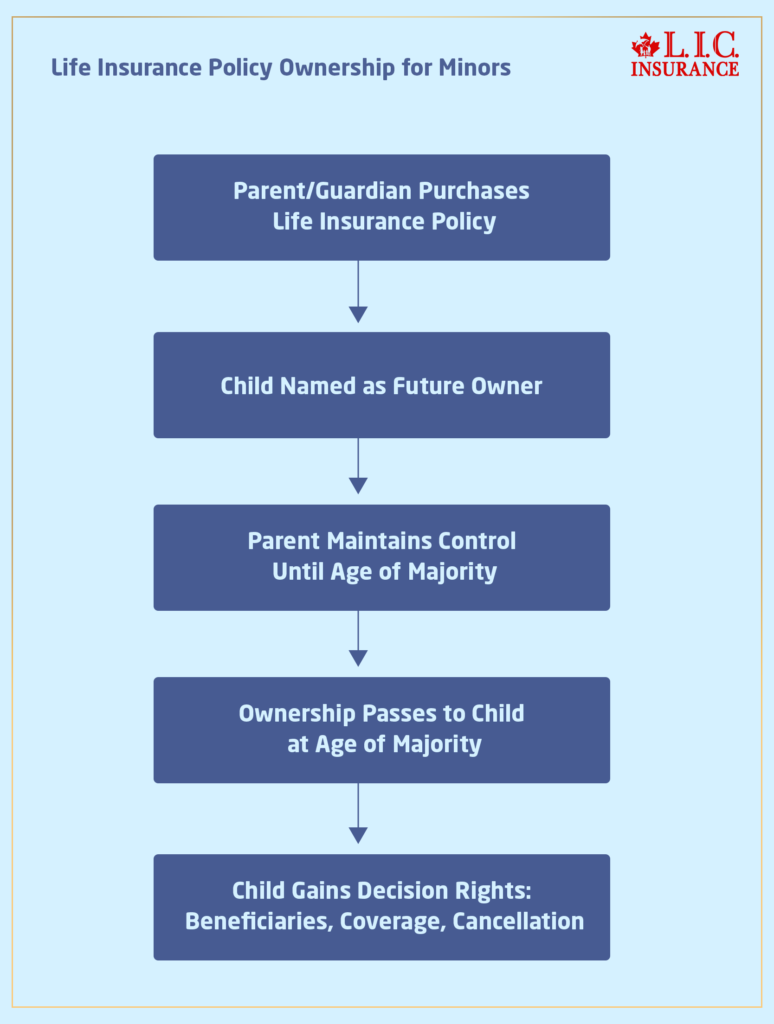

In Canada, the right to make decisions on the policy, such as changing beneficiaries, adjusting coverage, or cancelling the policy, is held by a Life Insurance Policy owner. For minors, the law typically prevents them from directly owning a policy due to their age and lack of legal capacity to enter contracts. Term Life Insurance Plans are nevertheless capable of being purchased by parents or legal guardians on behalf of their children. Ownership then passes to the child once they attain the age of majority.

For example, a client once came to Canadian LIC anxious about establishing Life Insurance for their 12-year-old. The parent wanted the child to take control of the policy without complications eventually. By purchasing a policy with the child named as the future owner, the parent ensured the child would gain ownership rights when they turned 18 or 19, depending on the province. This approach gave peace of mind, knowing the child would have financial resources later in life.

Why Consider Life Insurance for Kids?

Such an option as Term Life Insurance for Kids might seem really out of the ordinary. Children don’t have financial dependents and rarely have a big debt burden. Yet, there are several clear reasons why such a decision might be well reasoned:

- Locking in Low Premiums: For example, Life Insurance rates are quoted based on a person’s age and health status, so families who buy coverage when their kids are young and healthy will secure their lower rates as the policy is converted into adulthood. Many parents purchase Term Life Insurance online for the ease of locking in these low rates.

- Building a Financial Foundation: Some parents prepare for their child’s future needs by using Life Insurance as a financial tool. For example, cash value policies, such as Whole Life Insurance Policies, can be used later for education or other expenses. Although Term Life Insurance Plans do not accumulate any cash value, they can offer affordable coverage, which develops into lifelong protection.

- Simplified Future Coverage: If a child develops health conditions later in life, having an existing Life Insurance Policy can ensure they retain coverage without needing to qualify again medically. One family we helped with a case at Canadian LIC had a child who developed a chronic illness, and early coverage allowed them to avoid higher premiums and get denied applications later on.

Who Owns the Policy Until the Child Can Take Over?

Traditional Policy ownership is usually by parents or legal guardians until the child attains the age of majority. At this stage, the adult will be responsible for running the policy, including remittances for premiums and any changes that may be warranted. Upon reaching the majority, transferring the ownership can be smooth and complete.

At Canadian LIC, we’ve seen the scenario where parents are reluctant to pass over control of a policy. To make the transition very smooth, we advise open communication with the child about the purpose and benefit of the policy so they get proper education to use the policy when it’s their responsibility.

What Are the Benefits of Early Ownership?

When a child assumes ownership of a Life Insurance Policy, it empowers them to take control of their financial future. Here are some of the benefits of early ownership:

- Responsibility: Taking ownership of a policy teaches financial responsibility and introduces the concept of long-term planning.

- Continued Protection: A policy originally purchased as Term Life Insurance for Kids can often be converted to Permanent Coverage without additional medical exams, ensuring lifelong protection.

- Flexibility: As the policy owner, the child can adjust the coverage to fit their evolving needs, such as starting a family or purchasing a home.

Our client’s 21-year-old was able to take their converted policy and use that to get a mortgage. Because they were so early, this gave them an advantage that perhaps other young adults wouldn’t have, moving their financial story further ahead.”.

How to Buy Term Life Insurance for Kids Online

Purchasing Life Insurance online has now become easy and fast. For example, with tools like Canadian LIC’s online platform, parents can compare Term Life Insurance Quotes in minutes, explore policy options, and even apply in just minutes. Here’s how it works:

- Research and Compare Plans

Look for policies designed for children and consider factors like coverage limits, conversion options, and premium costs.

- Request Quotes

Use an online quote tool to get accurate pricing for Term Life Insurance Plans.

- Submit an Application

Complete the application process with the child’s basic information. Some policies may require a medical questionnaire, while others do not.

- Review and Finalize

Once approved, review the policy details carefully. Ensure it aligns with your long-term goals before making it official.

At Canadian LIC, we’ve guided countless families through this process, helping them choose policies that meet their unique needs.

Key Considerations Before Purchasing

Before committing to a policy, parents should assess their financial situation and goals. Here are some key points to consider:

- Budget: Ensure the premiums fit within your budget without straining other financial obligations.

- Future Needs: Think about how the policy might benefit your child in adulthood.

- Coverage Type: Decide whether Term Life Insurance for Kids or another type of coverage best suits your objectives.

One family we assisted opted for a combination of Term and Permanent Life Insurance, giving them both affordability and the potential for long-term growth.

Canadian LIC: Helping Families Build a Secure Future

Among the many decisions to be taken for securing your child’s future, choosing the right Life Insurance option cannot be really very easy. Canadian LIC offers you comprehensive choices with a clear and simple planning process. With decades of experience, we have been taking families across Canada through their options and giving them policies that they actually deserve. If you want to opt for Term Life Insurance Policies or simply buy Term Life Insurance Online, our expertise will help you make the right choice.

Why Take Action Now?

The earlier you invest in Life Insurance for your child, the more benefits you can accrue in the long run. Low premiums, guaranteed coverage, and financial security are just some of the advantages of acting early. By taking steps today, you’re not only helping protect your child’s future but also equipping them with tools to navigate their financial journey with confidence.

Canadian LIC is here to guide you every step of the way. For your family, get Term Life Insurance Quotes and find the best options. We’ll collaborate with you to create a plan that’s tailored just right to lay the ground for success for your child. Secure your child’s future today with Canadian LIC!

More on Term Life Insurance

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions About Life Insurance Ownership for Children

In most cases, minors cannot legally own Life Insurance Policies because they are not allowed to enter into binding contracts. Instead, a parent or legal guardian typically owns the policy on behalf of the child until they reach the age of majority. At that point, ownership can transfer to the child.

Parents can choose between Term and Permanent Life Insurance.

- Term Life Insurance for Kids: Offers coverage for a specific period, often with the option to convert to permanent coverage later.

- Permanent Life Insurance: Provides lifelong coverage and may accumulate cash value that can be accessed later.

Yes, Term Life Insurance for Kids is an affordable way to secure coverage at a young age. The policy can often be converted to permanent Life Insurance later without requiring a new medical exam, ensuring lifelong protection.

- Term Life Insurance Plans: Offer temporary coverage at a lower cost, ideal for families looking for affordable short-term protection.

- Permanent Plans: Provide lifelong coverage and build cash value, which can be accessed in the future for expenses like education or starting a business.

Purchasing Life Insurance for a child has several benefits:

- It secures low premiums for life.

- It ensures coverage regardless of future health changes.

- It can provide financial benefits, such as cash value accumulation (for Permanent Policies).

One family Canadian LIC worked with was especially grateful for their foresight when their child developed a chronic condition. The policy they purchased early ensured lifelong coverage and peace of mind.

Yes, once the child reaches the age of majority (18 or 19, depending on the province), you can transfer ownership to them. This allows the child to take full control of the policy, including decisions about coverage, beneficiaries, and premiums.

Yes, many insurance providers, including Canadian LIC, offer the option to buy Term Life Insurance online. This makes it easy for parents to compare Term Life Insurance Quotes and secure a policy from the comfort of their home.

Yes, insurers typically limit the coverage amount for minors to reflect their financial dependency status. These limits vary by insurance company, but policies often max out between $25,000 and $500,000. Speak with Canadian LIC to explore coverage options that align with your goals.

Yes, even though children don’t have financial dependents, Life Insurance for kids offers several benefits, such as locking in low premiums, ensuring coverage despite future health changes, and providing a financial tool for long-term planning.

If you stop to pay premiums, the policy could lapse, resulting in a loss of coverage. Some policies may offer a grace period or cash value to help keep the policy active temporarily. Speak to Canadian LIC about your options if you’re struggling to maintain payments.

Family riders can be a cost-effective way to add coverage for children to an existing policy. However, standalone policies offer more flexibility and benefits, such as the ability to convert to Permanent Life Insurance Policies or transfer ownership to the child.

Yes, many insurers offer family riders that include coverage for children under a single policy. This is an affordable way to provide protection without purchasing separate policies. However, if long-term benefits or ownership transfer is a goal, individual Term Life Insurance Plans might be a better option.

Yes, insurers typically cap coverage for minors to ensure the policy matches their financial needs. These limits vary but are generally lower than those available to adults. When obtaining Term Life Insurance Quotes, parents can review options suited to their goals.

The process involves notifying the insurer once the child reaches the age of majority. The transition is straightforward and requires proof of age. Canadian LIC helps families navigate this process, ensuring a smooth handover.

Invest in the future of your child with a Life Insurance Policy. Whether it’s Term Life Insurance for children, suitable due to affordability and flexibility, or Permanent Insurance, the proper policy will ensure your child is protected no matter what life has in store. Canadian LIC is here to help you best choose the right fit for your family. Compare Term Life Insurance Quotes today and take that first step toward securing your family’s financial future.

Sources and Further Reading

- Canada Life: Should I Buy Life Insurance for My Child?

This article discusses the types of Life Insurance available for children and the benefits of early coverage.

Canada Life - Insurdinary: Life Insurance for Children in Canada Explained

This guide provides an overview of children’s Life Insurance, including policy types and considerations for parents.

Insurdinary - Serenia Life Financial: A Guide to Life Insurance for Kids in Canada

This resource offers insights into purchasing Life Insurance for children, including steps to get started and factors to consider.

SereniLife - MoneySense: Life Insurance for Kids: Do You Really Need It?

This article examines the necessity of Life Insurance for children and explores the pros and cons.

MoneySense - Protect Your Wealth: Child Life Insurance: Is It Right for Your Family?

This comprehensive guide discusses the workings of child Life Insurance, its benefits, and potential drawbacks.

Protect Your Wealth

Key Takeaways

- Children Cannot Legally Own Policies Until Adulthood

Parents or guardians own Life Insurance Policies for minors, with ownership transferring to the child when they reach the age of majority. - Term Life Insurance for Kids Offers Affordable Coverage

Term Life Insurance Plans for kids provide low-cost protection and flexibility for future needs, including conversion to permanent coverage. - Benefits Include Locking in Low Premiums

Securing a policy while a child is young and healthy ensures affordable premiums for the long term, even as they grow older. - Lifelong Protection is Possible

Early Life Insurance Policies can offer lifelong coverage, especially if converted into permanent plans, regardless of future health changes. - Ownership Transition Promotes Financial Responsibility

Transferring policy ownership to children when they become adults empowers them to manage their financial future responsibly. - Family Riders Are an Alternative Option

Adding children to an existing family policy can provide coverage, but standalone policies offer more flexibility for ownership and conversion. - Online Term Life Insurance Options Simplify the Process

Parents can conveniently compare Term Life Insurance Quotes and apply online for hassle-free policy setup. - Long-Term Benefits Outweigh Initial Costs

Investing in Life Insurance for kids secures financial protection, fosters responsibility, and offers potential financial benefits in adulthood.

Your Feedback Is Very Important To Us

Thank you for taking the time to provide your feedback. This questionnaire is designed to help us understand your concerns and challenges related to Life Insurance ownership for children. Your insights will allow us to serve you better.

IN THIS ARTICLE

- Can a Child Be the Owner of a Term Life Insurance Policy?

- What Does It Mean for a Child to Be the Owner of a Life Insurance Policy?

- Why Consider Life Insurance for Kids?

- Who Owns the Policy Until the Child Can Take Over?

- What Are the Benefits of Early Ownership?

- How to Buy Term Life Insurance for Kids Online

- Key Considerations Before Purchasing

- Canadian LIC: Helping Families Build a Secure Future

- Why Take Action Now?