- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- 2024 Average Term Life Insurance Rate Chart by Age: What Canadians Need to Know

- Understanding Term Life Insurance Rates in Canada

- Average Term Life Insurance Rates by Age in Canada

- Factors That Affect Term Life Insurance Rates

- How Canadian LIC Helps Canadians Choose the Right Term Length

- When Should You Buy Term Life Insurance?

- Comparing Term Life Insurance Rates in Canada

- Tips for Lowering Your Term Life Insurance Premiums

- Average Monthly Rates for Term Life Insurance

- Final Thoughts: Why Act on Term Life Insurance with Canadian LIC Today

2024 Average Term Life Insurance Rate Chart By Age: What Canadians Need To Know

By Harpreet Puri

CEO & Founder

- 11 min read

- November 8th, 2024

SUMMARY

Questions regarding Life Insurance costs always characterize its decisions. To a lot of Canadians, the cost of life insurance is a stumbling block in determining an affordable rate. When individuals consider their need to protect their loved ones, Term Life Insurance Quotes Online help them realize that people have several Life Insurance options based on age, coverage, and lifestyle. We have seen here at Canadian LIC all sorts of clients come in with different goals and needs, newly hired professionals building a financial future for retirees considering extra coverage for the family’s stability. Herein lies the question: how does age affect Term Life Insurance Rates in Canada?

In this guide, we will break down the average Term Life Insurance Rates by age for 2024. Knowing how these rates change with the increase in age can be helpful for you when making decisions about when to purchase life insurance and why there may be changes in your rates. Using relatable stories from our everyday interactions, we will explain some of the nuances of Term Life Insurance Rates and why you should not delay taking up a policy.

Understanding Term Life Insurance Rates in Canada

Term Life Insurance is one of the most popular types of coverage across all affordable options for Canadians. It pays a certain death benefit over a set period, such as 10 to 50 years. The Life Insurance Premium is purely based on the fixed rate basis that appears to rely heavily on your age, health, and coverage amount.

While researching Term Life Insurance Quotes Online, you will find that rates skyrocket with age; this is the simple reason why older applicants generally present increasing risk. Here is a good example: Canadian LIC often recommends that its younger clients secure it at a lower rate early, as the Term Life Insurance cost tends to go higher as the person grows old. Of course, it’s not just about age; health and lifestyle factors come into play. Here’s a summary of Term Life Insurance Rates by age in Canada.

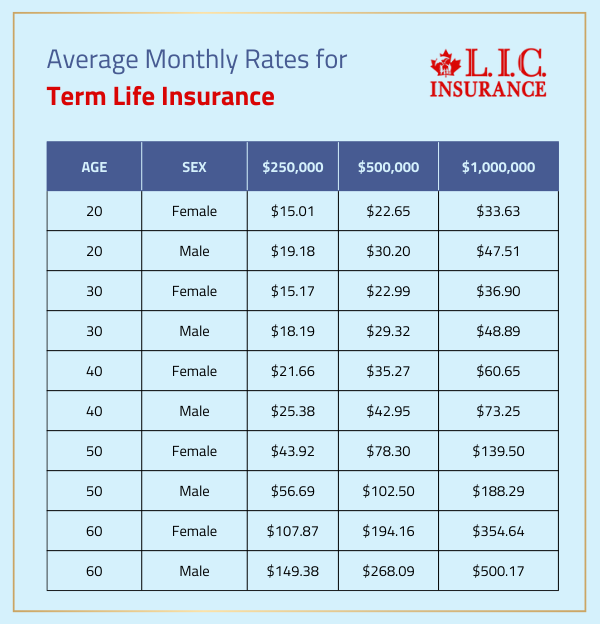

Average Term Life Insurance Rates by Age in Canada

To help you get a clearer picture, here’s a breakdown of the average monthly cost based on a $500,000 Term Life Insurance Policy in Canada:

- Ages 20-30: This age group tends to see the lowest Term Life Insurance Rates. A healthy 25-year-old might pay around $20-$30 per month for a 20-year Term Life Insurance Policy with $500,000 coverage. This rate is relatively low because younger individuals pose a lower risk. Our clients often come in seeking these lower rates, looking for stability while building their careers and starting families.

- Ages 31-40: By this age, many Canadians begin thinking more seriously about long-term family and financial protection. A 35-year-old can expect to pay between $30-$40 per month for a similar Term Life Insurance Policy. For many, this stage of life includes significant financial responsibilities like mortgages and childcare, which increases the importance of coverage.

- Ages 41-50: Life insurance premiums start to rise significantly in this age group. A healthy 45-year-old may pay $50-$80 per month for a 20-year Term Life Insurance Policy. With Canadian LIC’s expertise, we guide clients in this age group to make the most of their policies, helping them balance their insurance with other financial priorities.

- Ages 51-60: At this stage, many clients come to us expressing concern about affordability. A 55-year-old can expect monthly premiums between $100-$150 for a similar policy. It’s important to note that health changes over time, so rates in this age range often reflect any health conditions that may have developed.

- Ages 61 and Above: After age 60, Term Life Insurance Rates can become quite expensive. A healthy 65-year-old might pay $200-$300 per month or more. At this age, options may be more limited, and some clients choose shorter terms or lower coverage amounts to make premiums more affordable.

These figures are general averages and may vary widely depending on health, lifestyle, and specific terms in a policy. Remember these numbers when obtaining Term Life Insurance Quotes Online, as the individual’s actual rate will vary from this estimate.

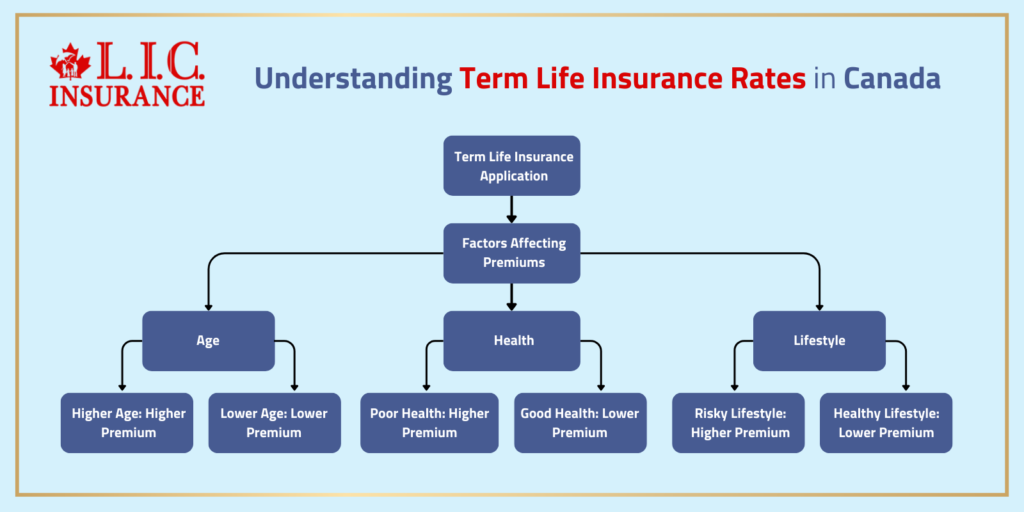

Factors That Affect Term Life Insurance Rates

Beyond age, several other key factors influence the rates for Term Life Insurance Canada. Understanding these factors can help you take control of your premiums:

- Health Status: Good health often leads to better insurance rates. For instance, non-smokers with healthy lifestyles tend to receive lower quotes than those with medical conditions or smoking habits. Canadian LIC frequently encourages clients to take medical exams, which can help determine the most accurate rate.

- Coverage Amount: Higher coverage amounts mean higher monthly premiums. Some clients opt for a lower coverage amount if they need to manage costs, while others see the benefits of a larger payout for their family’s future.

- Policy Term Length: The longer the term, the higher the cost. A 30-year term will have a higher premium than a 10-year term, given the extended coverage. Many of our clients choose their term based on life stages, such as having young children or nearing retirement.

- Gender: Statistically, women tend to live longer than men, which is often reflected in slightly lower life insurance premiums for female applicants.

How Canadian LIC Helps Canadians Choose the Right Term Length

The most common question we receive at Canadian LIC is whether the term should be one year, 10 years, or 20 years. Clients often tend to be very confused as to whether a 10-year, 20-year, or 50-year policy would be suitable for them. Typically, younger clients or those with specific time-bound financial goals take advantage of longer terms.

For example, a 32-year-old father of two preferred a 10-year term that would pay his mortgage and ensure future security for his family. Later, he agreed to pay for a 20-year term simply because that would really be the balance of affordability within the long period of coverage. These tailor-made solutions do indeed make our clients feel secure and sure about their choices.

When Should You Buy Term Life Insurance?

It is wise to buy Term Life Insurance Plan early because, as mentioned above, younger applicants get better rates while waiting till later in life can quadruple your premiums. For instance, clients in their 20s and 30s who enter into Canadian LIC get locked in a cheap rate that does not change over the term.

For instance, let’s consider the case of a 28-year-old female not interested in tying herself to a Term Life Insurance product. After weighing all her alternatives, she finally purchased a 30-year Term Life Insurance. She did that so that she could capture lower rates and would not have to purchase another policy later at much higher rates.

Comparing Term Life Insurance Rates in Canada

In an attempt to find Term Life Insurance quotes, especially while looking online, comes up with a feeling of humongous choice. Let Canadian LIC help you find the best competitive quotes suited to your needs. Comparing quotations from several life insurers can save you thousands of dollars, but what is equally important is to figure out the policy features, exclusions, and extra costs.

For instance, in the mid-40s couple, we had a pair that had already perused various quotes from different providers, and by reviewing their needs, lifestyle and financial goals, we were able to narrow the field further, resulting in not only a better rate but also a much better coverage policy than they found on their own.

Tips for Lowering Your Term Life Insurance Premiums

There are several strategies you can use to make Term Life Insurance more affordable:

- Opt for a Shorter Term: If you only need coverage for a specific period, such as until your children graduate, a shorter term could lower your premiums.

- Maintain a Healthy Lifestyle: Regular exercise, a healthy diet, and avoiding smoking can positively impact your rates. Some providers offer rate reductions for policyholders who meet certain health milestones.

- Consider Annual Premiums: Paying annually instead of monthly can sometimes result in a discount.

For instance, in the mid-40s couple, we had a pair that had already perused various quotes from different providers, and by reviewing their needs, lifestyle and financial goals, we were able to narrow the field further, resulting in not only a better rate but also a much better coverage policy than they found on their own.

Average Monthly Rates for Term Life Insurance

Final Thoughts: Why Act on Term Life Insurance with Canadian LIC Today

As you can see, Term Life Insurance quotes in Canada vary widely based on age, coverage amount, and other individual factors. The big decision really does need to be made with timing in mind – the longer that you wait, the more expensive it will be and the fewer options you’ll have.

This is a process we make as straightforward and supportive as possible at Canadian LIC. We assist our clients in understanding the factors behind the Term Life Insurance Rates to ensure that they get a policy that suits their needs and budget. Do you want to begin your path for Term Life Insurance or lock in a rate? Then you can contact Canadian LIC, which is the best insurance Brokerage committed to providing you with the most reliable advice, rates, and financial security for you and those around you.

More on Term Life Insurance

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs: 2024 Average Term Life Insurance Rates by Age in Canada

Term Life Insurance Rates tend to increase as you age. For example, a 30-year-old will usually pay less for the same coverage than someone who is 50. At Canadian LIC, we see many clients in their 20s and 30s who want to lock in lower rates early. Waiting too long can mean higher costs and limited options.

Younger people generally have lower health risks, which results in lower Term Life Insurance Rates. Insurers view younger applicants as less likely to make a claim soon, so they offer more affordable premiums. At Canadian LIC, we often encourage younger clients to secure a Term Life Insurance Policy to take advantage of these lower rates.

Yes, you can easily get Term Life Insurance Quotes Online. By providing basic information, such as your age, coverage amount, and term length, you can quickly receive an estimate. Many of our clients start with online quotes to get a general idea of rates before discussing specific options with us at Canadian LIC.

Your health plays a big role in determining your Term Life Insurance Rates. A medical exam may be required to assess factors like blood pressure, cholesterol, and any underlying conditions. Non-smokers and those with healthy habits usually get lower rates. At Canadian LIC, we guide clients on how lifestyle choices impact their Term Life Insurance Policy and help them find the best options available.

While there’s no single best age, many people benefit from buying Term Life Insurance in their 20s or 30s. At this stage, rates are lower, and you’re more likely to lock in an affordable premium. Canadian LIC often works with young professionals who recognize that starting early can save them money and secure long-term financial protection.

Some Term Life Insurance policies allow you to increase coverage later, but this can depend on your provider and policy type. At Canadian LIC, we help clients understand options that might allow additional coverage if their financial needs grow. However, if you add coverage later, you may pay higher rates, as they will be based on your age and health at that time.

Generally, a 20-year term policy has higher rates than a 10-year policy because of the extended coverage. Many clients choose longer terms for more consistent protection, especially if they have young children or long-term financial commitments. At Canadian LIC, we help clients weigh the benefits of each term length based on their unique situations.

Yes, Term Life Insurance Rates in Canada can differ by gender. Women often receive lower rates because they statistically have a longer life expectancy. This rate difference varies between providers. Canadian LIC provides clients with quotes that consider gender factors, helping them make the most informed decision.

Online quotes provide a helpful estimate, but your actual rate may differ based on a full assessment of your health and lifestyle. At Canadian LIC, we find that clients benefit from initial online quotes but gain a better understanding of their true rates through a more detailed evaluation.

Your Term Life Insurance Rates are generally fixed once you start a policy. However, if you quit smoking or make significant health improvements, you may qualify for lower rates by reapplying for a new policy. Canadian LIC works with clients interested in reevaluating their policies, especially if they’ve made positive health changes.

The coverage you choose should reflect your financial obligations, including debts, mortgages, and family needs. Many clients at Canadian LIC select coverage that equals 5-10 times their annual income. We discuss each client’s financial situation to recommend a coverage amount that ensures their family’s security.

Smoking increases health risks, so insurers often charge higher Life Insurance Premiums to smokers. Canadian LIC advises clients who smoke on potential rate increases and encourages them to consider quitting to secure lower premiums. Non-smokers can usually benefit from significantly reduced rates.

Yes, the longer the term, the higher your monthly premium will be. A 30-year Term Life Insurance Policy, for instance, costs more than a 10-year policy because of the extended protection. Canadian LIC helps clients choose terms that align with their financial goals and life stages to get the most value from their investment.

Many Term Life Insurance policies in Canada offer renewal options. However, your premium will likely increase, as rates will be based on your age at the time of renewal. At Canadian LIC, we often assist clients in comparing renewal costs to other policy options, ensuring they make a choice that fits their budget.

If you outlive your term, the policy simply ends, and no benefits are paid. Some clients choose to convert their policy to Permanent Life Insurance if they want coverage for their entire life. Canadian LIC guides clients on available options near the end of their term, allowing them to maintain coverage if needed.

Yes, Term Life Insurance Rates are usually lower than Whole Life Insurance rates. Term Life Insurance provides coverage for a specific period, which is why it costs less. Whole Life Insurance, on the other hand, offers lifelong protection and accumulates cash value component, making it more expensive. At Canadian LIC, we help clients decide which type of policy best fits their needs and budget.

The Life Insurance Company considers factors like age, health, lifestyle, coverage amount, and term length. Younger applicants in good health usually receive lower rates. Canadian LIC frequently helps clients understand how their individual profiles affect their Term Life Insurance Policy rate and guides them toward choices that best suit their circumstances.

Yes, you can often add riders to enhance your Term Life Insurance coverage. Common riders include critical illness, disability, and accidental death benefits. Many clients at Canadian LIC choose riders to tailor their policies, adding coverage for specific needs without purchasing separate policies.

Yes, you can cancel your Term Life Insurance Policy anytime, but you won’t receive any money back, as term policies do not accumulate cash value. We advise clients at Canadian LIC to weigh their options carefully before cancelling to ensure they don’t lose valuable coverage.

Yes, your occupation can affect your Term Life Insurance Rates if it involves high-risk activities. Jobs in industries like construction, aviation, or firefighting might come with higher rates. At Canadian LIC, we work with clients in different professions to find policies with competitive rates based on their specific work risks.

Yes, most Term Life Insurance Rates are fixed for the duration of the term, which makes it easier to budget for the premium. We often see clients at Canadian LIC appreciate the stability of a fixed rate, as it provides consistency in their monthly expenses.

No, in Canada, the death benefit from a Term Life Insurance Policy is generally not taxed. This allows beneficiaries to receive the full amount. Canadian LIC often explains this benefit to clients who are concerned about leaving their families with financial security without tax implications.

Missing a payment can lead to a grace period, often 30 days, to catch up on your payment. If you fail to pay within this period, your policy may lapse. At Canadian LIC, we encourage clients to set up automatic payments to avoid missing due dates and risking a loss of coverage.

Yes, many Term Life Insurance policies offer a conversion option to a permanent policy without requiring a new medical exam. This feature is beneficial for those who may want lifelong coverage later. Canadian LIC assists clients in evaluating if and when a conversion is a good option based on their evolving needs.

Yes, you can still qualify, but your Term Life Insurance Rates may be higher depending on the condition. Canadian LIC works with clients with various health backgrounds, helping them find providers that offer the best rates and options for their specific health profiles.

Yes, many clients use Term Life Insurance to cover mortgage debt. By choosing a term length that matches your mortgage term, you can ensure the coverage will help pay off the mortgage if something happens to you. Canadian LIC frequently assists homeowners in selecting coverage amounts that provide peace of mind for their loved ones.

Most Term Life Insurance policies allow renewal at the end of the term, though rates will likely increase since they are based on your age at renewal. At Canadian LIC, we guide clients in evaluating renewal options versus starting a new policy to ensure they receive the most favourable rate.

Yes, most Term Life Insurance policies cover you worldwide, so you’re protected no matter where you are. If you travel frequently, Canadian LIC can help ensure you have a policy with global coverage to keep you secure wherever you go.

Yes, you can change your beneficiaries at any time by notifying your insurance provider. This flexibility allows you to adjust your policy as your life circumstances change. Canadian LIC helps clients understand how beneficiary changes work and provides guidance when they need to update their policies.

The approval process can take a few days to several weeks, depending on factors like the required medical exam and underwriting process. Canadian LIC works closely with clients to expedite the process and provides updates to ensure they’re informed every step of the way.

Not all policies require medical exams, but for larger coverage amounts, a medical exam may be necessary to determine your Term Life Insurance rate. Canadian LIC offers guidance on both exam-required and no-exam policies, helping clients choose what fits best with their comfort and coverage needs.

Yes, Canadian LIC provides the option to apply for Term Life Insurance online. Many clients start with Term Life Insurance Quotes Online, and we guide them through the application process to ensure they have all the necessary information and documentation.

If your financial needs change, you may have the option to increase your coverage, convert your policy, or adjust your term if allowed by your insurer. Canadian LIC frequently assists clients in adapting their policies to fit life changes, ensuring they maintain adequate coverage as their financial responsibilities shift.

Here are some of the FAQs that we generally respond to at Canadian LIC in order to update our customers about Term Life Insurance quotes. Would you like to know detailed and simple information on how to acquire Term Life Insurance quotes in an inexpensive and comprehensive manner? Then, approach us for all of your support.

Sources and Further Reading

- Sun Life Canada: Offers detailed insights into Term Life Insurance options and rates.

Sun Life - MoneySense: Provides comprehensive guides on the best life insurance options in Canada for 2024.

MoneySense - WealthRocket: Features articles on top life insurance companies in Canada, including Term Life Insurance policies.

Wealth Rocket - Wealth Awesome: Lists and reviews the best Term Life Insurance companies in Canada for 2024.

Wealth Awesome - Savvy New Canadians: Offers insights into the top life insurance companies in Canada as of 2024.

Savvy New Canadians

Key Takeaways

- Age Significantly Impacts Rates: Younger applicants usually secure lower Term Life Insurance Rates, as insurers consider them lower-risk.

- Rates Increase Over Time: For each age bracket, rates rise due to increased health risks associated with aging. Acting early helps lock in more affordable premiums.

- Factors Beyond Age: Health, lifestyle, coverage amount, and policy term length also influence Term Life Insurance Rates in Canada.

- Fixed Premiums for Term Duration: Most Term Life Insurance policies offer fixed premiums, providing predictable monthly costs for the length of the term.

- Policy Flexibility Options: Many Term Life Insurance policies allow for conversions to permanent insurance or additional coverage with riders, making them adaptable to changing needs.

- Online Quotes and Provider Comparisons: Using online quotes helps compare rates across providers, but final rates may vary based on a full health and lifestyle assessment.

- Reliable Financial Security: Choosing the right Term Life Insurance Policy helps protect your family financially, covering debts and providing stability in case of unforeseen events.

Your Feedback Is Very Important To Us

We’d love your feedback! Your insights will help us better understand the challenges Canadians face when exploring Term Life Insurance Rates.

Thank you for sharing your feedback!

IN THIS ARTICLE

- 2024 Average Term Life Insurance Rate Chart by Age: What Canadians Need to Know

- Understanding Term Life Insurance Rates in Canada

- Average Term Life Insurance Rates by Age in Canada

- Factors That Affect Term Life Insurance Rates

- How Canadian LIC Helps Canadians Choose the Right Term Length

- When Should You Buy Term Life Insurance?

- Comparing Term Life Insurance Rates in Canada

- Tips for Lowering Your Term Life Insurance Premiums

- Average Monthly Rates for Term Life Insurance

- Final Thoughts: Why Act on Term Life Insurance with Canadian LIC Today