- Are psychological or psychiatric services covered under Super Visa Insurance?

- Understanding Super Visa Insurance Coverage

- Struggles with Mental Health Coverage

- The Scope of Psychological and Psychiatric Coverage

- Exploring Super Visa Insurance Costs and Plans

- Customizing Your Super Visa Insurance

- Choosing the Right Coverage

- The Role of Canadian LIC in Supporting Families

The time has finally come when your parents have arrived in Canada on a Super Visa and are so excited to spend quality time with you and the grandkids. What if, after a few weeks, your father starts showing signs of depression – something she’s never talked about before but now can’t be ignored? You get concerned and start to think about getting professional help, but a question pops up: “Are psychological or psychiatric services covered under our Super Visa Insurance?”

This is a common dilemma faced by many families who welcome their parents or grandparents to Canada on a Super Visa Program. While Super Visa Insurance covers medical services, the details around mental health services, particularly psychological or psychiatric care, are unclear. Many of our clients at Canadian LIC have asked the same question: are their loved ones covered for mental health issues that may arise during their stay?

Let’s get into it. We’ll look at whether psychological or psychiatric services are covered under Super Visa Insurance in Canada. We’ll share client stories to illustrate the issues and give you the inside scoop on how to deal with this part of Super Visa Insurance. By the end of this blog, you’ll know what to expect from your Super Visa Insurance and how to get your loved ones the help they need.

Understanding Super Visa Insurance Coverage

One of the main requirements for obtaining a Super Visa to visit Canada is Super Visa Insurance. The insurance shall have a minimum coverage of $100,000 for health care, which includes hospitalization and repatriation, and must be for at least twelve months starting from the date of entry into Canada. While the basic requirements are straightforward, what’s actually included sometimes varies according to the policy chosen.

Most of the Super Visa Insurance Plans focus on emergency medical care. So, god forbid if your parent or grandparent suddenly falls ill or gets hurt, this insurance will pay for treatment, hospitalization, and all other associated medical expenses. But in the case of mental health, this is not very clear.

Struggles with Mental Health Coverage

At Canadian LIC, we often hear from clients who are confused about what their Super Visa Insurance actually covers, especially regarding mental health services. Take the case of Mrs. Kaur, who brought her elderly mother to Canada on a Super Visa. A few months into her stay, Mrs. Kaur’s mother started exhibiting symptoms of severe anxiety. Concerned, Mrs. Kaur wanted to seek professional help for her mother. However, after going through the entire Super Visa Insurance Policy, she found out that this did not include routine psychological service coverage, with only emergency psychiatric care provided. This left Mrs. Kaur in a difficult position—should she pay out of pocket for the care her mother needed, or should she wait until the situation escalated into an emergency, which might then be covered by the insurance?

This is typical of what most of our clients go through: Super Visa Insurance Plans often cover emergency psychiatric services, including hospitalization following a severe mental health crisis, but usually exclude coverage for ongoing therapy or counselling. This has been the cause of extreme stress on families—more so when they already have to deal with the emotional toll from a loved one’s mental health issues.

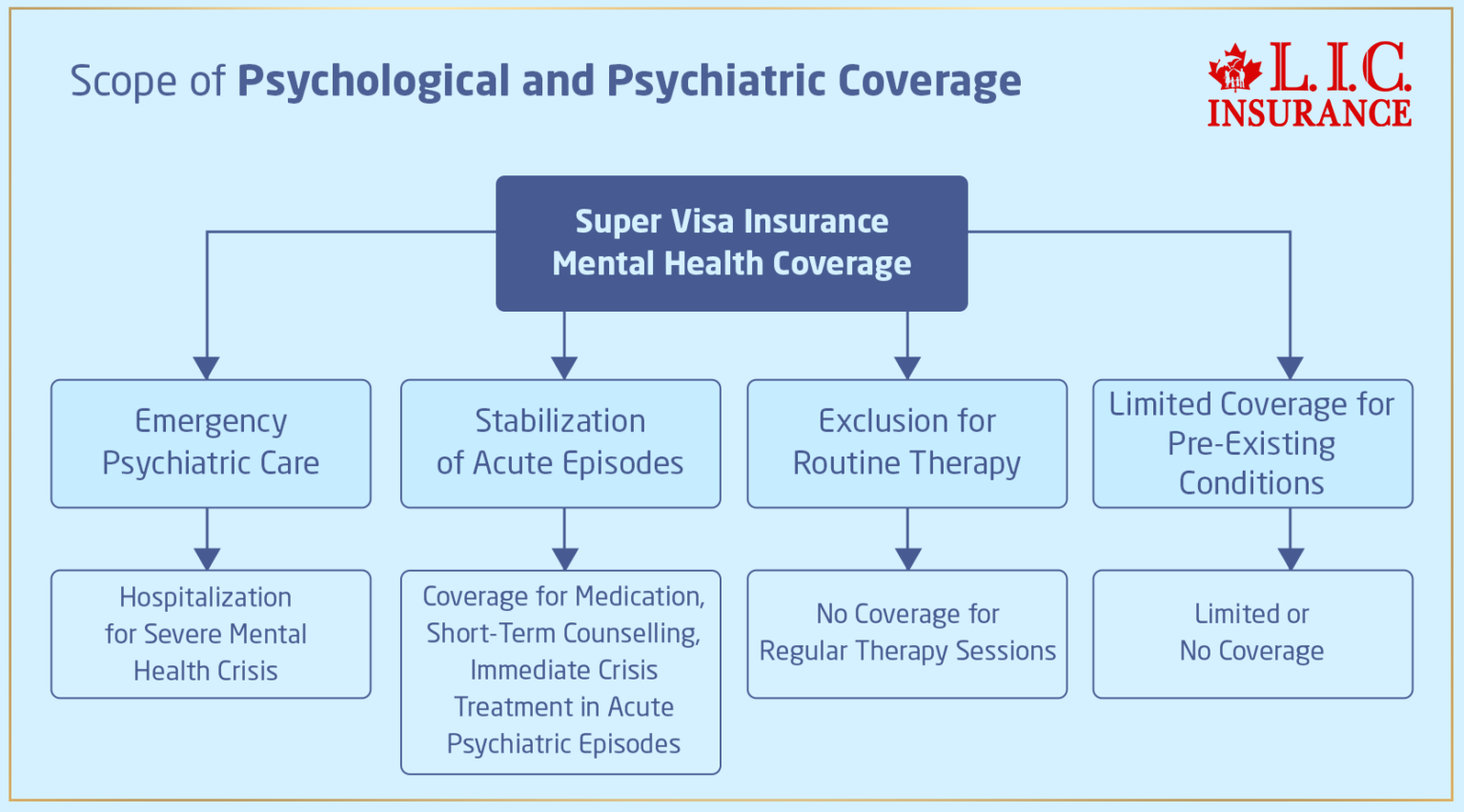

The Scope of Psychological and Psychiatric Coverage

What does one expect of Super Visa Insurance concerning the coverage of mental health? The answer certainly varies from insurer to insurer and often from plan to plan, but generally speaking:

- Emergency Psychiatric Care: Most Super Visa Insurance Plans cover emergency psychiatric care, which typically includes hospitalization due to a severe mental health crisis. This might involve the sudden onset of severe depression, anxiety, or other mental health disorders that require immediate medical attention.

- Stabilization of Acute Episodes: Super Visa Insurance can insure expenses incurred to stabilize the medical condition in acute psychiatric episodes. Such coverage can be provided for medication, short-term counselling, or other forms of treatment that may be needed to help the immediate crisis.

- Exclusions for Routine Therapy: Routine psychological services, such as regular therapy sessions, are typically not paid for. So, even if your loved one needs continuing counselling or therapy, you will not have a Canadian insurance company to pay those bills.

- Limited Coverage for Pre-existing Conditions: In case you have a pre-existing mental health condition with your loved one, the coverage may be limited or even non-existent. Some plans of Canadian Super Visa Insurance do provide coverage for any pre-existing condition, although it seems that the focus is more on the physical health area and less on the area of mental health.

Exploring Super Visa Insurance Costs and Plans

However, when you actually start to look at Super Visa Insurance, you will find out that overall costs can vary widely depending on the coverage. Most of our Clients, when coming to Canadian LIC, will be drastically surprised to find out that the cost of a policy significantly rises if one wants a comprehensive policy that includes mental health services.

When comparing Super Visa Insurance Plans, it’s important to look beyond the price tag. Besides that, even if it is affordable, ask yourself if that policy will fulfill all of your needs—especially if your loved one has a history of mental health issues—and whether you’re worried about the potential need for psychological or psychiatric care while they’re here.

At Canadian LIC, we are ready to help customers go through a lot of quotes on super visa insurance and help them understand what is beneficial under the policy criterion and what is not. We stress on the families to make them imagine losing a loved one as a result of such cases, not to scare them, but because it helps in preparation. Now you can decide wisely, considering what super visa insurance products cost in relation to the benefits they carry, to protect your loved ones in every respect properly.

Customizing Your Super Visa Insurance

This is because there are so many gaps in the ordinary standard Super Visa Insurance Plans that some of these families require customization of the coverage so that it conforms to what would be more suitable for them. This may include buying extra insurance that is particularly oriented toward mental health services, or it may even mean an altogether more expensive policy that would cover much more.

For example, some clients have settled for policies with a wider coverage of mental health, even though these tend to be associated with a higher cost of Super Visa insurance. They found that peace of mind, knowing that their loved ones had proper and adequate coverage that was worth that high extra expense. Others have chosen to add supplemental insurance that focuses on mental health, providing additional coverage that standard Super Visa Insurance Plans might lack.

Choosing the Right Coverage

Let us come back to Mrs. Kaur and her mother now. When she realized that her existing Super Visa Health Insurance Plan did not have the services to provide for her mother’s mental health treatment, Mrs. Kaur contacted us at Canadian LIC for consultation. We were able to help her explore options in buying additional insurance to cover psychological services or upgrading the current policy. In the end, Mrs. Kaur chose the more comprehensive Super Visa Insurance Plan that would permit coverage for mental health—which was more expensive. She rationalized this additional cost with the thinking that at least her mother would be taken care of and there wouldn’t be any more financial stress added to the family members.

The Role of Canadian LIC in Supporting Families

We are very proud of our client-centred approach at Canadian LIC. We understand that each family’s situation is unique, and finding the correct Super Visa Insurance can be overwhelmingly tedious. This is why we take it upon ourselves to guide and assist you with every step and ensure you receive appropriate coverage at a Super Visa Insurance Cost within your means. Here’s how we do this:

Personalized Consultations to Understand Your Needs

First of all, when you contact us at Canadian LIC, we do not offer a solution that will fit all. We start by really getting to know you and your family. Have you gone through anything like this insurance process before? Do you have special concerns, like needing coverage for mental health services? We listen very carefully to your situation because we recognize that understanding your special needs is the key to finding the appropriate Super Visa Insurance Plan.

Recently, the Singh family visited our website to search for coverage for their elderly father, a heart patient who had previously suffered from anxiety. They were overwhelmed by the options available and concerned about the potential Super Visa Insurance Cost. Listening to their areas of concern enabled us to recommend a plan that would really give them peace of mind—a full scope of health coverage that includes mental health but at an affordable price.

Guiding You Through Super Visa Insurance Plans

The sheer number of different Super Visa Health Insurance Plans can be difficult to navigate on your own, as you need to find coverage that is equally affordable. We at Canadian LIC make it easier for you. Our services are focused on breaking down options into their benefits and limitations, allowing you to make a decision. Whether you are interested in a basic plan or one that offers more sophisticated forms of coverage, such as coverage for psychological or psychiatric services, we are here to guide you.

Look at Mrs. Ahmed, for instance. She needed a plan for her mother, who has a history of depression. Mrs. Ahmed was specifically concerned about finding coverage for mental health services but also had to keep the Super Visa Insurance Cost tight. We helped her compare Super Visa Insurance Quotes Online, showing her options that balanced coverage and were cost-effective. Mrs. Ahmed left feeling confident that she had made the best choice for her mother’s stay in Canada.

Helping You Compare Super Visa Insurance Quotes Online

Comparison of online quotes for super visa insurance is part of today’s digital decision-making. But we understand that it can be overwhelming to sort through the various options and determine which offers the best value for your family. We will be happy to help you compare quotes from various providers and find a plan that answers your needs and works within your budget.

Consider Mr. and Mrs. Lee, who were bringing Mrs. Lee’s parents to Canada for an extended stay. They wanted more information about the cost of super visa insurance but also wanted to know whether any type of mental health needs would also be covered or not? We helped them run through the options available to them, comparing quotes and dissecting the details of each plan. By the end of our consultation, they had picked a plan that offered them accurate coverage at an affordable price, setting their minds at rest.

Supporting Families with Real-Life Experience and Empathy

What really sets Canadian LIC apart is the experience in Super Visa Insurance. We have assisted countless families in going through the complexity of such plans, bringing that experience into each consultation. Having seen firsthand how vital it is to have proper coverage and how extremely important it is when it pertains to mental health, we use our real-life experiences to offer you solutions that are going to work based on what we have seen with other clients.

For example, the Patel family was in a difficult situation when their visiting mother, here on a Super Visa, had a mental health crisis. They did not know that their initial policy did not have ongoing coverage for psychological care. After calling us, we were in a position to help them upgrade their plan, and their mother received the care she needed without financial stress. Our years of experience allowed us to identify the best solution for their situation quickly.

Ensuring You Make Informed Decisions

At Canadian LIC, we strongly believe that an informed client is a satisfied client. We will take the time to explain each aspect of the Super Visa Insurance Plans you are considering. We don’t just tell you what’s covered; we also explain what’s not covered and what that really means for your family. This way, you’re fully aware of what your insurance will and will not do, so there are no surprises later on.

For example, the Khan family came to us looking to get the lowest Super Visa Insurance Cost. We discussed it with them, and then they realized that some of those cheap plans really didn’t cover important areas like mental health services. We helped them pick a plan that would provide them with affordability coupled with the right coverage and gave them peace of mind that they had done it right.

Ongoing Support Throughout the Policy Term

Our commitment to you does not come to a close once you purchase super visa insurance. For Canadian LIC, that support will continue even after the Super Visa Insurance Plan is sold. Call us if you have questions regarding your policy at any time, would like to make a claim, or need to update it. Just a telephone call or email away; we are here to help with anything that comes your way.

Last month, for example, the Garcia family didn’t know what to do when their father needed immediate psychiatric care. They had no idea whether their plan covered the treatment, and they were extremely anxious about the cost. We guided the Gárcias through the procedure, filed the claim, and made sure they received the coverage they deserved. Our ongoing support made a challenging situation a little easier for the Garcias, and we’re proud to have been there for them.

Customizing Coverage to Fit Your Unique Needs

Every family is different, and so are the needs for insurance. We at Canadian LIC know what works for one family may not work exactly for another. That’s why we offer the ability to customize your Super Visa Insurance Cover. From covering mental health services to making sure pre-existing medical conditions are included, we can help you tailor the policy to your exact needs.

For instance, the Wong family was interested in ensuring that their visiting father’s father’s pre-existing mental condition was covered. We worked with them to customize a plan with full mental health coverage, so they can be at peace and know that their father is fully protected. By customizing their policy, they were able to address specific concerns which would have been missed with a regular plan.

The End Note

Mental health is an area that should be carefully considered with regard to Super Visa Insurance. While most, if not all, standard policies would adequately cover emergency psychiatric care, routine psychological services are often inadequately covered. In other words, it creates a problem for the family when a loved one needs routine psychological support during their stay here in Canada.

At Canadian LIC, we believe that every family should have peace of mind and know fully that their loved ones are covered. Therefore, we can find an ideal Super Visa Insurance Plan for you that not only satisfies the mere basics but also addresses your specific needs, including mental health care.

Do not gamble on mere chance concerning your family’s family’s health and well-being. Take the very first step today by looking online through super visa insurance quotes and choosing the one with the most excellent coverage. If you don’t know where to get started, give us a call here at Canadian LIC, and we will work with you to find a solution that will suit your pocket but still give you the peace of mind that comes with knowing your loved ones are protected. After all, when it comes to family, only the best will do.

More on Super Visa Insurance

- Appealing a Denied Claim Under Super Visa Insurance

- Changing the Effective Dates of My Super Visa Insurance After Purchase

- Including My Spouse in the Same Super Visa Insurance Policy

- Getting Super Visa Insurance Over 85 Years

- Filing a Complaint About My Super Visa Insurance Provider

- Consequences of Not Having Valid Super Visa Insurance

- What If the Super Visa Insurance Expires While the Visitor Is Still in Canada?

- Waiting Period For Super Visa Insurance

- Super Visa Insurance Refundable or Not?

- Finding the Most Affordable Super Visa Insurance Plan

- Buying Super Visa Insurance in Canada

- Medical Test Required for Super Visa Canada

- Processing Time for a Super Visa in Canada

- Canceling Super Visa Insurance

- Paying Monthly for Super Visa Insurance

- The Right Time For Super Visa Insurance To Start

- Super Visa Program and Insurance Requirements

- Super Visa Insurance- Advantages

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs: Understanding Super Visa Insurance and Mental Health Coverage

Primary coverage areas of Super Visa Insurance include unexpected or sudden medical emergencies with respect to hospitalization, surgery, and repatriation. As regards mental health services, however, it is a varied area. Some regular Super Visa Insurance Plans would include urgent psychiatric treatment; however, some of them cannot be used for scheduled psychological services like continuous therapy or counseling.

This is quite common at Canadian LIC—to see families like the Saxena’sSaxena’s, who were very upset when they found out their plan didn’tdidn’t cover the ongoing therapy sessions that their father was receiving. We helped them understand exactly what their current coverage consisted of and further demonstrated options to meet their needs better. This strongly shows the importance of going online to review super visa insurance quotes so that you get a proper plan for mental health services that truly matter to you.

The cost of super visa insurance may vary on a case-to-case basis, depending on the applicant’s applicant’s age, health condition, and other factors that might have different coverage requirements. If mental health services are required to be covered, then the cost could be higher, but this insurance will help ensure that your loved one is taken good care of during his or her stay in Canada.

Recently, we dealt with the case of the Aslam family, who needed to cover their mother’s pre-existing anxiety disorder. They were a little concerned about the higher cost of super visa insurance. We pointed out how comprehensive coverage could save them thousands of dollars in the long run by avoiding large out-of-pocket expenses. We always advise our clients to consider cost versus benefits—more so where mental health is a priority.

Yes, some plans for super visa insurance provide comprehensive coverage that can include physical and mental health services. These plans are likely to be more expensive but offer peace of mind in the sense that one has protection for all aspects of his or her loved one’s health.

For example, the Lees did have reservations about the mental health security of their father as much as his physical health. We helped compare a number of online super visa insurance quotes for them and directed them to a plan that had not only emergency psychiatric care but also ongoing psychological services. This way, they were able to have confidence that in any situation, their father would be well cared for.

While comparing online quotes for super visa insurance, pay particular attention to what is covered under each plan. Look out in detail for coverage related to emergency psychiatric care, if there are any limits placed on the overall coverage, and whether it includes/excludes routine psychological services. Not just the price but details of the coverage have to be compared to make sure you get a plan that suits your needs.

For instance, the Patel family was very frustrated with the comparisons because there was too much technical jargon. We stepped in to break things down for them, showing how one could compare Super Visa Insurance Quotes Online based on their need for mental health coverage. This approach helped them choose a plan that gave full protection without frilly extras.

Suppose your current Super Visa Insurance Plan doesn’t cover the mental health services you need. You may switch to a different policy that includes mental health coverage or purchase supplemental insurance to include it. We at Canadian LIC are in a position to help you consider options and find the best solution for you.

The Gujjar family recently found out that their policy did not cover the ongoing therapy sessions their mother was undergoing for depression. Quite distressed and very concerned about the costs, they came to us. We managed to upgrade their plan so that it had proper mental health coverage, all the while keeping the Super Visa Insurance Cost within their budget. This experience illustrates very well the need to review and adjust one’s own coverage accordingly.

While most Super Visa Insurance Plans are very upfront about their costs, some may hold out certain fees or exclusions, especially for mental health services. So, in essence, reading the fine print and knowing what is or is not covered is definitely a good idea. Transparency is always put in front and center with Canadian LIC; we work to make sure our clients know, to the fullest of their ability, what could be expected in potential costs.

For example, the Walia family had no idea that their plan had a high deductible for psychiatric care when they bought a plan that wasn’t easily identified as having such. After working with us, they switched to a plan that better met their needs, with the cost more predictable and therefore avoidable as a financial surprise.

Canadian LIC is oriented to understanding your very needs and finding the right Super Visa Insurance Plan for you, be it comprehensive coverage, including mental health services, or just looking to keep the Super Visa Insurance Cost low. We walk you through the process, bringing in the experience gathered from other similar clients to help you come out with decisive actions that take care of your family’s well-being.

For example, the Khan family needed coverage for their father’s mental health condition but were unsure where to begin. We listened to their concerns and went online to shop for super visa insurance quotes, finding one that met all their requirements. With Canadian LIC, they felt supported and confident in their choice.

Yes, lowering the cost of super visa insurance is possible while making sure that the most important coverage stays in place. At Canadian LIC, we can help strike that delicate balance between affordable pricing and comprehensive protection. You may have a plan with a higher deductible while making sure that it covers such critical areas as mental health services. We worked with the Sharma family, who needed to keep costs low while making sure their father’s anxiety condition was covered. We helped them pick a plan that had the right trade-offs to give them the right coverage at a price they could afford.

If you purchase a Super Visa Insurance Plan online and later find out it doesn’t include the mental health services you need, don’t worry—you still have options. You can either upgrade your existing plan or buy additional coverage to fill the gap. In fact, we at Canadian LIC help do this for many of our clients who find themselves in the predicament outlined above. For instance, Desai’s family bought a plan online that didn’t include coverage for their mother’s depression. We later got an opportunity to help the Desais upgrade their plan to have the coverage they needed at no major Super Visa Insurance Cost increase.

It would be best if you read through the plans very keenly to ensure the Super Visa Insurance Quotes Online are correct and that no necessary coverage, particularly for mental health, is missing. Here, at Canadian LIC, we will help break down the quotes in a manner that our clients are able to know what each plan covers, while at the same time, we can also try to point out any possible gaps. The Pandey family, for example, had a few quotes but started to get a little uneasy at some that they had found out on the internet, so we were able to take them line by line through the details, making sure they had a plan with a lot of comprehensive coverage including mental health, with no hidden surprises.

A few Super Visa Insurance Policies do cover pre-existing mental health conditions, but most of these come at an added premium. We at the Canadian LIC help you go through such options and present what is covered, how, and the impact on the overall Super Visa Insurance Cost. We recently helped the Chawla family, who were concerned about their father’s long-standing anxiety disorder. We were able to find a plan that could offer the proper coverage they desired but make the cost as little as possible manageable.

Yes, most Parents and Grandparents Super Visa Insurance Plans offer some kind of refund on cancellation of the policy; however, some conditions or fees might be attached to the refund. If you realize that your plan does not satisfy your requirements—like not having mental health coverage—be sure to get in touch with Canadian LIC as soon as possible. We will help you understand the cancellation policy and provide you with a more suitable plan. It was this very issue that brought the Sheikh family to us with the discovery that the initial plan did not include their father’s depression. We helped the Sheikhs go through the painful procedure of cancelling the plan and guided them in choosing another one that best suited them, reducing the financial impact.

Review this policy time and again and see whether you need to make any amendments to it in order to ensure your Super Visa Insurance continues to be in effect and meets your parents’ needs, especially when their mental health requirements change. Canadian LIC will continue to help you through this journey so that you may easily manage your policy for as long as it is needed during your parents ‘ stay. The Grover family contacted us after their dad’s mental health condition worsened. We helped them update their policy to include additional mental health services and ensured that such services were fully covered without breaks, all at no hefty increase in the Super Visa Insurance Cost.

Trust Canadian LIC for All Your Super Visa Insurance Needs

Knowing the intricacies of the Super Visa Insurance, as well as the mental health coverage, might prove very difficult for one. Canadian LIC—The Best Insurance Brokerage—is here to assist you. Whether you need the most cost-effective Super Visa Insurance Plans, want to compare the Super Visa Insurance Quotes Online, or want to get the best coverage for your loved ones, we are here to help. Contact us today to know your options. Choose a plan that suits your family best.

Sources and Further Reading

- Government of Canada – Super Visa Information

Detailed information about the Super Visa program, including insurance requirements and application process. Government of Canada – Super Visa - Canadian Life and Health Insurance Association (CLHIA)

Provides guidelines on travel and visitor insurance, including coverage specifics and consumer protection information. CLHIA – Travel and Visitors to Canada Insurance - Canadian Mental Health Association (CMHA)

Offers resources and information on mental health care in Canada, including services available to visitors and insurance considerations. CMHA – Mental Health in Canada - Insurance Bureau of Canada (IBC)

An overview of how insurance works in Canada, with sections on travel and health insurance for visitors. IBC – Visitor Insurance

These sources offer additional information and context for understanding Super Visa Insurance, mental health coverage, and making informed decisions about protecting your loved ones during their stay in Canada.

Key Takeaways

- Mental health coverage in Super Visa Insurance varies, with emergency care often covered but not routine therapy.

- Balance Super Visa Insurance Cost with the need for comprehensive mental health coverage.

- Personalized support from Canadian LIC ensures your plan fits your family's needs.

- Regularly review and update your Super Visa Insurance plan to meet evolving health needs.

- Canadian LIC provides ongoing support for navigating Super Visa Insurance Plans and quotes online.

Your Feedback Is Very Important To Us

We appreciate your time in providing feedback to help us better understand the challenges Canadians face regarding psychological or psychiatric services covered under Super Visa Insurance. Your responses will help us improve our services and support.

Please submit your responses through the provided link or return this form to our office. Your feedback is invaluable, and we thank you for taking the time to help us serve you better.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]