- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Best Term Life Insurance Plans For Couples

- Why Term Life Insurance Makes Sense for Couples

- Types of Term Life Insurance Plans for Couples

- How Canadian LIC Helps Couples Find the Right Plan

- Key Features to Look for in a Term Life Insurance Plan

- Benefits of Working With Canadian LIC's Term Life Insurance Brokers

- Comparing the Best Term Life Insurance Plans for Couples in Canada

- Common Questions Couples Ask About Term Life Insurance

- The Role of Term Life Insurance Cash Value in Couples' Plans

- Steps to Purchase a Term Life Insurance Plan for Couples

Best Term Life Insurance Plans For Couples

By Harpreet Puri

CEO & Founder

- 11 min read

- January 3nd, 2025

SUMMARY

This blog delves into the best Term Life Insurance Plans for couples in Canada, exploring Joint and Individual Policies, important features to look out for, and the role of Term Life Insurance Brokers. It explains how Canadian LIC makes it easier for one to simplify the process by comparing Term Life Insurance Quotes Online and providing one with personalized guidance. The blog also discusses coverage flexibility, rider options, and how Term Life Insurance Cash Value can benefit couples in ensuring financial security.

Introduction: Understanding Couples' Concerns About Financial Security

Life is filled with milestones, starting with marriages, buying first homes together, and planning a family. As fantastic as these can be, it comes with accompanying financial responsibilities for the couple involved. Many such couples in Canada worry about where their family would fall if something tragic were to occur. Without that safety net of proper insurance to fall back upon, the question can weigh severely. This is where the right Term Life Insurance Plan becomes truly indispensable. With options created for couples, Term Life Insurance can be an assurance and source of financial stability.

Let’s cover the most typical issues couples often face: how to protect one another without sacrificing a fortune. What if, for example, one partner has a higher salary? How would you compare the policies without drowning in industry terminology? At Canadian LIC, we have seen those challenges and made it possible for thousands of couples to find what they need in coverage.

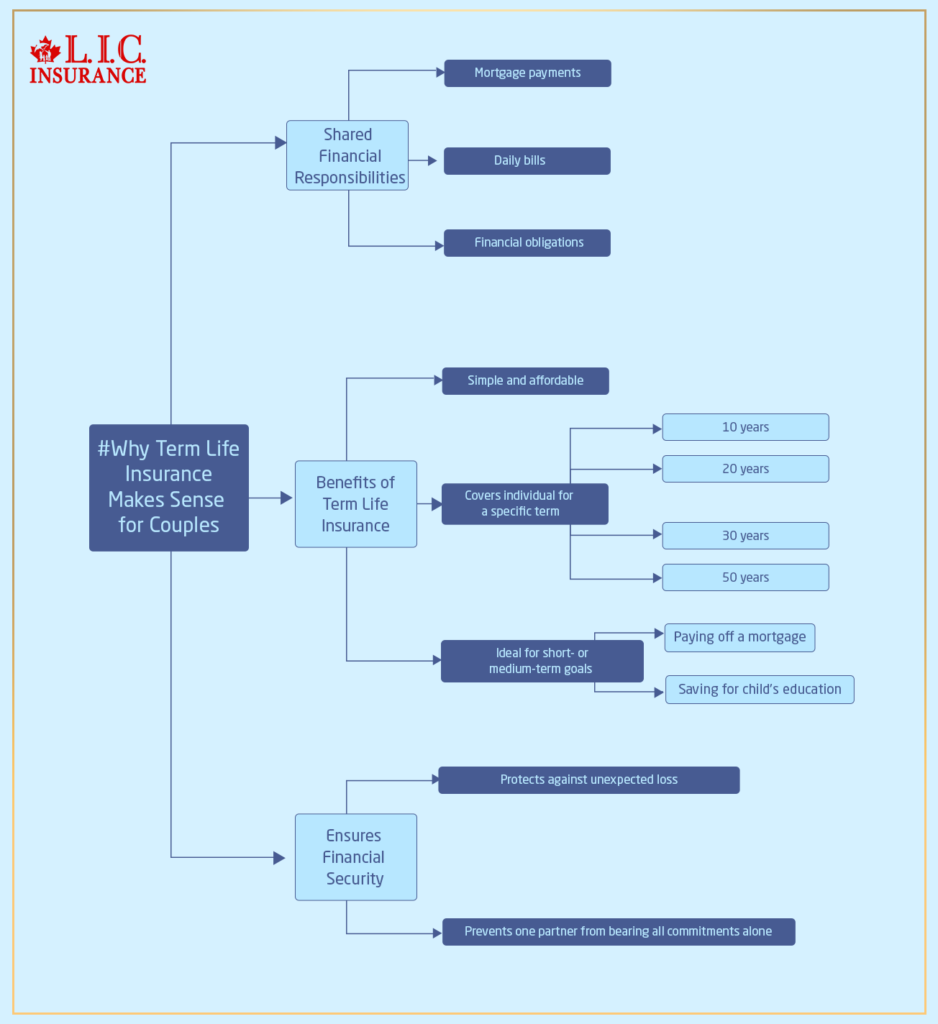

Why Term Life Insurance Makes Sense for Couples

With a partnership, everything is shared-including dreams, responsibilities, and expenses. Everything from mortgage payments to daily bills is interlocked in financial obligation. A Term Life Insurance Policy ensures that when one partner leaves unexpectedly, the other doesn’t have to carry the burden of meeting these commitments.

Term Life Insurance is simple and affordable compared to Permanent Insurance. It covers the individual for a term, usually 10, 20, 30 or 50 years, which suits couples working toward short- or medium-term goals, such as paying off a mortgage or saving for their child’s education.

Types of Term Life Insurance Plans for Couples

Couples have several options when it comes to Term Life Insurance. Here are the most popular ones:

In the Joint Policy, one plan includes both partners. It is, as a general rule, relatively less expensive to have two single policies. Term Life Insurance occurs in two flavours:

- First-to-die policies: The insurance benefit is paid out when the first partner dies. This helps to pay off immediate expenses, such as loans or funeral costs.

- Second-to-die policies: The benefit is paid after both partners pass away. They are less common and more geared toward estate planning.

Individual Term Life Insurance Policies

Many couples prefer to have Separate Policies. This is more helpful if the other partner is considered to have more coverage because they have a better income or higher financial obligations. For instance, one partner could opt for a policy with a higher Term Life Insurance Cash Value while the other just takes a simple plan.

Convertible Term Life Insurance

This kind of policy will allow you to switch to a Permanent Life Insurance Plan without the need for another medical exam. It is great for couples who may want lifetime coverage in the future.

How Canadian LIC Helps Couples Find the Right Plan

At Canadian LIC, we often experience couples getting torn between choosing the Joint or Individual Policy. An example would be a newly married couple who has just bought a house for themselves. They had come to us with uncertainty about whether a Joint Policy would suffice for them. On assessing their requirement, we provided them with a Joint Term Policy for the mortgage and an individual policy for the spouse with more income so as to be thoroughly covered. And they walked away feeling assured.

Key Features to Look for in a Term Life Insurance Plan

The couple should focus on the features of the Term Life Insurance Policy that can meet their Life Insurance needs. Among them are:

- Coverage Amount: Figure out how much coverage you want to pay off common debts, substitute your income in case of demise, and keep working toward future aims. Most people underestimate the coverage required to ensure their lifestyle survives.

- Policy Term Length: Select a term that corresponds to your loan term. For example, if you have a 25-year mortgage, a 25-year term is appropriate.

- Renewability and Conversion: Choose policies that can be renewed at the end of the term or converted to Permanent Coverage without requiring a medical exam.

- Riders: Add riders such as Critical Illness Coverage or accidental death benefits to supplement your policy. These will provide extra security without having to purchase separate plans.

Benefits of Working With Canadian LIC's Term Life Insurance Brokers

Finding the right plan can be pretty overwhelming, but Canadian LIC’s experienced Term Life Insurance Brokers help make it more manageable. Compare Term Life Insurance Quotes Online for multiple providers with our brokers so you get the best value for your budget. Our brokers take the time to break down policy details in plain language so you will never be guessing.

Canadian LIC brokers don’t just quote but listen to specific concerns and tailor advice based on your particular situation. Some clients worry that they may need to choose between Joint Life Insurance Policies or Individual Policies. Our brokers break down the pros and cons, offering recommendations specifically for you. They also describe the benefits of adding riders like Critical Illness or Disability Coverage so you know how these features improve your Term Life Insurance. They compare policies from trusted providers so you can be sure to get not only the most affordable Term Life Insurance premiums but also the best coverage for your needs.

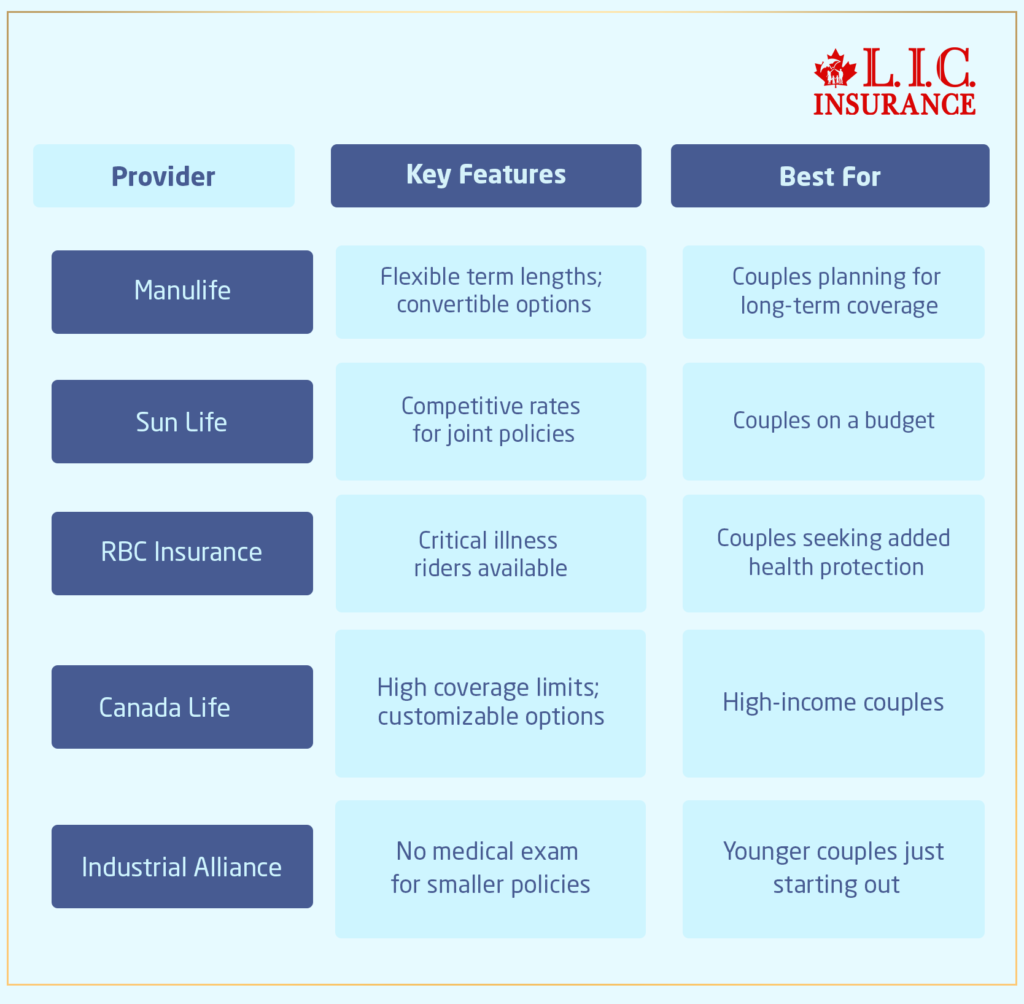

Comparing the Best Term Life Insurance Plans for Couples in Canada

To help you get started, here’s a comparison of some top options:

Common Questions Couples Ask About Term Life Insurance

How much does a Term Life Insurance Plan cost for couples?

The cost of a Term Life Insurance Plan varies based on age, health, coverage amount, and term length. Generally, Joint Policies are less expensive than two individual policies but typically less flexible.

Can we modify coverage if our financial situation changes?

Yes, most providers do offer changes during the policy term. This is really helpful for those couples who may be going through life changes such as a new baby or career change.

Is it better to apply together or separately?

Joint application for Joint Policy can reduce the cost of premiums. However, a Separate Policy will be more relevant if one spouse has specific requirements.

The Role of Term Life Insurance Cash Value in Couples' Plans

While Term Life Insurance usually doesn’t generate a cash value, some companies do offer hybrid policies. These allow for a savings component so that couples can accumulate a financial reserve while maintaining coverage. Such policies are indeed expensive, but for couples looking to maximize their investment, they may be the way to go.

For instance, one couple wanted a plan that provided protection with growth. We led them to a Term Policy with a relatively modest cash value component, which gave them security and provided them with some financial cushioning in case emergencies arose.

Steps to Purchase a Term Life Insurance Plan for Couples

- Assess Your Needs: List your financial obligations and future goals.

- Compare Policies: Compare Term Life Insurance Quotes Online with the expertise of Canadian LIC from some trusted providers.

- Consult a Broker: Work with our brokers to customize a plan that fits your budget and priorities.

- Complete the Application: Fill in the application accurately with health and lifestyle information to ensure a problem-free approval process.

- Review the policy: Make sure before signing all terms and conditions are understood.

Why Canadian LIC is the Best Choice for Couples

At Canadian LIC, we boast of tailor-made solutions for every couple. Our brokers have ample experience when it comes to the special requirements of spouses during various life cycle stages, from young couples who just got married up to their old age retirement phase.

We learn that insurance is not a simple transaction but rather an act of love for the safety of loved ones. We make every client feel appreciated and confident in their choice.

Take the First Step Today

Choosing the appropriate Term Life Insurance does not need to be hard. With guidance from Canadian LIC, you are guaranteed a smooth future without all the stress and worries. You should not let things get worse by waiting till it is late. Connect with Canadian LIC and see what works for you by selecting the right Term Life Insurance Policy.

More on Term Life Insurance

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions About Term Life Insurance Plans for Couples

The best plan will depend on your shared financial goals, age, and budget. Many couples like Joint Policies because they are cheaper. You can compare Term Life Insurance Quotes Online with the help of Canadian LIC brokers to find the best plan for you.

Term life usually does not offer cash value buildup, but certain hybrid plans can. If you have questions or need advice as to whether this kind of product will help you reach your goals, Canadian LIC brokers can assist.

You can obtain a Joint Coverage or Individual Policy through a trusted broker. Canadian LIC will make the process easy for you, gathering the required documents and filling out your application correctly.

Yes, brokers simplify the process and offer you useful knowledge. They compare the policies of several providers to ensure you get the best deal.

Most plans allow you to adjust your coverage if your situation changes. You may want more coverage when you start a family, for example. Canadian LIC brokers make sure you understand these options when you’re choosing your policy.

This ranges from age to health, the amount of coverage, and length of term, among others. Joint Policies may be cheaper compared to two Single Policies. Term Life Insurance Online quotes in Canada are available with Canadian LIC.

If neither of the partners dies within the term, the policy lapses without a Term Life Insurance payout. Many providers allow renewal or conversion to a Permanent Plan. Canadian LIC can elaborate on these further.

Calculate your shared debts, income replacement needs, and future goals to decide. Canadian LIC brokers can assist with finding the right balance.

Joint Policies are cost-effective, but Separate Policies offer more flexibility. Canadian LIC helps couples decide based on their unique needs.

Yes, it can provide financial stability if one partner passes away unexpectedly. With the right plan, you can secure your children’s education and well-being.

Yes, brokers explain policies in simple terms. Canadian LIC brokers ensure you fully understand your Term Life Insurance Plan before making a decision.

Term Life Insurance is actually designed for a term, and Whole Life Insurance is designed to last for a lifetime. The latter is typically costlier, and Canada LIC brokers can guide comparisons between the two.

You can also use online tools or consult with brokers. Canadian LIC offers an easy platform for you to compare Term Life Insurance Quotes Online and get the best plan.

Yes, smokers pay higher premium rates. Joint Policies could carry higher premiums when one partner is a smoker. However, brokers in Canada still have several choices for even those who smoke.

Some require a medical exam, while others do not. Canadian LIC brokers can help point you to plans that can fit your needs, among which are no-medical-exam options.

Many providers give discounts for Joint Policies. Canadian LIC helps compare Term Life Insurance Quotes Online while identifying cost-cutting opportunities.

Most policies have a grace period. Canadian LIC advises clients to set reminders or automate payments to avoid lapses in coverage.

Yes, it can be used to pay off any debt. The Canadian LIC brokers of Canada ensure that your coverage amount matches your debt.

It will depend on your circumstances at that time. Canadian LIC brokers can discuss whether renewal or conversion would better suit your long-term needs.

Approvals can usually take a number of days, sometimes weeks, based on the insurer and the specific documents needed, and Canadian LIC brokers ensure a faster process if all the essential documents are present.

Sources and Further Reading

Government of Canada – Life Insurance Information

https://www.canada.ca

The Government of Canada provides detailed information on life insurance options and their benefits.

Manulife – Term Life Insurance

https://www.manulife.ca

Explore Term Life Insurance Plans and features tailored for Canadian couples.

Sun Life – Term Insurance Plans

https://www.sunlife.ca

Sun Life offers insights into Term Life Insurance coverage, joint policies, and additional riders.

RBC Insurance – Life Insurance Options

https://www.rbcinsurance.com

RBC Insurance provides comprehensive details on Term Life Insurance and critical illness riders.

Canada Life – Insurance Solutions

https://www.canadalife.com

Canada Life discusses coverage flexibility and options for couples.

Industrial Alliance – Life Insurance for Families

https://ia.ca

Industrial Alliance offers no-medical-exam policies and coverage options for younger couples.

Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca

A reputable source for understanding life insurance regulations and industry practices in Canada.

Key Takeaways

- Term Life Insurance Benefits Couples: Term Life Insurance Plans offer affordable and flexible coverage, ensuring financial stability for couples in Canada.

- Options to Suit Every Need: Couples can choose from joint policies, individual plans, or convertible Term Life Insurance, depending on their financial goals and priorities.

- Tailored Features Matter: Key features like coverage amount, term length, and rider options should align with your shared financial responsibilities and future goals.

- Cash Value in Certain Plans: While most Term Life Insurance Plans don’t build cash value, hybrid options with savings components can be beneficial for some couples.

- Brokers Simplify the Process: Canadian LIC brokers compare Term Life Insurance Quotes Online, tailor recommendations, and provide personalized support, making the decision process stress-free.

- Protection Beyond Premiums: Adding riders like critical illness or disability coverage enhances the protection a Term Life Insurance Plan provides for couples and their families.

- Timely Adjustments Are Key: Many policies allow for adjustments during the term, ensuring coverage evolves with your changing needs.

- Working With Experts Is Crucial: Experienced brokers like those at Canadian LIC ensure you get comprehensive coverage at the best value, tailored to your unique situation.

Your Feedback Is Very Important To Us

We value your insights! Please take a moment to share your thoughts about finding the best Term Life Insurance Plans for couples. Your responses will help us serve you better.

Thank you for sharing your valuable feedback! We appreciate your time and will use your insights to enhance our services.

IN THIS ARTICLE

- Best Term Life Insurance Plans For Couples

- Why Term Life Insurance Makes Sense for Couples

- Types of Term Life Insurance Plans for Couples

- How Canadian LIC Helps Couples Find the Right Plan

- Key Features to Look for in a Term Life Insurance Plan

- Benefits of Working With Canadian LIC's Term Life Insurance Brokers

- Comparing the Best Term Life Insurance Plans for Couples in Canada

- Common Questions Couples Ask About Term Life Insurance

- The Role of Term Life Insurance Cash Value in Couples' Plans

- Steps to Purchase a Term Life Insurance Plan for Couples