You want to spend time with your family or take in the stunning scenery, so you’re organizing a trip to Canada. When you’re ready to leave, you go through the trouble of getting a Visitor Insurance Policy. You wonder, “Are there age limits that will affect my insurance options?” This is a common concern among visitors to Canada, especially older people and families with young children, that complicates an exciting experience.

At Canadian LIC—the best insurance brokerage—we see clients dealing with these issues every day. From a grandfather visiting his grandkids to a young couple exploring the Canadian Rockies, each scenario brings its own challenges and questions. The age limitations for acquiring visitor Canada Insurance Cover in Canada will be explained in this blog, giving you all the knowledge you need to make the right decision. Whether you’re getting a Visitor Insurance Quote or just curious about different Visitor Insurance Plans, we’ve got you covered with real stories from our daily interactions with clients just like you.

Understanding Age Restrictions in Visitor Insurance

Why Age Matters

Insurance policies are designed to manage risk, and age is a crucial factor that insurers consider when assessing the likelihood of someone needing medical care. Here are some simple points that explain why age is so important in determining the terms and costs of Visitor Insurance, especially in the context of visiting Canada.

Age as a Predictor of Health Risks

Statistically, older adults are more likely to require medical attention than younger individuals. According to health data, people aged 65 and older are three times more likely to be hospitalized than those aged 15-44.

Canadian insurance companies use this data to assess the risk of insuring older travellers. This risk assessment directly impacts the premium rates, which are higher for older travellers, to offset the increased likelihood of claims.

Young Travellers and Adjusted Terms

While young adults (ages 18-30) generally have lower health risks, infants and toddlers have higher risks of common illnesses and require routine medical checks.

For very young travellers, insurers might adjust terms to cover frequent but less severe claims, such as for colds or minor injuries. This may mean higher premiums or specific exclusions for routine pediatric care.

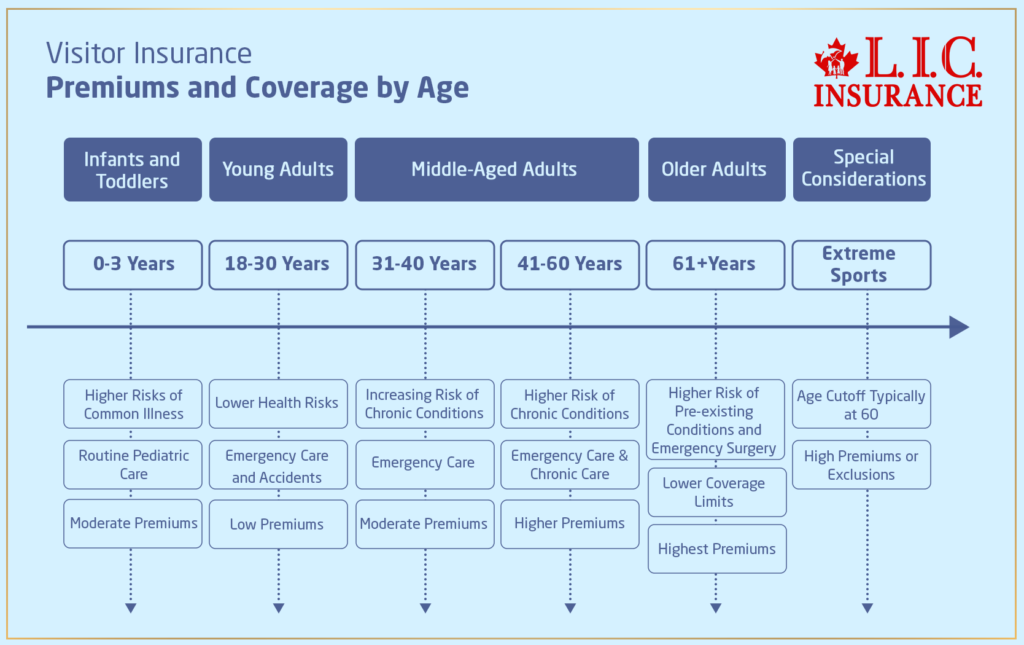

Premium Variations by Age Group

| Age Group | Typical Premium Cost | Commonly Covered Risks |

|---|---|---|

| Under 18 | Low to Moderate | Injuries, Acute Illness |

| 18-40 | Low | Emergency Care, Accidents |

| 41-60 | Moderate | Chronic Conditions, Emergency Care |

| 61+ | High | Pre-existing Conditions, Emergency Surgery |

61+ High Pre-existing Conditions, Emergency Surgery

Explanation: This table shows how premiums generally increase with age. Young adults typically enjoy lower rates due to fewer risks, but premiums begin to increase after age 40 as the risk of chronic illnesses rises.

Coverage Limits and Age

Insurers may impose lower coverage limits for older adults due to the increased cost of treating age-related illnesses.

Older travellers might find that while they can obtain insurance, the maximum coverage amount offered could be lower than for younger travellers, or they might need to pay extra for higher coverage limits.

Age Restrictions for Certain Benefits

Some benefits, like coverage for adventure or extreme sports, may end at a certain age, usually 60.

Insurance providers consider older travellers to be at higher risk of injury in high-risk activities. As a result, older individuals may either be excluded from such coverage or need to pay significantly higher premiums for these benefits.

When you talk to Visitor Insurance Agents or get a Visitor Insurance Quote, knowing how age affects your options helps you make informed decisions. If you’re older, you may need to prioritize coverage for pre-existing medical conditions or plans with higher medical coverage limits. If you’re younger, you should look for comprehensive but affordable plans that cover medical emergency care and adventure sports.

By understanding these factors, you can understand the Visitor Insurance landscape better and get coverage that suits your health needs and travel plans. Always check the details of any policy and talk to an agent to get the best deal for you.

Last month at Canadian LIC, we assisted a 78-year-old woman, Mrs. Thompson, who planned to visit her son in Toronto. Initially, she was shocked by the premiums quoted because they were significantly higher than what her son had estimated. Through our consultation, we explained how age impacts insurance rates and helped her find a plan that offered adequate coverage without being prohibitively expensive.

Common Age Brackets and Their Impact

Visitors to Canada Insurance Plans often categorize applicants into age brackets, each with tailored coverage options and premiums. Understanding these can help you find the best fit for your needs.

Under 30 Years: Generally, the most cost-effective. These plans are straightforward, often offering comprehensive coverage with lower premiums.

30-60 Years: Premiums start to increase slightly, reflecting the greater likelihood of claims as people age.

60-80 Years: Here, premiums rise more noticeably. Some insurers impose restrictions, like mandatory medical exams or limited coverage options.

Over 80 Years: Finding coverage can be challenging. Some companies might not offer new policies, or the premiums might be very high.

A client, Mr. Jacobs, in his early 60s, found it frustrating that his premium was higher than what he used to pay in his 50s. Our agents at Canadian LIC took the time to explain how moving into a new age bracket affected his Visitor Insurance Quote, and we explored several Visitors to Canada insurance plans that met his needs without stretching his budget.

Exploring Through Age-Related Restrictions

Tips for Older Travelers

Older travellers need to pay special attention to the terms and conditions of their visitor medical insurance coverage. Some tips include:

Check for Pre-existing Medical Condition Coverage: This is crucial for older adults as many have pre-existing medical conditions that could exacerbate while travelling.

Understand the Policy’s Limitations and Exclusions: Know what is not covered to avoid surprises during a claim.

Consider Higher Coverage Limits: This might increase the premium but can significantly reduce potential out-of-pocket expenses for medical care in Canada.

We recently helped a couple in their 70s, the Hendersons, who were overwhelmed by the complexities of their policy choices. They were particularly concerned about insurance to cover pre-existing conditions. After reviewing several options, they chose a plan that offered extensive coverage for such conditions, ensuring peace of mind during their stay.

Advice for Families with Young Children

While insurance for young children is typically less complicated, parents should still be vigilant about the specifics of the coverage.

Look for Family Plans: These can be more economical and convenient than purchasing insurance individually for each child.

Review Coverage for Routine Care: Unlike adults, young children may require medical attention for routine issues, which are not always covered.

The O’Brien family visited our office last week because they were concerned about their two young children during their Canadian holiday. We helped them secure a family plan that included coverage for routine checkups and common childhood illnesses, making their trip worry-free.

The End

Don’t let age restrictions or medical coverage stop you from exploring Canada. At Canadian LIC, we will walk you through every step so you understand your options and find the best Visitor Insurance Plans. Contact us today for a personalized quote and start your journey with peace of mind. Whether you’re hiking in the wilderness or on city streets, having the right insurance is your safety net. Let Canadian LIC be your guide to a stress-free adventure in Canada.

Find Out: Documents needed to buy Visitor Insurance

Find Out: The process to file a Visitor Insurance claim

Find Out: Can Visitor Insurance be extended if you decide to stay longer?

Find Out: The best Visitor Insurance

Find Out: Is it mandatory to have Visitor Insurance in Canada?

Find Out: The differences between Visitor Insurance and Travel Insurance

Find Out: Can Visitor Insurance be bought after arrival in Canada?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions on Visitor Insurance Related to Age

Your age is one of the main factors that determines the risk and cost of your insurance. For example, when Mr. Lee, 72, came to us for a quote, the first question we asked was his age. This helps us to quickly determine which plans are best for him and what the premium would be. It ensures we give you the most accurate options for you.

If you are above 65, look for plans that cover pre-existing medical conditions and don’t have high out-of-pocket expenses. Just last month, we helped Mrs. Gupta, 68, find a plan that covered her hypertension without burning a hole in her pocket. Talk to your Visitor Insurance agent and discuss your health openly to find the best plan.

Younger travellers pay less because they are less likely to have health issues. Compare several Visitor Insurance Quotes and look for plans that cover what you need. We recently helped a 25-year-old couple choose a comprehensive but affordable plan. We stressed the importance of including coverage for the adventure activities they would be doing in Canada.

Yes, some plans are family-specific and offer bundled coverage, which can be more cost-effective than individual plans. For example, the Chen family with two toddlers used our services at Canadian LIC to find a plan that covered the whole family under one policy, which made managing their coverage easier and more affordable. Ask your Visitor Canada Insurance Coverage agent about family plans and how they can be customized to include children’s health needs.

While no age group is completely excluded, older travellers may pay higher premiums or have restrictions. If you’re in this situation like Mr. Robertson, who is 83 and was last year, don’t worry. We at Canadian LIC have solutions for such cases; we explore alternative insurance providers or senior-specific plans for older travellers.

Yes! You can extend your Visitor Insurance as long as you request before your current policy expires. Premiums will increase with age and length of stay. We extended Mr. Patel’s stay last winter; he was happy to spend more time with his grandkids without worrying about insurance.

Get in touch with a licensed insurance advisor who knows the ins and outs of age in insurance. Tell them your specific age-related concerns. At Canadian LIC, we use this information to search for and give you the best quotes that balance coverage and cost.

Here are the FAQs to help you with your age and Visitor Insurance questions so you can make an informed decision for your Canada visit. At Canadian LIC, we want your insurance buying experience to be as seamless as possible and age no matter what.

Sources and Further Reading

For those interested in delving deeper into the topics discussed in the blog about age-related aspects of Visitor Insurance in Canada, the following sources and further reading materials can be extremely helpful. These resources offer additional insights and detailed information that can enhance your understanding and assist you in making informed decisions regarding Visitor Insurance.

Health Canada

Website: Health Canada

Resource: Provides comprehensive information on health statistics, including age-related health risks and prevalence of chronic diseases in Canada.

Canadian Life and Health Insurance Association (CLHIA)

Website: CLHIA

Resource: Offers detailed reports and guidelines on health insurance practices in Canada, including insights on how age influences insurance premiums and coverage limits.

Canadian Pediatric Society

Website: Caring for Kids

Resource: Hosts valuable information on children’s health and the medical care requirements for young travelers in Canada.

Insurance Bureau of Canada

Website: Insurance Bureau of Canada

Resource: Provides advice and articles on various types of insurances, including Visitor Insurance, with specific references to policy conditions and age-related factors.

Government of Canada – Travel Insurance

Website: Travel.gc.ca – Travel Insurance

Resource: This government portal offers critical information and advice for all travelers, focusing on the necessity and intricacies of travel insurance.

Additional Online Resources

WebMD

Website: WebMD Travel Health

Resource: Provides health tips and medical advice for travelers, including discussions on how age can affect travel health risks.

Centers for Disease Control and Prevention (CDC) – Travelers’ Health

Website: CDC Travelers’ Health

Resource: Offers extensive guidelines on health precautions for international travelers, including age-specific recommendations.

By exploring these sources, you can gain a broader perspective and a more detailed understanding of how age factors into Visitor Insurance decisions in Canada. These resources will equip you with the knowledge to choose the best Visitor Insurance Plan that suits your age and travel plans.

Key Takeaways

- Age significantly influences Visitor Insurance policies, affecting eligibility, coverage options, and premium costs.

- Older travelers often face higher premiums due to increased health risks associated with aging.

- Very young travelers have specific insurance needs, such as coverage for routine pediatric care and common illnesses.

- Different age groups may have varying insurance needs and options available to them.

- It’s crucial for older travelers to choose policies that adequately cover pre-existing conditions.

- Consulting with knowledgeable Visitor Insurance Agents can help navigate the complexities of insurance based on age.

- Many insurance policies offer the option to extend coverage if the stay is extended, but this must be done before the current policy expires.

- Families traveling with children or elderly members should explore plans that address the needs of all family members under one policy.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com